Briefing MONTHLY #21 | November 2019

Summit season | Indonesia’s new ministry | Best countries for business

Image: ASEAN secretariat

FIRST: RCEP

PLACED: MAHATHIR

SCRATCHED: APEC

Trade: In the parlance of the diplomatic racetrack the Regional Comprehensive Economic Partnership (RCEP) trade deal is the rough outsider with room to improve. Despite the predictable gush of hyperbole from some politicians now, the “world’s biggest trade deal” signed off in Bangkok at the East Asian Summit (EAS) is more of a reconciliation of existing bilateral agreements than a transformational breakthrough. This is especially the case now India is not a member, for some time at least. Australia’s own India Economic Strategy report actually backed RCEP over persevering with bilateral Indian trade negotiations on the basis that this was a more expeditious way to get some access to the Indian market. RCEP was born out of concern about the Asia splitting and anti-China character of the original Trans-Pacific Partnership (TPP), which in turn was designed - in Barrack Obama’s words – to rewrite the rules of the 21st century (which it does) to fend off the rise of China. Now China has won a relatively modest pan-Asian trade deal which it will use to burnish its pro-globalisation credentials in contrast to the Trump Administration. Nevertheless, with more than two thirds of Australia’s trade flowing through Asian supply chains, the creation of the RCEP framework should provide some Australian businesses with better access to a region which is gradually integrating into the world’s biggest market. As with Australia’s own new trade deal with Indonesia, the challenge now is to use the new institutional framework created to push for improvements in specific areas in future.

The Asian Trade Centre has the best recent analysis of RCEP here.

India’s economic boom is souring fueling the discontent about RCEP. This Financial Times analysis looks at what went wrong.

Leaders: The annual summit of the ten-member Association of Southeast Asian Nations (ASEAN) followed by the 16 member EAS and ancillary events like the RCEP Summit or the Quadrilateral foreign ministers gathering, is also a catwalk for regional leadership. With the US once again vacating this territory so President Donald Trump can ride his hobby horses at home, the predictions of Chinese grandstanding are inevitable. But President Xi Jinping’s tendency to ignore Asia’s peak gathering in favour of the competing Asia Pacific Economic Cooperation (APEC) summit (see below) undercuts this. Premier Li Keqiang (who Prime Minister Scott Morrison met) is more businesslike than brutalising. That left a void to be easily filled by the octogenarian, revisionist Malaysian Prime Minister Mahathir Mohamad. Mahathir is now the most interesting leader in the region for his preparedness to openly recant his past mistakes on issues like Malay preferences and offer frank views of issues such as living with China. The Australian government will be relieved to see his more positive approach to the bilateral relationship in this James Massola interview given the effort Australia has made to help the new Malaysian government on governance issues. But Mahathir also dominated the ASEAN business summit with his new confidence in globalisation and free trade. How Mahathir keeps the Pakatan Harapan government on a trajectory to winning a future election and handles the handover of the prime ministership will have a big impact on the credibility of democracy in South East Asia.

This Lowy Institute The Interpreter analysis is one of the best recent insights into the crucial leadership transition in Malaysia.

Institutions: APEC was memorably skewered by former foreign minister Gareth Evans as “four adjectives in search of a noun.” Now it is more like 21 leaders in search of a hotel. The cancellation of the Chile summit due to local political divisions, follows the failure of the group to produce a normal communique in Papua New Guinea last year due to US-China divisions. (Meanwhile the promised US-China trade deal now needs a new venue for any signing ceremony.) The APEC group once seemed like a successfully benign sort of multilateralism due to its slow-moving consensus building approach to economic integration and a large bureaucratic tail where such integration was carefully socialised away from the predations of opportunistic and populist politicians. Two difficult summits in a row show how even the soft face of multilateralism is under pressure. Next year’s APEC summit is in Malaysia. So over to that former APEC baiter Mahathir, once again. However, the often supine ASEAN institution showed a bit of spine in Bangkok when seven out of ten leaders failed to turn up to the ASEAN-US Summit side event due to the low level US representation at the overall summit. And this came as the US tried to soften the blow of its leaders failing to fly out to Asia by offering the ASEAN leaders a meeting with Trump in the US.

Read Erin Watson-Lynn on how the failure of the Chilean economic showcase brought down APEC.

NEIGHBOURHOOD WATCH

INDONESIA’S CABINET: CONTINUITY AND CHANGE

Batik before business: the new ministry at the Merdeka Palace

While the appointment of former presidential rival Prabowo Subianto as defence minister has dominated coverage of Indonesia’s new ministry, there are other important forces at work. President Joko Widodo appears to be highly focussed on ensuring his final term agenda will not be sidelined by an increasingly assertive legislature in a system where the conventions of government are still being worked through. Apart from bringing Prabowo’s Gerindra Party into the government coalition to give Widodo about in 75 per cent of the legislature seats, he has also allowed three party leaders to serve as ministers in a shift from his past approach. While the stability of the coalition might be questionable, at least Widodo will have a clear line of communication to the party bosses. Half the members of the outgoing ministry have been retained in a nod to continuity, although six have new jobs. There is a distinct increase in the number of retired military or police officers and a reduction in the number of women, most notably the loss of self-made businesswoman and high-profile fisheries minister Susi Pudjiastuti. While there are new technocrats such as GoJek founder Nadiem Makarim reflecting the old Indonesian approach of appointing such non-party people to government, the overall tone is a more political team. Two key changes will be important to implementing the soon to be fully ratified free trade agreement with Australia. Former trade minister and more recent investment minister Tom Lembong, who was a key advocate of the agreement, has not been reappointed. Australia will now look to the Australian-educated Coordinating Minister for Economic Affairs Airlangga Hartarto to push implementation ahead. And with education and training a key part of the trade deal, the decision to shift higher education into the education ministry and out of the research ministry, may require some rethinking by Australian education institutions. Newly appointed deputy foreign minister Mahendra Siregar will also be a key new Australian contact point.

This analysis by the Australia Indonesia Centre’s Kevin Evans looks at the new team from many perspectives.

This Jakarta Post article examines why the ministry is dominated by elite figures despite Widodo coming to office as an outsider.

CHINA EXIT IS HARD

The World Bank has cast some doubt on the ability of companies to move production out of China in response to the US trade war arguing that global supply chains are inflexible. Amid anecdotal evidence that foreign manufacturers are moving out of China to places such as Vietnam, the Bank’s latest East Asia and Pacific Update says: “While companies are already searching for ways to avoid U.S. tariffs by either moving entire production lines out of China or complementing existing operations with production in other countries, developing East Asian and the Pacific countries face limited absorptive capacity due to their relatively small size and inadequate infrastructure. Therefore, other countries in the region are unlikely to replace China in global supply chains in the short to medium term.” Meanwhile the International Monetary Fund annual Asia and Pacific economic outlook has continued to flag shifts in global supply chains due to companies leaving China, although it places more emphasis on slower regional growth due to the trade row. Both agencies have cut their regional economic growth outlook by 0.3 per cent for next year to 5.1 per cent for the IMF and 5.7 per cent for the Bank (they include different countries). The IMF says: “A marked deceleration in merchandise trade and investment, driven by distortionary trade measures and an uncertain policy environment, is weighing on activity, particularly in the manufacturing sector.” While the Bank says: “Weakening external demand combined with global trade policy uncertainty have been weighing on the regional activity through declining exports, deteriorating business confidence, and weakening investment.” Nevertheless, Asia will remain the world’s fastest-growing major region, contributing more than two-thirds of global growth.

JAPAN’S SELL ORDER

Japanese Prime Minister Shinzo Abe memorably told US investors to “Buy my Abenomics” when he visited the New York Stock Exchange in 2013 at the height of his promise as an economic reformer. Six years later on the cusp of becoming the country longest serving prime minister, he has turned that message on its head with an unexpected crackdown on foreign investment. As part of the general tightening of foreign investment rules in other parts of the world (including Australia) for security purposes, Japan has proposed that foreign investors should pre-notify investments of more than one per cent in a range of industries. While there are certain exemptions, the very low threshold has raised concerns that Japan is yet again trying to curtail foreign takeovers and investor activism despite the promise of Abenomics to open up the economy.

ASIAN NATION

AUSTRALIA IS “VERY NEAR”

Australia’s deepening ties to the Philippines received strong endorsement during a private visit to Sydney by the country’s Vice-President Leni Rebredo in October. In the middle of a bitter battle at home over the validity of her election in 2016, Rebredo used her one public appearance to thank Australia for its development aid and its support for action against Islamic terrorists. “Australia has been a very able partner,” she told the Australia Philippines Business Council event, “It helps that Australia is very near. I look forward to strengthening our relations.” Rebredo was elected vice-president in 2016 from different party to President Rodrigo Duterte and has since been excluded from a role in government under pressure to stand down. But she made it clear during the visit that she was not going to wilt under the pressure and was looking for new ways to leverage her position to raise money from the private sector for programs that she supports, such as improving equality for women. She argued that women had done quite well in senior leadership roles in the Philippines from the presidency to the Senate, but this was not flowing down to the village level where more action needed to be taken.

EDUCATING ASIA

Chinese students in Australia. Animation: Rocco Fazzari.

It has been a turbulent month for Australia’s $36 billion international education industry as the challenge of reducing dependence on China continues to make waves.

The main alternative source of students in South Asia is facing a new impediment with the Home Affairs department tightening access rules for students from India, Nepal and Pakistan to get visas. The Australian Financial Review reported that the department has raised the "risk status" of the three countries from medium to high because of fraud, visa cancellations and visa holders becoming "unlawful non-citizens".

As Australian universities develop strategies for closer engagement with Indonesia under the soon to be implemented bilateral trade agreement, the Australian government has issued a guide to new rules for foreign researchers in Indonesia. In July, Indonesia passed a law which imposes criminal penalties and fines of up to $400,000 on foreign researchers found guilty of violating visa regulations.

In the latest contribution to the debate about security risks from university research collaboration with Chinese academics, China Matters has issued a policy brief proposing a Critical Centre for Research Collaboration to work with all sectors to identify and manage the risks arising from collaboration. The proposal argues Australia benefits from joint research because it gives Australian universities access to cutting edge technology, finance and know-how. But it notes jointly developed technology could be used for military purposes or human rights abuses making a better risk management important.

But just days after that proposal, the Group of Eight universities stepped up their commitment to China with a new agreement with Chinese universities to increase collaboration in cutting-edge research and increase dialogue in areas that steer clear of sensitive military and security issues. A delegation of Australian vice-chancellors also held discussions with Chinese employers about their expectations of Chinese students returning to join the workforce after an education in Australia.

DEBT TRAP: NOT YET

New research from the Lowy Institute has called into question the increasingly common assertion that Chinese lending to South Pacific countries is forcing them into a debt trap. The research, which draws on the Institute’s Pacific Aid Map, tends to reinforce International Monetary Fund analysis that while debt is rising in these countries it reflects a range of factors – especially vulnerability to disasters – rather than Chinese lending. And traditional lenders including major domestic banks, Japan, the Asian Development Bank and the World Bank still play a larger lending role than China. The research suggests that Chinese lending in the Pacific is more concessional than in other parts of the world somewhat reducing the risk of a debt trap.

REPORTING ASIA

The first outcomes from the largest ever philanthropic support for Australian media coverage of the region have started appearing in Australian publications in October. The relatively new Judith Neilson Institute for Journalism and Ideas funded about a dozen media organisations in its first round of funding earlier in the year with three of the grants specifically focussed on coverage of the Indo-Pacific region. The Australian Financial Review reopened its South East Asia bureau based in Jakarta just in time for Prime Minister Scott Morrison’s visit to Jakarta for the inauguration of President Joko Widodo. The Australian has started rolling out a series of articles about the Chinese diaspora across the region putting Australia’s debate about the role of its own ethnic Chinese population in a broader perspective. And Guardian Australia has appointed a Pacific editor to build a network of correspondents around the region whose work will also appear across the Guardian international network.

DEALS AND DOLLARS

EXPORT GRANTS REVIEW

The Federal government’s review of the export market development grants scheme is due to report by March next year in time for changes to be included in the Federal Budget. The review is headed by Anna Fisher, co-owner of wine exporter Zontes Footstep. She will be assisted by Australia Post chief executive Christine Holgate, who used to head Blackmores, and Aspen Medical chief executive Bruce Armstrong. Minister for Trade, Tourism and Investment Simon Birmingham said the review would examine the best ways of supporting exporters or prospective exporters to successfully enter new markets, diversify into existing markets or pursue new export growth strategies.

REA EXPANDS ASIAN FOOTPRINT

Property search company REA Group has entered a joint venture with Singapore-based digital marketplace 99.co that aims to expand their joint presence in Singapore and Indonesia. REA is already the top property search site in Australia, Malaysia, Thailand and Hong Kong and will now be the top site in Indonesia and be in a better position to expand its business in Singapore. REA Group chief executive Owen Wilson said: “The Singapore marketplace is ripe for disruption. Our customers in this market want a true industry partner who can deliver world leading products and experiences.”

PAPER MONEY

Japan’s Nippon Paper has bought the Australian cardboard packaging business of Orora for $1.72 billion butting it in a stronger position to compete with Anthony Pratt's Visy Industries. The Japanese giant believes the paper packaging market will grow at the expense of plastic packaging because of environmental concerns. Nippon Paper's local subsidiary, Australian Paper, already manufactures and sells high-strength kraft paper to producers including Orora, who convert the material into end products like boxes and cartons. While Nippon Paper has subsidiaries around the world, this will be its largest investment outside Japan.

BLACKMORES SEEKS CHINA HELP

The biggest shareholder in nutrients company Blackmores, Marcus Blackmore, says he is looking for a Chinese joint venture partner to help re-invigorate its business and has admitted that a Chinese takeover offer is on his mind. Blackmore, who owns more than 20 per cent of the company, has just handed management over to new chief executive Alastair Symington after six months of running the company himself after the departure of the company's previous chief executive Richard Henfrey. Blackmores' rival, Swisse, was bought by Chinese company Health & Happiness in 2015 and 2016.

OUT OF INDIA

Insurance company IAG has finally sold its India business as its winds down what was once one of corporate Australia more significant Asian expansions. It has sold its 26 per cent interest in a joint venture with the State Bank of India for $640 million to private equity investors Napean Opportunities LLP and Warburg Pincus. While the price is a good return on the $170 million invested in the business a decade ago, it is at odds with the Australian government’s efforts to encourage more investment in India. It parallels a decision by the ANZ Bank to pull out of its Grindlays Indian business in 2000 which made it difficult to re-enter the country.

DIPLOMATICALLY SPEAKING

“That was the first time I’d heard that phrase used, but … when we heard those words we had some sense of understanding about what the Prime Minister was talking about. I did not have the sense that [the speech] derogated in any way from Australia’s commitment to elements of the multilateral system which we believe very strongly in.” Department of Foreign Affairs and Trade secretary Frances Adamson revealing to a Senate Estimates hearing that she did not have advance knowledge of Prime Minister Scott Morrison’s speech criticising negative globalism.

DATAWATCH

China and India have emerged as amongst the biggest improvers in the World Bank’s latest annual Ease of Doing Business rankings. New Zealand remained the global leader followed by Singapore. Australia was ranked 14 globally, up from 18 the year before. The chart shows a selection of countries from the Indo-Pacific region ranked by their score out of 100.

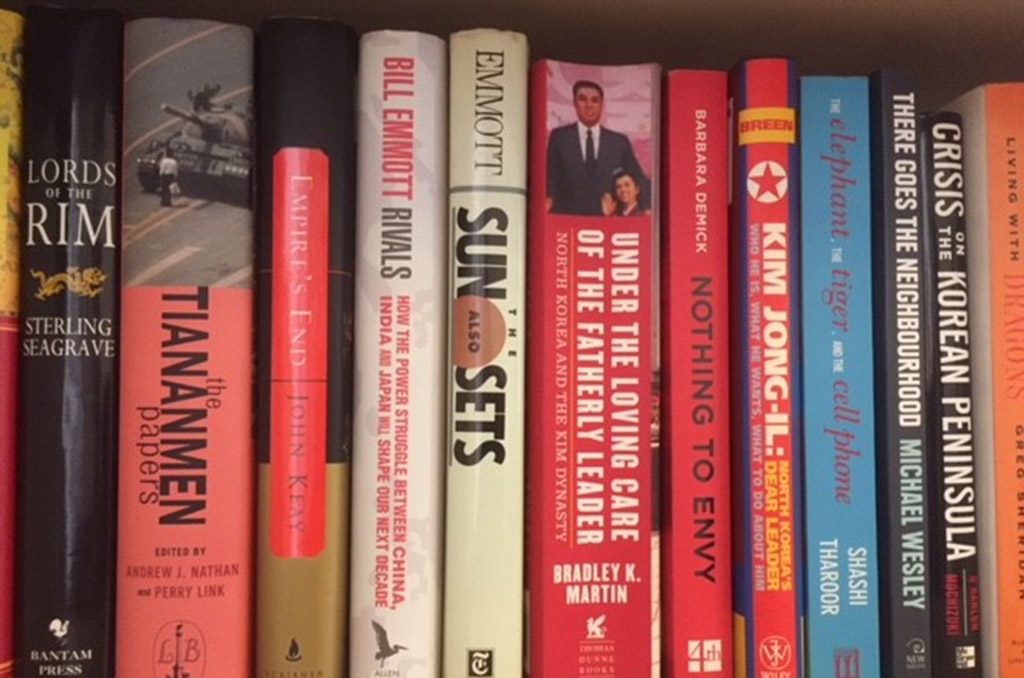

WHAT WE'RE READING

THE FUTURE OF ASIA: ASIAN FLOWS AND NETWORKS by McKinsey Global Institute

When the authors of this study about how Asian networks are redefining globalisation, they only found one out of eight global flows where the Asian role had contracted over the past decade: waste. The refusal of Asian countries to keep absorbing rubbish from the rest of the world – which Australian councils have experienced this year – neatly encapsulates the main finding from the study. That is that growing regionalisation in Asia is giving its individual countries the heft to set their own terms of engagement with the world- right down to choosing what rubbish to recycle. This is the latest in a series of McKinsey Global Institute publications looking at rising Asia from different perspectives. And it is looking at two of the most debated aspects of modern Asia – how can such a diverse region be seen as a unified entity and even then how independent of the rest of the world is it? The study manages this challenge by developing four distinct Asias: Advanced Asia which provides capital and technology; China which acts as a regional anchor and a connectivity and innovation platform; Emerging Asia which provides labour and long-term market growth potential, and is culturally diverse; and Frontier Asia and India. The argument is that the integration and intraregional flows across different Asias are creating powerful networks. The first of three major networks analysed is industrialisation where Asia-for-Asia supply chains are being created. The second is the way innovation hubs of capital and technology are emerging in the region which allow Asian countries to leapfrog other parts of the world. The third are culture and mobility networks in which Asian define their own entertainment and tourism flows free of traditional western economic power in these areas. The point of the whole exercise is to reinforce the idea that non-Asian companies and policy makers have to recognise that they have to work with Asian operating models across many spheres of life. It contains multiple insights into how Asia’s role in the world is increasing. But it does tend to skate over some deep-seated challenge such as environmental pressures and demographic changes.

ON THE HORIZON

A NEW NEIGHBOUR LOOMS

Australia’s complicated history dealing with the Bougainville group of islands off Papua New Guinea is about to get more complicated this month when the residents vote on independence. The referendum is due to start on November 23 and last until December 7 with the results due to be known by about December 20. The vote is not definitive but is supposed to inform a future negotiation with PNG. However observers expect it to strongly favour independence. Australia has already provided organisational assistance to the referendum but is likely to be drawn much further into assisting any new nation.

Read Ben Bohane’s Lowy Institute analysis on the referendum and beyond here.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. For more information please contact [email protected]

Read previous issues and subscribe >>