Briefing MONTHLY #25 | March 2020

Animation by Rocco Fazzari.

ASIA'S HOSPITAL PASS

For a region that has made much about its preparedness for the next crisis since the local economic upheaval of 1998, the coronavirus epidemic has produced a mixed result. Individual countries such as Singapore and Taiwan have won global attention for their mitigation and control procedures. But the concept of a more unified Asia has been left wanting in the face of an unexpected crisis which actually started in the region. Deep seated historical grievances quickly soured the way the two most developed economies – Japan and South Korea – managed their bilateral travel bans. And the oldest institution – the Association of Southeast Asian Nations (ASEAN) – has only managed to produce a bland statement restating old commitments to trade openness.

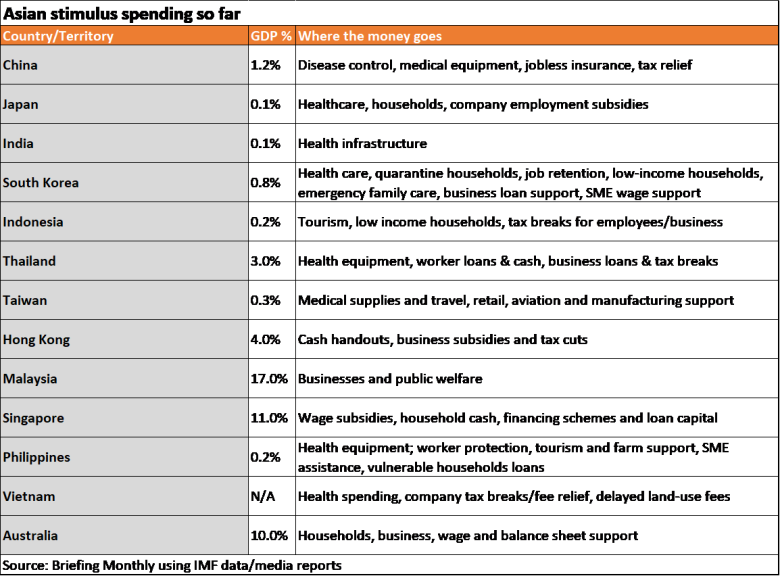

Asia’s collective focus on crisis preparedness since the 1998 financial meltdown (which was once also called an “Asian flu” in the financial sense) has produced a spate of institutions ranging from the Chiangmai Initiative to the East Asia Summit. These western-styled, mostly geo-economic institutions may yet come to the fore in the economic recovery from the coronavirus crisis. However, the financial rescue packages to deal with the virus crisis have diverged sharply, with Singapore and Malaysia last week announcing measures equal to more than 10 percent of GDP. But other countries from China to Indonesia have only announced stimulus equal to around one percent of GDP.

So, at this point it is an older, more utilitarian sort of Asia which has emerged with the most credibility from a crisis which has left the world’s traditional leaders from the United States to the newer Group of 20 looking flat-footed. Those Asian countries, from Korea to Singapore, which have some cultural foundations in the Confucian precepts of at least soft authoritarianism and civic harmony seem to have, so far, best managed the parallel technical health management and more political social controls that are needed to deal with the epidemic. But these seem to have been very organic (although drawn from the shared past SARS experience) rather than the result of any modern shared pan-regionalism. For example, neighbouring Japan and Korea have taken quite different approaches to testing. And we are still yet to see how the generally poorer, more culturally diverse and fractious countries from India to Indonesia manage. Indeed, those two countries last week took opposite approaches to a lockdown.

Nevertheless, the emergence of any Asian health management ‘model’ for dealing with a modern crisis would be globally significant when this part of the world already contains half the world’s population and is on track to be more than half its economy. Still, there are fascinating questions.

- Do small homogenous societies such as Taiwan and Korea really offer health solutions that have global applicability in more heterogenous societies?

- Is this a moment for China to rehabilitate its authoritarian model which has recently lost much credibility?

- Will Australians draw security from these relative Asian successes in mitigating COVID-19 or become more insecure about their geographic location?

- Will the laidback Australians who spurned social distancing for the beach ever appreciate how even a developing nation like Vietnam was more serious about controlling a disease outbreak?

NEIGHBOURHOOD WATCH

FINDING THE MODEL

China: China has now been responsible for the sharpest strategy shifts in the COVID-19 battle raising big questions about how its approach will ultimately be reviewed. It went from suppressing the original information about the Wuhan outbreak to imposing the world’s so far harshest lockdown. It has now banned foreigners entering the country after criticising Australia for doing that to Chinese travellers. And it is trying to restart its economy faster than many other major countries anticipate amid concerns about second round of infections from returning citizens.

- In this interview with Science magazine, China’s Center for Disease Control and Prevention director-general George Gao provides a rare insight into the country’s virus management.

Japan: After fumbling the management of the first major cruise ship COVID-19 cluster, Japan then responded quickly with early school closures and some other shutdowns with an eye to restoring order and keeping the Olympic Games on schedule. They have now been postponed. But despite having a population used to wearing masks and pre-existing forms of social distancing, there are now signs of rising infections possibly requiring a new wider lockdown. Japan has applied a policy of only testing people with extended, visible symptoms running the risk of missing unsymptomatic cases. It admits anyone who tests positive to a hospital, so officials want to avoid draining health care resources with less severe cases.

- This New York Times story raises the question of whether Japan has underestimated the infection risks as it relied on its own unique distancing culture to keep the Olympics on track.

South Korea: The rapid spread of the virus from within a religious sect in South Korea unnerved the world, but the country has now become the world best practice recovery model. It has rolled out widespread testing faster than most countries and also pursued aggressive tracing of infected people using mobile phone and other electronic data. Five Korean companies produce a combined 135,000 testing kits per day and they are now being besieged by supply requests from other countries.

- This article from Pro-Publica explains how Korea pioneered a testing model which stopped people getting infected waiting for assessment in hospitals. And see below: The virus verdict

Taiwan: Exclusion from the World Health Organisation by China means Taiwan has been forced to be more vigilantly self-reliant in dealing with disease risks. This time it managed to swiftly integrate its national health insurance database with its immigration and customs database to generate real-time alerts when patients with a risky travel history visited clinics presenting suspicious symptoms. It introduced travel quarantine, rigorously tracks returnees and promoted face mask wearing via a rationing system.

- This Sydney Morning Herald article by Ben Hurley explains how Taiwan applied the lessons from SARS in 2003 to get ahead of the latest Asian epidemic.

Singapore: After being lauded as a case study in keeping its COVID-19 threat under control, the past week has seen Singapore suddenly toughen its social controls as infection numbers have risen and implement a large economic assistance package. It has tightened border controls and stepped up social distancing enforcement after earlier relying more on early community messaging, temperature checking, isolation of infected people and intensive follow-up of their contacts.

- This article from The Conversation by the National University of Singapore’s Dale Fisher, an Australian doctor, explains the country’s early response. And see below: The virus verdict

Indonesia: An ingrained tendency to sometimes deny problems and a poorly functioning centre/province coordination process has left Indonesia with one of the region’s biggest COVID-19 threats. President Joko Widodo’s declaration that a lockdown would not work in Indonesian culture has transferred the burden of dealing with the epidemic to an under-prepared and poorly-funded hospital system. Emerging evidence of an unusually high mortality rate is raising fears that Indonesia will be a stark contrast to the successful containment models in other parts of Asia and a lingering disease hotspot.

- As various Indonesian local governments impose their own lockdowns, this OpEd piece from The Jakarta Post argues that they need to use religious communities to persuade the public to implement pandemic controls.

India: Prime Minister Narendra Modi demonstrated significant diplomatic clout by pushing Saudi Arabia to hold the early summit last week of the Group of 20 leaders to discuss coronavirus. But whether he can use his even greater clout at home to successfully impose the world’s biggest lockdown on his sprawling nation is now one of the biggest questions in the fight against a global pandemic. China has only done this in a more localised way using its superior social controls, but India is now facing a sudden unregulated mass movement of workers back to their villages, potentially spreading the virus.

- India’s health care system is not ready for what it is facing, according to this article from The Caravan.

Malaysia: A month ago, medical doctors held the jobs of prime minister, deputy prime minister and health minister in Malaysia. But now a new administration is turning to the army to implement a partial lockdown. Malaysia has the highest number of reported infections so far in Southeast Asia and has linked most of them to a religious gathering in late February near Kuala Lumpur amid the change of government. It has extended a previous two-week lockdown for another two weeks until April 14 and has launched a second economic stimulus package after one of the region’s first such packages was overshadowed by the political showdown.

- This Reuters article from malaysiakini examines how a single event at a mosque may have been the region’s coronavirus hotspot.

Vietnam: Vietnam has been gaining attention for apparently containing the virus without having the resources of wealthier countries for intensive testing. Instead it has concentrated on closing down some areas, quarantining people, tracing their contacts, and using state power to mobilise medical students and retired doctors to the containment campaign.

- This is an interesting account from a Vietnamese American comparing virus management in developing Vietnam and the wealthier west.

“It is not surprising that in a region as diverse as Southeast Asia, governments are responding in different ways. But public health systems will be quickly overrun and deaths from the virus will rise sharply if more aggressive containment measures are not put in place quickly.” - Asia Society Policy Institute Senior Fellow Richard Maude on the crisis

THE ROAD BACK

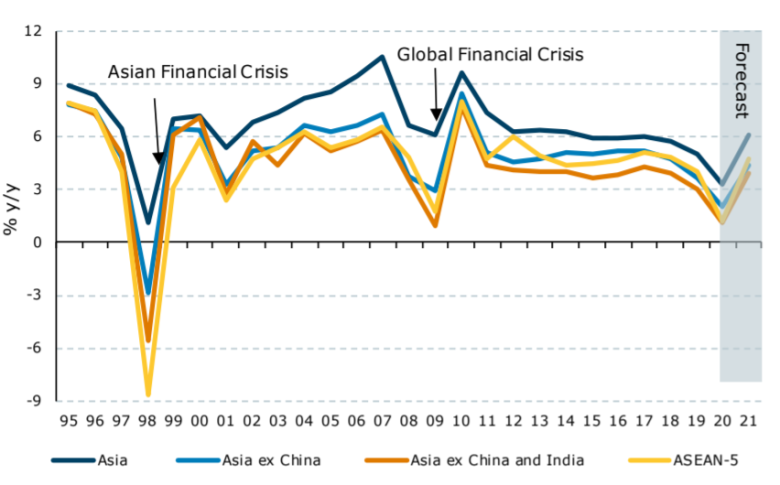

Source: ANZ Bank

ECONOMIC GROWTH AND GOVERNMENT SPENDING

Assessing the economic impact of the coronavirus in Asia is difficult with so many different approaches to virus control and economic stimulus now under way. The first official data in the region for the first quarter comes from Singapore – one of the region’s perceived virus control success stories and most connected economies. But it is a warning sign with the country facing a full year economic contraction of 1-4 percent. But the ANZ Bank forecast (above) sees regional growth at 3.3 percent for the year, which is only down 1.8 percentage points. Meanwhile Malaysia, Singapore and Hong Kong have led the budget spending on the crisis although full details are unclear from some countries. Some others like Japan have suggested much bigger assistance packages are still in the pipeline. Various regulatory and monetary stimulatory measures have also been implemented, especially in China, but not shown in the table (which was current at the end of March).

REGION OR BUST

How pan-Asian institutions have responded to the epidemic

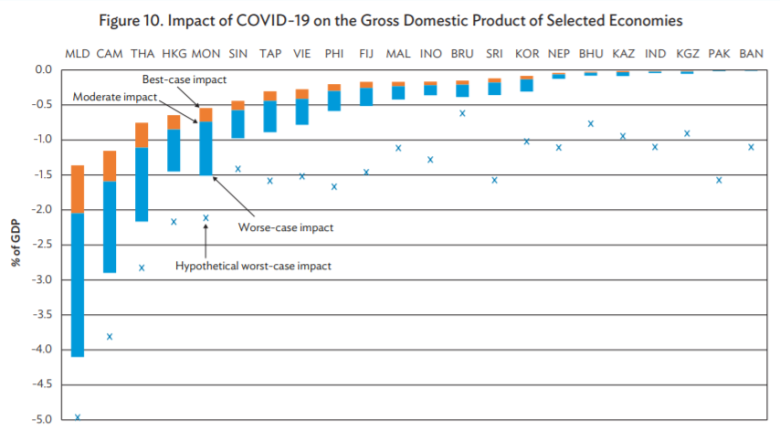

This Asian Development Bank chart shows the potential economic impact of an outbreak of the pandemic on various Asian countries (excluding China and Japan). But it was issued in early March before the spread beyond China was clear.

ADB: The Asian Development Bank has produced the most wide-ranging response to the pandemic of Asia’s regional institutions with a US$6.5 billion initial package on March 18 for its members. It is split between US$3.6 billion for members to deal with health and economic problems; US$1.6 billion for small and medium enterprises, domestic and regional trade, and firms directly impacted; and about US$1 billion in other concessional resources reallocated from existing projects. The World Bank announced a US$14 billion package the day before.

The ADB’s main economic analysis issued on March 10 was still largely focussed on how China’s management of the crisis would affect the region, but a more wide-ranging analysis is due later this week. The initial analysis focused heavily on a downturn in regionwide tourism. But it also identified how the Maldives, Cambodia, Thailand, Hong Kong, Mongolia, Singapore, Taiwan, and Vietnam were particularly dependent on trade and production linkages with China.

ASEAN: Vietnam has postponed the normal early year summit of Association of Southeast Asian Nations (ASEAN) leaders from April until late June, just after it suspended visas for foreigners entering the country. So far, the region’s oldest diplomatic group has only publicly addressed the crisis through meetings of health and economic ministers. Senior health officials met on March 13 and later said they had shared updated information on enhanced surveillance and containment, laboratory diagnosis and treatment in health care facilities in public and private hospitals. Three days earlier economic ministers said after meeting that they agreed to keeping the ASEAN market open for trade and investment; strengthening regional information sharing and coordination; and collaboration efforts to respond to the economic challenges from COVID-19.

AMRO: The economic research agency established to support the ASEAN Plus Three (China, Japan and Korea) countries says they still have the economic policy space to mitigate the impact of COVID19 and shore up growth. ASEAN+3 Macroeconomic Research Office economist Anne Oakling said on March 5: “China has already implemented measures to support its economy, including providing financial support to affected sectors. Other countries are likely to follow suit. Skilful use of various policy levers by regional policymakers is more important than ever, given that uncertainty about the epidemic is high and the risk of continuing contagion and a global economic slowdown is rising.”

APEC: The region’s largest economic cooperation group has started postponing meetings of officials (initially specifically for trade and tourism now delayed until June) in preparation for the Asia Pacific Economic Cooperation group summit in Malaysia in November. But APEC Policy Support Unit director Denis Hew said on February 17 that “experience has shown us that health outbreaks such as the coronavirus are economic and multilateral issues as much as they are medical concerns.” He said APEC’s experience with severe acute respiratory syndrome (SARS) 18 years ago showed that the Asia-Pacific has the capacity to cope with such events. “Lessons learnt from that experience led to the establishment of the Health Task Force to help address health-related threats to economies’ trade and security, focusing mainly on emerging infectious diseases.”

ERIA: This economic research agency mostly funded by Japan which operates parallel to ASEAN has so far only publicly addressed the crisis through an AMCHAN (American Chamber of Commerce) ASEAN meeting on February 27. The Economic Research Institute for ASEAN and East Asia website cites an address by ASEAN International Advocacy & Consultancy president Shaanti Shamdasani as saying the real threat comes from a range of factors – COVID-19 is just the ‘icing on the cake.’ “Our current economic system and infrastructure is misconstrued. We are burning so much money that we are sitting on a Triple Bubble burst, causing a worst-ever world crisis.”

PEAK JAPAN

When the author Brad Glosserman argued in his book Peak Japan last year that the Olympic Games would mark the zenith of Japan’s power rather than the starting point for a more influential country, he could not have imagined what has happened. With the best-case scenario now a postponement for a year, Japan’s strengths and weaknesses have been on display. The management of the coronavirus cases on the Diamond Princess cruise ship highlighted a bureaucracy that struggled to manage an unexpected situation. But the country’s relatively low COVID-19 cases since then have highlighted a disciplined population used to wearing masks. But with the economy in a sharp downturn even before the Olympics delay and new questions about coronavirus emerging, Prime Minister Shinzo Abe’s reported plans to retire on a high next year as his country’ longest serving prime minister are looking complicated. A successful Olympics would have capped an unexpectedly long period in power, but now his legacy is in the hands of forces beyond his control.

ASIAN NATION

Digital divide … Singapore ministers at the online summit with Australian counterparts.

ECOMMERCE MATES

Australia’s new digital economy agreement with Singapore was somewhat gazumped when Singapore entered a similar agreement with New Zealand and Chile back in January. But prime ministers Scott Morrison and Lee Hsien Loong managed to put theirs into practice with their virtual summit forced by the coronavirus travel bans. With digital commerce growing fast, this agreement is part of several attempts to develop new trade rules to manage this growth from the World Trade Organisation to the revamped Trans-Pacific Partnership (TPP). Australia’s existing trade agreement with Singapore has already pushed economic integration further than with other Southeast Asian countries and the two countries hope some other regional counties might be enticed to join up to the new Digital Economy Agreement. It provides more robust rules that ensure businesses, including in the financial sector, can transfer data across borders and will not be required to build or use data storage centres in either jurisdiction; improves protections for source code; establishes new commitments on compatible e-invoicing and e-payment frameworks; and delivers new benchmarks for improving safety and consumer experiences online. The Prime Ministers also announced seven side agreements to govern mattes ranging from trade facilitation to personal data protection.

FRENCH CONNECTION

New Caledonia wants to negotiate a trade agreement with Australia to lure more businesses to the French territory as Australia and France increase joint military exercises in the Pacific. The new Minister for the Economy, Foreign Trade and Energy Christopher Gyges visited Australia in March also seeking the removal of double taxation on businesses. He told The Sydney Morning Herald the territory’s previous government had been protectionist but that attitude had now changed. He said there should be more cooperation between Australia and France on trade, education, training and infrastructure throughout the region.

INDONESIA CALLING

While the coronavirus epidemic has cast a shadow over Indonesia’s health system, a new report says it offers an important new area of collaboration for Australian business. It says there has been an 88 percent increase in per capita health spending since 2019 and online solutions have played a growing part in servicing this need. The report by Asialink Business and the Medical Technologies and Pharmaceuticals Industry Growth Centre (MTPConnect) says the shortage of health professionals and inadequate physical infrastructure has made digital delivery mechanisms and efficient and competitive way to get services to people spread across 17,000 islands. It says: “Australia’s world-class healthcare system and reputation for delivering good health outcomes at an affordable price provide Australian digital health businesses with a strong value proposition in Indonesia. Australian digital health businesses will face domestic and international competition in Indonesia but can leverage their domestic experience and expertise to position themselves as a trusted partner or provider to Indonesia’s health sector.”

DEALS AND DOLLARS

JAPAN: BIGGER IS BETTER

Japanese investment in Australia is growing in size and complexity in a continuing shift away from the traditional focus on the resources industry, according to a new analysis. Six investments last year were valued at more than $500 million, compared with only three in 2017. On the other hand, there were only four deals valued at under $25 million compared with seven back in 2017. While this sample size is small, the now-annual survey by law firm Herbert Smith Freehills finds that: “Japanese corporations are now very familiar with the Australian market and increasingly comfortable with more complex transactions.” Overall, the survey identifies 42 transactions in 2019 (37 acquisitions and five sales) compared with 36 in 2018, and 33 in 2017. The transactions where a value was disclosed were worth $25.76 billion compared with $11 billion in 2018 and $4 billion in 2017. The survey says there has been a continued increase in majority and 100 percent takeovers across a range of sectors, with more focus on actually operating in Australia rather than exporting products back to Japan.

TWO BILLION TONNES AND COUNTING

It took BHP 40 years to export its first billion tonnes of iron ore to Asia and only five years for the second. So, with that striking measure of regional engagement, it’s not surprising that BHP chairman Ken Mackenzie is backing deeper engagement with China amid the debate about diversification. He told The Australian Financial Review Business Summit that this was the time for a different kind of relationship with China that goes beyond the transactional one of the past. “I would encourage all of us to be thinking about how we broaden and deepen that relationship,” he said noting how BHP was working carbon emissions and automated mining operations with Chinese partners in this way. “The prime minister once said, and I agree with him, they’re not trying to be us and we are not trying to be them. There’s always going to be differences but there is also a lot of commonality on the shared value to be created. I think we need to focus more on those things and on the positives in our relationship.”

SHRINKING HUAWEI

Chinese telecommunications company Huawei has axed its local board after launching a last ditch campaign of public meetings to make the case for remaining in Australia. The company is reportedly cutting about half its local workforce after being excluded from the development of Australia’s 5G network. The company had maintained a high-profile local board led by former senior naval officer John Lord since 2011, which had included former Victorian Premier John Brumby and former foreign minister Alexander Downer. It will now return to a conventional local branch operation in Australia.

MALAYSIA WIN FOR LYNAS

Rare earths producer Lynas Corp has won a new three-year license to continue operations in Malaysia subject to conditions, which will require the construction of new plants to handle waste and raw materials. The approval came amid the Malaysian political crisis and followed strong opposition to the company’s Malaysian operations within the former government. It requires Lynas to stop importing raw materials which contain naturally occurring radioactive material by July 2023 when Lynas will have built a plant to partially process those commodities in Western Australia. Lynas is the largest rare earths producer outside China, making it an important player in the debate about reducing dependence on China.

DIPLOMATICALLY SPEAKING

"I hope that the progress made during our RCEP (Regional Comprehensive Economic Partnership) negotiations does not go to waste… We will continue to talk, to see what is possible to bring down some of the government imposed trade barriers between our countries, whether via RCEP or by some other means in the future. The India Economic Strategy was ambitious in its goal of lifting Australian investment in India from $15 billion in 2018 to $100 billion by 2035. Now, while my government hasn’t made that explicit commitment, we are firmly dedicated to substantially increasing investment."

- Trade Minister Simon Birmingham speaking in Mumbai about closer trade ties with India.

DATAWATCH

MALAYSIA'S MOMENT

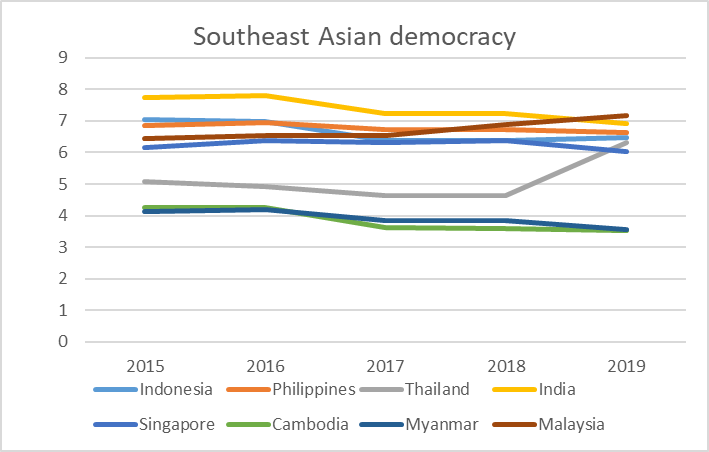

Malaysia’s change of leadership has implications beyond the country itself, given the challenges facing democracy across the Southeast Asian region. This chart, drawn from the Economist Intelligence Unit rankings, shows how Malaysia has been the only country on a steady upward trajectory in the past five years. India, Asia’s largest democracy, has been included as an added reference point. The viability of the new government will face its first official test on May 18 when the Parliament will meet for the first time since the leadership change.

WHAT WE'RE READING

CONTEST FOR THE INDO-PACIFIC by RORY MEDCALF (La Trobe University Press/Black Inc)

This book literally begins and ends with two maps which usefully visually demonstrate why the new way of describing Australia’s region as the Indo-Pacific is so contested. One shows how the idea of linking the Indian and Pacific Oceans has been around since the first European explorers came through, and the second shows how China is trying to refashion how the world is viewed on a map.

Rory Medcalf was one of the first Australian analysts to embrace the idea of a single strategic zone running from the east coast of Africa to the west coast of the US as a replacement for the once prevailing idea of the Asia Pacific. This long-delayed book places his original India-boosting approach to the idea in a much grander framework of a less China-focussed and more multipolar region with shifting combinations of various countries depending on the time, place and issue. He provides a fast-paced but scholarly history of different ways of imagining the region with some fabulous references to old maps.

The map re-reading is fascinating, but it is his shift to creating a new and future mental map of how the region might work that is the real and more controversial heart of the book. The great debate about the Indo-Pacific is whether it has simply been contrived by those frustrated and fearful of China’s rise to provide reassurance or whether there is a compelling and practical alternative to China-dominated region, however that region is defined.

With his historical research and then his current deep knowledge of the many so-called mini-lateral links emerging between the likes of Japan, India, South Korea, Australia and Indonesia (as well as the US), Medcalf makes a strong case for the latter. He says: “This super-region is too vast and complex for any country to succeed in protecting its interests alone. There will be a premium on partnerships… The future is not solely in the hands of an authoritarian China or an unpredictable, self-centred America.”

But for all Medcalf’s elegant multi-polar theorising, the brutal truism about the Indo-Pacific idea is that it depends on a more forthright India joining the festival of mini-lateralism in a way that constrains China. Medcalf is commendably realist about this, noting that India (and Indonesia for that matter) often tend to be less than the sum of their parts. On the other hand, he tends to be quite pollyannaish about Japan, despite domestic reservations about aspects of Prime Minister Shinzo Abe’s more activist Indo-Pacific security policies.

This is a timely book because the Indo-Pacific is the generally accepted way of characterising the region even if there is still quite a lot of disagreement about what it means. It is an interesting book to be reading when China may be on the cusp of winning global credit for its management of the coronavirus crisis despite being the place it started. Medcalf sees China as an emerging global power which has a lot of weak points which make it susceptible to his recommended modern strategic competition rather than old fashioned containment. Coronavirus management may prove an unexpected challenge to that.

ON THE HORIZON

THE VIRUS VERDICTS

Some Asian voters are set to provide the first formal response on how governments have handled the coronavirus crisis.

South Koreans will choose new National Assembly members on April 15 in a rapid test of how they view the way leftist President Moon Jae-in and his Democratic (or Minjoo) Party have managed the epidemic. Korea has won worldwide attention for its fast rollout of extensive testing and tracking of infected people from electronic data sources, including mobile phones. But early opinion polling appears to show that despite the international applause, voters seem to remain divided on party lines over how the government has performed with the Democratic Party in front of the more conservative United Future Party. The Democratic Party is the dominant political party in the country but doesn’t have an absolute majority in the National Assembly. A poor result would make Moon a lame-duck president for the remaining two years of his term. South Korea has a fractious party system with frequent mergers and name changes to secure advantage. But this election will see the introduction of proportional representation in the Assembly, which will add extra complexity to the result on top of the special provisions being implemented to manage voting during the epidemic.

Singapore’s government appears to be laying the groundwork for an election amid the coronavirus epidemic even though the poll is not required until April 2021. The release of new electoral boundaries on March 13 is seen as setting a potential timetable for an election because the last three elections have been held within two months of the report’s release. Government ministers have also added to the speculation by arguing that the coronavirus will still be a challenge in a year and so an election will occur under unusual circumstances whenever it is held. Prime Minister Lee Hsien Loong has said the country is going into a hurricane and a government with a fresh mandate could possibly best deal with the future issues. The government would benefit from an election held under social distancing rules to manage coronavirus because Singapore’s opposition parties typically generate their most attention with large rallies during the short nine-day election campaign. Most opposition parties have criticised the prospect of an early election due to the restrictions their campaigns would face. The new election boundaries involve a small increase in the number of parliament members and a shift from multi-member seats with six members to four members. After Malaysia’s change of government in 2018, there was a lot speculation the move might have emboldened Singaporeans to support more opposition candidates but that appears to have faded as Malaysia’s government has come unstuck.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. For more information please contact [email protected]

Read previous issues and subscribe >>