Briefing MONTHLY #15 | March 2019

Rethinking China | Election season | Asia’s best dining

Game on with China. Animation: Rocco Fazzari. View it here.

RETHINKING CHINA

Redefining the relationship with a rising China has become the preoccupation of the moment across a range of Australian institutions with new funding and diplomatic language in play. The creation of the National Foundation for Australia-China Relations has raised the prospect of greater coordination of government, business and community engagement with China after a period of erratic national policy making reflecting duelling business and security imperatives. The foundation will receive $44 million from the Federal government over five years which is almost ten times what the Australia China Council (ACC) – which it replaces – might have received. However, it will also absorb some already funded activities such as the annual High-Level Dialogue. Businessman Warwick Smith, who will shift as chairman from the ACC, says the Foundation will have a more independent voice than the ACC and a much greater coordinating role in China relations. He is planning Foundation offices in Sydney and probably Beijing to emphasise its more independent stature. He says the relationship with China has become more complex than any other foreign relationship creating a challenge of being able to maintain Australian values while respecting China’s system. He hopes the Foundation will play a crucial role in creating a new culture of shared information within Australia about China rather than competing camps. Nevertheless, the initiative has ventilated existing faultlines with former China ambassador Geoff Raby declaring the foundation “suggests that sounder foreign policy voices are again being heard in Canberra.” But Australian Security Policy Institute director Michel Shoebridge says the initiative “can’t hide from the fact that there are also increasingly stark differences (with China) - mainly on security and strategic issues.”

At the same time the Business Council of Australia has created a new China leadership committee, which will also be chaired by Smith. And Austrade is coordinating a new Festival of Australia promotion in May in partnership with industry at a time of erratic treatment of Australian exporters by Chinese regulators. The sponsors include Wine Australia, Meat & Livestock Australia, Dairy Australia, Hort Innovation, DFAT, Tourism Australia, State governments, Australia-China Chambers of Commerce and the AFL.

Meanwhile, Asia Society Australia has kicked off its own contribution to this rethinking about China with the launch of a series of essays examining the idea that “bounded engagement” will be the new paradigm within which China relations will be conduct. “The setting in which engagement occurs will be less expansive and open-ended than in the past,” writes Bates Gill in the first essay. At the same time China Matters is seeking public input into the formulation of a new narrative about China to be delivered to a new Federal government. “This narrative acknowledges that our capacity to influence is limited. Our interests have to be negotiated with clear eyes,” the current draft says. This process coincides with similar moves in other countries. The University of California’s 21st Century China Center and Asia Society’s Centre on US-China Relations has embraced the term “smart competition” in a new report about seeking common interest and pushing back against China’s increasingly assertive policies. And a new European Commission strategy on China presented to the European Parliament says “there is a growing appreciation in Europe that the balance of challenges and opportunities presented by China has shifted.” It seeks a “more realistic, assertive, and multi-faceted approach.” And a new report from the British Parliament’s foreign affairs committee says current policy fails to recognise that China is both a “viable partner” and an “active challenger” for Britain.

Mixed messages from China business surveys: See DEALS AND DOLLARS below.

Australia's Ambassador to the People’s Republic of China, H.E. Jan Adams AO PSM, addressing an Asia Society Australia Executive Briefing yesterday. Picture: Julia Bergin/Asia Society Australia

FESTIVAL OF DEMOCRACY

Indonesia is challenging India for the world’s most complex election, Thais are facing a new sort of parliamentary deadlock and Filipinos may be looking post Duterte.

Thai opposition parties declaring they have won a coalition majority in parliament after the election.

THAILAND: CHANGING UNIFORMS

The military backed Palang Pracharat Party seems to have performed better than expected in Thailand’s long delayed election, notwithstanding a series of questionable mishaps with the vote counting. But the military is nevertheless doubling down on holding on to power with sedition charges against the leaders of the upstart Future Forward Party which came third and a delay in announcing official results until May 9. The hung result between Palang Pracharat and the Pheu Thai Party, associated with deposed former Prime Minister Thaksin Shinawatra, suggests that a compromise prime ministerial candidate should be found. That leaves a delicate judgement about how to avoid post-election turmoil in the hands of coup leading general turned appointed civilian prime minister and now aspirant elected Prime Minister Prayuth Chan-Ocha. With a likely stalemate in the lower house of parliament between a Prayuth-led government and an opposition coalition with more seats, this election in only a stepping stone to a future democratic settlement.

INDONESIA: NO TIME FOR PARTIES

Indonesia’s election system has been a work in progress since democracy was restored in 1999, but the world’s third largest democracy is now going for the title of the world’s most complex election. Most attention has been focussed on the relatively colourless competition between 2014 rivals President Joko Widodo and former military officer Prabowo Subianto, with Widodo appearing to be well in front. But underlying this for the first time is a simultaneous election for about 20,000 national and local assembly seats with more than 200,0000 candidates. And further consolidation of voting on a single day for other positions is planned in future. What may prove more interesting than the predictable presidential race, is how the 16 national parties emerge from this first mega-election. The presidential candidates’ own parties, the Indonesian Democratic Party of Struggle (Widodo) and Gerindra (Prabowo), may become even more dominant due to a coat-tail effect. At the same time some of the country’s once prominent parties are in danger of being removed from the scene due to an increased threshold requirement that they get at least four per cent of the overall vote (regardless of their local success) to be eligible to take seats in the national assembly. The end result looks like being a more streamlined party system from an administratively complex election.

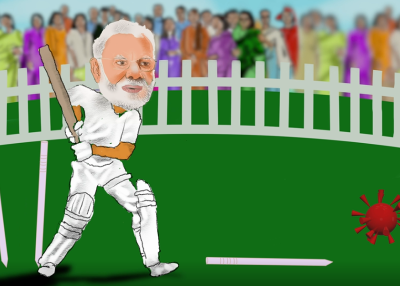

INDIA: CASH STILL RULES

Prime Minister Narendra Modi’s 2016 demonetarisation of about 80 per cent of the country’s banknotes was partly aimed at reducing corruption. But it doesn’t seem to have reduced the role of money in politics with the election which starts this Thursday estimated to be costing about 40 per cent more than in 2014. The New Delhi Centre for Media Studies has estimated the election will cost more than US$10 billion which compared with about US$6.5 billion for the US presidential and congressional elections in 2019. This will be more than $10 per voter in a country where about 60 per cent of people live on about $4 a day. The Indian Election Commission has already seized a higher value of illegal election inducements before voting has begun this year than in the entire 2014 election. This Scroll article suggests that elections are becoming more expensive because of increases in the size of constituencies; more “independent voters” to be persuaded; increased political competition and more candidates.

PHILIPPINES: SUCCESSION GAMES

Although it has been overshadowed by the bigger (India and Indonesia) or more uncertain (Thailand) polls, the Philippines election on May 17 will provide some insight into the future of President Rodrigo Duterte. Serving presidents often manage to maintain their political clout in the mid-term elections for half the Senate, the national assembly and various local governments. Duterte-aligned candidates seem likely to do well in the Senate thereby helping the still quite popular president to pursue his legislative agenda. But the more interesting question is whether these elections will provide a pointer to who might replace Duterte when his single term ends in 2022. The Philippines has a history of swinging sharply between presidential administration styles after the six years terms expire and the controversial Duterte will be concerned about potential retribution once he leaves office. His daughter Sara (in hometown Davao City) and longstanding staffer Bong Go (in the Senate) are running in what could be the beginning of a bid to extend the Duterte era.

ASIA BRIEFING UNWIRED

Don’t miss Asia Society Australia's special podcast series on the elections in India and Indonesia.

Episode One we talk to two emerging young players in Indian politics Charu Pragya and Manuraj Shunmugasundaram.

Episode Two we join the campaign closer to home with the Indonesian expatriates running their country’s election in Australia and the Indian Bharatiya Janata Party’s local campaign chief Jay Shah.Listen on Soundcloud and Spotify.

NEIGHBOURHOOD WATCH

ASIAN GROWTH EASING

The Asian Development Bank is forecasting regional economic growth will decline slightly over the next two years to 5.7 per cent this year and 5.6 in 2020. This is largely driven by a continuing fall in Chinese growth to 6.3 per cent and then 6.1 per cent in 2020 as restrictions on housing markets and shadow banking continue and as the trade conflict with the US weakens exports. But Indian growth is set to pick up from seven per cent last year to 7.2 per cent and 7.3 per cent over the next two years. Meanwhile South East Asian growth will decline from 5.1 per cent last year to 4.9 per cent this year and then five per cent next year. Asia’s current growth champion will remain Bangladesh over the next two years at eight per cent. Asia Society Australia hosted the ADB’s Australian launch of its Asian Development Outlook at Monash University’s CBD campus this year.

JAPAN’S NEW ERA

It says something about the capacity of Japanese people to live in modern and traditional worlds simultaneously that, according to opinion polling, its youngest citizens are most likely to use the Imperial calendar. The country has only had five imperial eras in more than a century. But the unveiling of the name Reiwa on April 1 for the reign of the incoming Emperor Naruhito has been revealing for the way it has stretched from computer programming uncertainties to the continuing power of mystical traditions. Drivers licences were only issued for the first time with the Gregorian (western) calendar date this year. Investment banker Peter Tasker says the new name has shown how “the ability to live unfazed in both Japanese time and Western time is an inspiring example of the cultural double-tracking that will be essential in today's multipolar, multi-perspective world.”

ASIAN NATION

BEYOND THE GLASS CEILING

Former foreign minister Gareth Evans has characteristically lifted the lid on a potentially divisive issue by questioning whether the quest for gender equity has come at the cost of greater ethnic and cultural diversity. “The existing leadership of organisations and institutions where the bamboo ceiling problem should have been visible simply haven’t had the bandwidth – or at least haven’t felt they had the bandwidth – to deal with it. Cultural diversity seems to be twenty years or more behind gender diversity as an issue that institutional leaders seem prepared to address,” Evans told the Asialink Chairman’s Dinner. He said that while removing any gender-based “glass ceiling” was embedded in the national psyche, cultural diversity was lagging. But despite the Australia in the Asian Century White Paper backing a 30 per cent board quota for directors with an Asian background, Evans said quotas were counterproductive at this point.

TELLING THE CHINA STORY

From defamation cases to the foreign influence peddling debate, the Australian media has become as much part of the China relations discussion as it is the platform on which is conducted. Now two quite different observers of this process have tried to untangle what it means for the media and the nation. In the latest edition of China Matters Explores The Australian newspaper’s former China correspondent Rowan Callick laments declining China literacy in the media but rejects claims of ideological bias. He offers some interesting ideas for dealing with the former including a way to improve Australian media access to China. But at Inside Story University of Technology Sydney Professor of Communication and Media Studies Wanning Sun argues the ABC’s news and current affairs coverage of China has increasingly followed a commercial media narrative of rising Chinese influence rather than a broader agenda. “It needs to adopt a calmer, more rational and evidence-based approach and move beyond a narrow security and intelligence focus - much of which is informed by Australian perceptions of the US position on China,” Sun says of the national broadcaster.

TO QUAD OR NOT

Former Prime Minister Kevin Rudd has questioned whether the Quadrilateral Security Dialogue (Quad) will survive potential leadership changes in Japan and India in his most comprehensive explanation of how he handled the issue early in his prime ministership. Many critics have blamed Rudd for in effect killing the first guise of the loose group (of the US, Japan, India and Australia) in 2008 in deference to China. In this Nikkei Asian Review article Rudd provides a detailed account of Australian consultations with the three other countries in 2007-9 to defend Australia’s cautious approach. While the Quad has had a low-level revival in recent years under the Abbott-Turnbull governments, Rudd says it still lacks “a galvanizing strategic vision” and identifies new potential equivocation in India and Japan.

DEALS AND DOLLARS

Japan on the Move. Animation: Rocco Fazari. Watch it here.

TURNING JAPANESE

Japanese investment activity has continued to diversify in Australia over the past year with 36 deals with a disclosed value of $10.5 billion compared with 32 deals valued at a disclosed $4 billion in 2017. While these top line figures underpin how Japan has overtaken Britain to become the second largest cumulative foreign investor after the US, they disguise a more interesting underlying story of growing sectoral variety, deal size and asset recycling. A new analysis by law firm Herbert Smith Freehills says Japanese investors are moving away from conservative minority interests to riskier high ownership deals; takeovers of ASX-listed companies are being used to buy global networks; and the rise in mid-sized deals shows a more diverse range of smaller Japanese companies are now seeing Australia as an offshore stepping stone. The analysis predicts more ASX takeovers; Japanese venture capital investments in local technology; investment in major infrastructure; and asset recycling especially from thermal coal to renewables.

CHALLENGER DEEPENS JAPAN LINK

Retirement income company Challenger has intensified its relationship with one of the largest insurance companies in Asia – Japan-based MS&AD – prompting speculation of a full takeover. MS&AD will increase its shareholding to more than 15 per cent and take a board seat in a continuation of the surge of Japanese financial services investment in Australia. In return Challenger will get better access to sell annuity products in Japan via MS&AD subsidiary Mitsui Sumitomo Primary Life Insurance.

KIRIN SELL-OFF ON HOLD

Japanese brewer Kirin’s Australian subsidiary Lion has warned it may now retain ownership of its food and drinks products in Australia due to a lack of buyers. The warning came after CC Amatil and Freedom Foods backed away from their joint bid for much of the Lion business. The sale is significant because Kirin was a leader of the recent new wave of Japanese investment in Australia outside resources. But while it is trying to exit the airy food and soft drinks sector, it has added to its alcohol exposure by buying 50% of Four Pillars Gin.

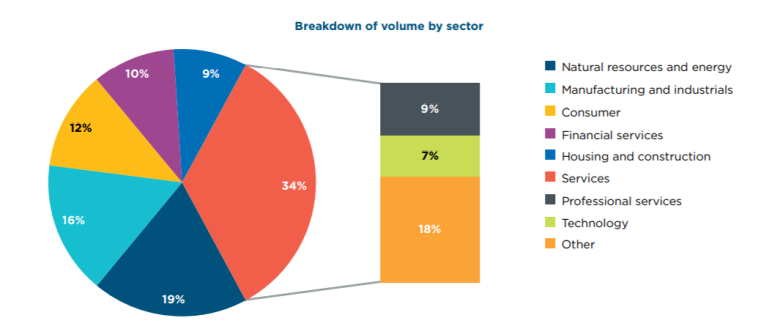

MIXED MESSAGES IN CHINA BUSINESS SURVEYS

Chinese investment in Australia dropped by more than a third last year taking the annual capital inflow down to its second lowest level in a decade. The fall came despite a 4.2 per cent increase in overall outbound Chinese investment and appears to put Australia on the same track as the recent sharp falls of Chinese investment into the US and Canada amid political tensions. The latest KPMG/University of Sydney annual survey of Chinese investment shows the investment flow dropped to $8.2 billion compared with $13 billion in 2017 and similar levels over the past seven years. The number of transactions also decreased 28 per cent for the first time since 2011, with 74 transactions compared with 102 in 2017. The report says the fall reflects a changed Chinese offshore investment strategy away from large strategic investments in resources, energy and infrastructure to smaller investments, often by private investors, into projects that are directly linked to Chinese consumer market demand and a desire to bring back high value-added sector expertise.

However, the second annual survey of Australian businesses operating in China has again showed noticeable resilience about current conditions and the future despite the bilateral diplomatic tensions and the China-US trade row. Just under 80 per cent of the 211 businesses surveyed expect to be profitable in 2019, up from 62.5 per cent in last year’s survey. However, at the same time general optimism about the next year was down 6.7 per cent to 71.6 per cent, although longer term 81.5 per cent of companies were optimistic about their China operations. The Westpac Australia-China Business Sentiment Survey for AustCham Shanghai found 53.5 per cent thought the ease of doing business had not changed, but 32 per cent though it had become more difficult.

FUTURE FUND EYES CHINA

The Future Fund says US-China trade tensions – especially over intellectual property - are hampering its ability to invest more in Chinese technology start-ups. Future Fund senior executive Wendy Norris told the Asian Venture Capital Journal conference in Sydney that the fund was devoting a lot of attention to how to invest in the Chinese private equity market, according to The Australian Financial Review. Superannuation fund HESTA general manager Andrew Major said Australian institutions were underinvested in listed and unlisted assets in Asia.

WILMAR SLICES UP GOODMAN FIELDER

Singapore-based agribusiness giant Wilmar International has taken full control of Australia/New Zealand food group Goodman Fielder from Hong Kong-based investment company First Pacific ending four years of joint ownership. Wilmar said the food manufacturer’s recent troubled operating performance could be turned around under its sole ownership. The two companies bought Goodman in 2015 for $1.37 billion hoping to use its portfolio of brands and factories to boost their South East Asian food business. But Wilmar has now bought First Pacific’s half share for about $300 million.

ASEAN: PHILIPPINES ON TOP

The Philippines is now the favoured location in South East Asia for investment despite political uncertainties surrounding the Duterte government, according to Australia and New Zealand businesses already operating in the region. The latest AustCham ASEAN survey shows the county has supplanted Vietnam (2017) and Myanmar (2016). The survey continues a trend of businesses actually operating in the region being more enthusiastic about its economic integration and maturation into a consumer marketplace than what appears to be the broader sentiment at home in Australia. About three quarters of those surveyed believed that ASEAN was a priority region for their company, but considerably fewer thought their boards or head offices had much understanding of the region. In a sign of shifting sentiment about the more integrated region, the survey showed concern about the ability to move workers across borders has supplanted concern about the enforcement of the law – although corruption remains the key challenge.

DUAL TRACK IN TRADE

Australian business is becoming more dependent on China and old Anglo markets (New Zealand and the US) for trade at a time when the fastest medium-term growth will likely be in emerging markets such as India, Indonesia and Vietnam. This is the ironic conclusion from the latest Australian Chamber of Commerce and Industry trade survey which shows dependence on China growing compared with 2016 with 61 per cent of businesses nominating it as a top three market. The survey also shows continued frustration or lack of understanding of the growing number of trade deals Australia has signed despite a stepped-up outreach effort by the Federal government to explain the agreements.

DIPLOMATICALLY SPEAKING

“Optimism is the currency of diplomacy. But these days some of us still wake up optimists but go to bed pessimists.” Former DFAT secretary Peter Varghese speaking after receiving the Asialink Edward “Weary” Dunlop medal

DATAWATCH

ASIA’S 50 BEST RESTAURANTS 2019

THE TOP TEN

- Odette (Singapore): Exquisitely executed dishes

- Gaggan (Bangkok): Ground-breaking emoji-led dining

- Den (Tokyo): Innovative Japanese with humour

- Suhring (Bangkok): Modern German in restored townhousE

- Florilege (Tokyo): Creative French cuisine

- Ultraviolet (Shanghai): Dining and hospitality are made into art

- Mume (Taipei): European techniques meet Taiwanese ingredients

- Narisawa (Tokyo): Innovative Satoyama cuisine

- Nihonryori RyuGin (Tokyo): Seasonal ingredients into works of art

- Burnt Ends (Singapore): Where there’s smoke, there’s fire

WHAT WE’RE READING

THE FUTURE IS ASIAN by PARAG KHANNA (Hachette Australia)

Parag Khanna dedicates his latest book to his “five billion neighbours.” It is a grand beginning to this latest contribution to the Asia rising genre of books but does immediately establish his key framing device: that the emergence of an Asia “system” is now a key force in international relations, but it is not all about China (with only 1.5 billion of those neighbours). In conversation during his Australian launch tour, he estimates the book is only about 45 per cent about China which he says sets it apart from its peers in this genre. Nevertheless, his most striking claim in the opening pages is to nominate the Beijing Belt and Road Initiative (BRI) Summit in May 2017 as the moment historians will look back on as the cornerstone of an Asian-led world order and “the most significant diplomatic project of the 21st century. Big claims aside, Khanna uses his academic training from the so-called English School of international relations to sketch an Asian-led world order which is much more comfortable with multi-polar and multi-civilisational foundations than the US-led order which has prevailed for much of the last century. At a time when Australian educational authorities have struggled with the introduction of more Asian history to school curricula, Khanna makes a compelling argument that understanding Asian history will be critical to understanding how his Asian-led world order will function. With elections now under way in four of Asia’s more significant democracies, Khanna’s chapter on how these countries are trying to balance traditional representative democracy with a more interventionist, Big Data and results driven form of technocracy also makes interesting reading.

ON THE HORIZON

TRADING UP WITH ASEAN

Australia’s trade agreement with South East Asia countries has been both overshadowed and sandwiched in recent years by the on-again off-again efforts to strike a bilateral deal with Indonesia and an Asia wide deal in the Regional Comprehensive Partnership Agreement (RCEP). But the ASEAN Australia New Zealand Free Trade Agreement (AANZFTA) is actually about to mark its tenth anniversary with negotiations starting over expanding its scope. The region wide agreement and bilateral agreements with Thailand, Malaysia and Singapore (see chart below) mean most imports enter Australia without tariffs. And it is little appreciated that AANZFTA has already provided some of the foundation stones for both the (completed) Indonesia agreement and (the still unfinished) RCEP process. Officials from the 12 AANZFTA members will meet in Melbourne at the end of April to decide where they can move forward when RCEP is soaking up much of the negotiating capacity in some member countries. At this stage changes to rules of origin, customs procedures and ecommerce are seen as areas of progress. But in an example of how one agreement can be used to go further in another, officials will also discuss how to add a government procurement chapter to AANZFTA because this is one area where the faltering RCEP has made good progress.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. Exclusive partnership opportunities are available. For more information please contact [email protected]

Read previous issues and subscribe >>