Briefing MONTHLY #27 | May 2020

After COVID | Bubbleplomacy | Asian studies blow

Animation by Rocco Fazzari.

PANDEMICS: THINKTANKS THRIVE

We are barely out of lockdown but the nation’s thinktanks are out of the blocks with more ideas than a debt-burdened government is possibly ready for on how COVID-19 will change Australia’s relationship with its region.

The issues range from new development aid priorities to reconstructed trade supply chains. But our survey of the new publications from various Australian thinktanks about the pandemic also underlines how an overarching question is emerging. Has the epidemic really changed regional relations forever, as is often asserted, or has it really just meant established divisions or challenges have been played out in a new theatre?

Former Indian foreign secretary Shyam Saran sees a world transformed with no return to a status quo which means it is even more important to “think hard about the possibilities and be prepared to counter what we don’t like and to support what seems more promising.”

With the rivalry between US President Donald Trump and Chinese President Xi Jinping intensifying over their management of COVID-19, John Lee, at the US Studies Centre, says: “When the pandemic eventually passes, ‘normal’ functioning of the global economy will not be like it was before.”

But the Diplomatic Academy of Vietnam’s Dang Cam Tu argues: “The pandemic is not necessarily a game-changer by itself, it is a reminder of pre-existing factors, trends, and values.”

Meanwhile some of these thinktanks are already looking beyond the pandemic to familiar issues that have briefly laid dormant from how Asia will manage climate change to the rivalry over infrastructure development.

See the survey below in What We're Reading.

NEIGHBOURHOOD WATCH

CHINA: THE MASKS HAVE IT

It is hard to assess true opinion in China, but the sight of the overwhelming majority of National People’s Congress delegates wearing face masks seemed to suggest greater uncertainty than the announcements on economic recovery.

The Congress was supposed to set the scene for the Communist Party’s centenary next year. Instead it revealed a government unable to risk some form of its traditional economic growth target, despite stepped-up stimulus spending. And this comes amid a trickle of new COVID-19 outbreaks when the country is trying to project itself globally as a virus mitigation success story. The shift to a tougher security approach in Hong Kong only looks like the resort to a familiar old nationalist playbook when the world was primed for something new after China’s belated acceptance of an inquiry into the virus.

- As Australia contemplates a more combative relationship with China, Asia Society Policy Institute senior fellow Richard Maude says there is no going back to the Howard era when commerce was more easily separated from security concerns.

JAPAN: PAYING THE PRICE

Japan has now announced stimulus packages nearing the size of the entire Australian economy in each of the last two months as it navigates an economy already in recession before the pandemic and a slow response to the initial virus outbreak. But the packages overstate actual new government spending, raising some questions about their impact. Nevertheless, Prime Minister Shinzo Abe declared victory for a “Japanese model” by ending the country’s voluntary lockdown on May 25. But that model of wearing face masks, obeying government requests, and contact tracing without intensive testing is still proving expensive to the government and is not boosting Abe’s public support.

- Tokyo governor Yuriko Koike has shown a better grasp of a health crisis, while Prime Minister Shinzo Abe has been uncharacteristically diffident, according to Aurelia George Mulgan at East Asia Forum.

INDIA: HOME AND AWAY

The sudden migration of millions of workers back home to their villages for the Indian government’s hastily declared lockdown has prompted debate about how to manage the world’s largest population. While the government was more decisive than what has happened in Indonesia, the lack of reliable data on migrant workers, the real rural/urban distribution and urban planning left the country unprepared for the massive exodus. Now, with people back home in their villages, there is a debate about whether it would be better for some of them to stay there if jobs can be created, which is creating more pressure for businesses to reopen. After the sudden, very harsh lockdown, accompanied by apocalyptic warnings about the virus, Prime Minister Narendra Modi appears to have completely changed course and is urging Indians to live with the disease as they rebuild the economy amid still rising infections.

India Today photo essay. Picture: Maneesh Agnihotri

- It is hard to imagine India in monochrome. This is a captivating photo essay from India Today of a nation going home for lockdown.

INDONESIA: AUTONOMY PAINS

The devolution of power to Indonesian cities and provinces almost two decades ago was a triumph of democratic renewal in the post-Soeharto state. But even this far on, the coronavirus pandemic has revealed unresolved weaknesses but also striking strengths in the evolving structure. From the beginning there have been major differences between the national government – where confusion, concern about macroeconomic stability, and some anti-scientific views prevailed – and local administrations which are closer to the people’s needs. By some estimates only a handful of the 34 provinces and only dozens of the more than 500 cities applied significant lockdowns and often at odds with more mercurial national rules. But some cities also acted fast and applied innovative policies that stopped infections. Now some are reporting revenue falls of as much as 90 per cent forcing them to reopen despite a rise in infections in line with President Joko Widodo calling for a “new normal” by July.

- This Australia-Indonesia Centre discussion about the pandemic with two of the country’s leading local government reformers – West Java governor Ridwan Kamil and Bogor mayor Bima Arya – shows how they have managed the pandemic despite central government indecision.

MALAYSIA: HIDING OUT

For a country in political turmoil, Malaysia has done relatively well controlling COVID-19 with less than 8,000 recorded cases in a nation of 32 million. But the political impasse over whether new Prime Minister Muhyiddin Yassin actually controls a majority in Parliament is taking the stimulus impact out of one of the region’s larger headline economic recovery packages. For example, the new government would need parliamentary approval to raise its debt ceiling, but has delayed the next sitting until July after a token first sitting with no debate on May 18.

- Mahathir Mohamad’s first day in Parliament as an opposition member has not dimmed his desire to return as prime minister, according to this Asia Times article.

ASIAN NATION

DIVERSIFY OR BUST

The day Trade Minister Simon Birmingham bluntly told Australian business in a television interview to start diversifying supply chains – including exports – away from the country’s biggest customer China trade will go down as an historic day in relations with China. And the fact Industry Minister Karen Andrews declared a few days later that a domestic manufacturing revival will depend on exports means that Australia’s commercial bonds with the rest of Asia are facing an important test.

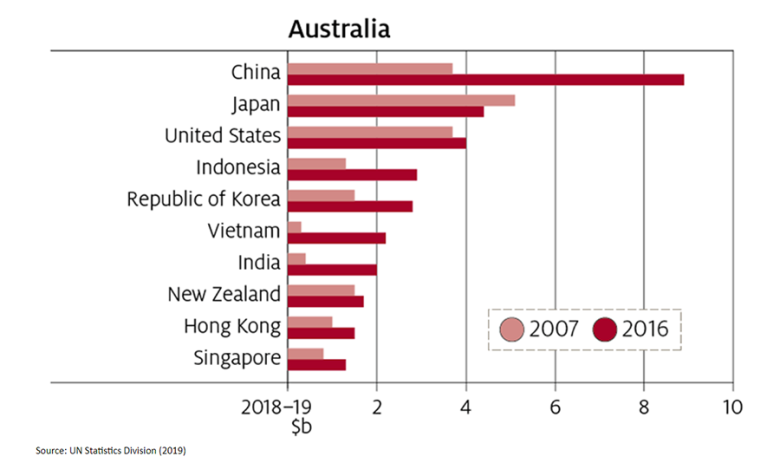

Over the last five years only two-way trade with India and Vietnam has grown as fast as two-way trade with China – but the value of China trade is still five times larger than that with the two alternative countries combined.

Prime Minister Scott Morrison’s efforts to yet again boost trade ties with India in early June (see On the Horizon below) and the start of the Indonesia-Australia Comprehensive Economic Partnership trade deal on July 5 couldn’t come sooner.

- Diversifying exports is easy to recommend but harder to implement. This Australian Financial Review article details the meat industry’s progress.

BUBBLE DIPLOMACY

When the lure of getting travellers from New Zealand is being used to browbeat State governments which still support border closures, the idea of a travel bubble is now a key part of the economic recovery and diversification strategy. But the idea popularised by New Zealand Prime Minister Jacinda Ardern is not to be dismissed, given travel is a top five Australian export and 1.47 million New Zealanders were only just beaten by Chinese as the top source of visitors last year. And travel is a bigger part of many South Pacific country economies, but some of them are still more cautious than the front-running Australian states – such as NSW – desperate for some tourism revenue.

Fiji has formally expressed interest in being part of an Australia-New Zealand travel bubble, and Vanuatu and the Cook Islands have reportedly shown interest. International Development Minister Alex Hawke has indicated support for extending the idea into the region.

But while the travel zone is well-advanced, there are quieter discussions under way about the possibility of a parallel business travel bubble into Asia, which would give some extra heft to the post-pandemic diversification push. This could be a test of the gradual efforts to turn the bilateral trade agreement with Singapore into something much more akin to the closer economic relations arrangement with New Zealand. Singapore is also considering “green lane” travel arrangements for selected countries. But a travel bubble might pose some much trickier diplomatic decisions deeper in Asia where, for example, heavier-handed China might have its virus risk more under control than lighter-touch Japan. China and South Korea have already opened limited business travel corridors between selected cities since early May with virus testing at either end.

- This South China Morning Post article looks at the state of play with travel reopening across Asia.

LIBRARY LOCKDOWN

The National Library of Australia has ironically pushed ahead with cutbacks to its Asian collection as the rest of the country has been coming to grips with a pandemic which has only underlined Australia’s connection to the region. Just as the government has been urging business to diversify trade channels beyond China, the library is planning to downgrade the focus of its Asian collection to at-best China, Indonesia and Timor Leste.

This threatens the future of one of the world’s most extensive collections of literary material from northeast and southeast Asia, built up over more than half a century and a core asset for Asian literacy and language study in Australia. The collection made the library a pioneer of Asian engagement within the country’s bureaucratic and arts institutions. But it now says that serial funding cutbacks will force it to focus on its Australian collection.

Asian Studies Association of Australia secretary Melissa Crouch says: “Cuts to the Asian Studies collection at the National Library of Australia would be devastating and send the wrong signal about Australia's commitment to understanding and appreciating its neighbours at a time when greater knowledge of and engagement with Asia is more important than ever.”

DEALS AND DOLLARS

TENCENT GOES SHOPPING

Despite rising tensions over the business relationship between China and Australia, an investment by China’s Tencent in Afterpay has been one of the highlights of the recovering sharemarket. Tencent Holdings bought a five per cent stake for about $390 million as part of its new focus on smart retail and payment platforms. The investment has been widely seen as a validation of the deferred payment concept, even at a time when consumers are tightening their belts due to the pandemic.

NAVAL BUSINESS

Naval shipbuilder Austal Asia says the push by Asian nations to boost their naval forces over the next decade could generate a steady pipeline of work for the company. Austal has invested heavily in Asia in recent years to establish its own shipyards in Vietnam and The Philippines. It also has shipyards in Australia, the US, and a small joint venture in China. In an interview with The Sydney Morning Herald chief executive David Singleton said the tensions in the South China Sea have prompted regional players, including Japan, South Korea, The Philippines and Indonesia, to consider beefing up their naval capabilities.

IT’S AMORE

South Korean cosmetics conglomerate Amorepacific has taken a 49 per cent stake in Australian luxury skincare company Rationale in its first investment in Australia. Amorepacific is the world's 12th largest cosmetics company and the leading player in South Korea. This is its first investment in an Australian brand, though the company opened operation here in 2018 through the launch of several of its 30 brands, including the mass-market Innisfree and luxury skincare brand Sulwhasoo.

PACIFIC PHONE DEAL

Australia is under new pressure to provide commercial support for telecommunications in the South Pacific after the bankruptcy filing by Digicel, which provides mobile phone services in Papua New Guinea and five other neighbouring countries. China Mobile is reportedly looking at buying the Digicel Pacific business, although Digicel has denied any discussions have taken place. The Australian Financial Review reported an Australian telecommunications executive was trying to put together a rival bid to China Mobile but might require an Australian government loan guarantee to do so. Two years ago Australia was forced to largely fund a telecommunications cable in the Pacific to it being built by Chinese firm Huawei.

ANZ WARNS ON CHINA

ANZ Bank chief executive Shayne Elliott has flagged a slowdown in business with China as a result of the recent bilateral trade tensions and the Hong Kong protests. Noting that the China business existed to service the trade and capital flow in and out of China, mostly to Australia and New Zealand, but also to other parts of Asia, he said: “The scale and breadth of that operation may well change as a result of this.” He said recent events had “raised the risk profile around certain parts of our business.”

DATAWATCH

FEEDING ASIA

Australian food export growth

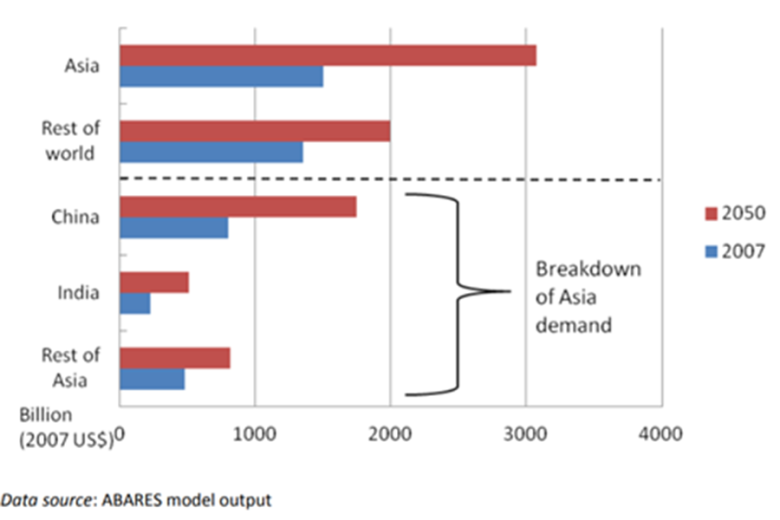

Long term food demand growth

DIPLOMATICALLY SPEAKING

“The goal of both Australia and China should be to reduce tensions and I think it would be helpful for some calm and frank engagement between our senior officials at this point. Because there is no doubt there needs to be an investigation (into COVID-19). Without Security Council backing there is no legal authority for other countries to go into China and collect evidence or interview witnesses and the like. So, I think the analogy with weapons inspectors is inappropriate because weapons inspectors only go in by invitation. So, they can be asked to leave if the sovereign nation does not want them there. We need China’s co-operation and support.”

- Former foreign minister Julie Bishop, May 12, 2020

WHAT WE'RE READING

A survey of post-pandemic thinking on Asia from Australia’s thinktanks

After Covid-19: Australia and the World Rebuild

(Australian Strategic Policy Institute. Published May 2)

This fast turnaround collection of essays by mostly Australian Strategic Policy Institute staff is built on the idea that the pandemic is a major opportunity to reset policy making and direction frameworks, indeed it asserts “a once in a lifetime opportunity.”

If there is a framework for the diverse contributions it might be the observation in the introduction by John Coyne and Peter Jennings that: “The pandemic has shown that far too much of our national resilience, from broadband bandwidth to the capacity to produce basic medical supplies, has been left to market forces and good luck rather than planning.” Marcus Hellyer takes this theme up in more detail by arguing that a new form of globalisation will emerge in which better risk weighting and resilience will be as important as lowering costs. “We’ll need to adopt a combination of measures involving diversified sources of supply, greater stockpiles and enhanced domestic manufacture. Doing so will require a level of central planning that we haven’t done outside of world wars, are not accustomed to and currently lack the capability to do,” he says. He acknowledges that paying for all this will be a major new wicked problem, although it seems a bigger role for government spending will be the answer.

The volume is split between essays about domestic reform ideas and then the global outlook. While there is plenty of concern about China, Huong Le Thu suggests that closer to home Australia should be concerned about a decline in the regionalism pursued for decades by the Association of Southeast Asian Nations (ASEAN). “Some countries may have changes of leadership, and others might even find themselves new political systems, if the crisis spins out of control,” she warns while acknowledging the pandemic is playing a little later in this region than the developed world. Amid a fractured recovery by individual countries, she says Australia needs a similarly diverse response to stay abreast of this possibly less unified region.

In a change of pace for an Australian Strategic Policy Institute publication, Brendan Nicholson ponders the way expert scientists have come to the fore in the media as a result of COVID-19 in contrast to the way they have often been ridiculed over climate change science. He considers whether this is because the pandemic is much more 'here and now' in people’s lives than the complexities of climate change, but suggests the media may emerge from this crisis knowing that “providing accurate information is vital to inform vast numbers of cared and confused people.”

Covid-19 and the Australia-China relationship’s zombie economic idea (Australia-China Relations Institute. Published May 7)

This report aims to debunk some of the conventional wisdoms that have entered the debate about economic diversification away from dependence on China. For example, it makes the point that several agricultural industries such as wool (at 80 per cent) and wine (at 20 per cent) are more dependent on exports to China than the typical universities. But universities have attracted more attention because of a few highly dependent institutions.

James Laurenceson and Michael Zhou write: “The Australia-China relationship has its own zombie economic idea: that Australian entities engaging heavily with the Chinese market are irresponsible in their risk management, and that, at a national level, Australia is ‘too dependent’ on China.” They readily concede that Australia is highly exposed to China with two-way trade of $235 billion compared with bilateral trade with Japan of $88.5 billion but put this in a bigger global picture.

Australia ranks 16th globally in terms of total goods going to China and is only 46th globally in terms of dependence on one market. Canada and Mexico are more than 50 per cent more exposed to the US than Australia is to China. They go on to argue that while diversification is worth looking at, the alternatives are not so easy to find. But their key point is that business, by its nature, is always doing risk and reward analysis and has already been doing that with China. “The basic incentives businesses have to get the risk/return equation right do not, for the most part, exist to the same extent for the Australian government,” they argue.

Impacts of COVID-19 on Australian agriculture, forestry and fisheries trade

(Australian Bureau of Agriculture and Resource Economics and Sciences. Published April 23)

With the Budget delayed and economic forecasts thrown into turmoil, this is one of the few comprehensive public assessments so far from a government agency on the way the pandemic will impact on trade. It firmly debunks the idea that Australians needed to worry about food security when the pandemic started. But it then warns that supply chain and logistic disruptions due to the pandemic do pose a threat to Australia’s ability to export two thirds of its agriculture production, mostly to Asia.

This has proven very timely with the subsequent Chinese threats to some food exports. Although the report also underlines the complex inter-relationship that now exists with China be pointing out that it needs about four per cent of Australia’s raw food exports as inputs for its own manufactured food exports. The other interesting risk factor with China is that it is now the largest supplier of machinery and farm chemicals to Australia – valued at more than $500 million a year. Indeed, the report concludes that the impact on production from disruptions to the supply of imported inputs is around 1.7 times greater than a demand shock to exports. “This is because a... sudden fall in demand... generally reduces prices but not production, and the products typically still find a market. In contrast, a sudden decline in the availability of inputs limit the ability to produce, so there is less to sell.”

COVID-19 Survey

(Aus-CSCAP/Asialink. First published May 1 and continuing)

This collection of essays from strategists, commentators and former officials from across most Asian countries is grappling with what may be the big question of the post-pandemic world: has the virus changed international relations forever or just exposed old problems from a new perspective?

There are some very diverse views on this question, although on balance the majority of writers think old challenges will dominate with new thinking on the margins. The Pacific Forum’s Ralph Cossa argues: “Some commentators are seeing the crisis as a ‘game-changer’, but that is far from certain – the tendency once the crisis has past may well be to simply lapse back into old habits and patterns.” On the other hand former Indian foreign secretary Shyam Saran sees a world transformed with no return to a status quo which means it is even more important to “think hard about the possibilities and be prepared to counter what we don’t like and to support what seems more promising.”

Between these polar views of change in the post-pandemic world there is nevertheless much commonality on the key issues: China-US relations; the future of globalised economics; the effectiveness of diplomatic architecture; and ways of preparing for the next pandemic. And on the latter point there is some welcome optimism with hope for better regional cooperation in the health field amid the less surprising doleful views about the first three issues. And the common thread on those issues is that with both the US and China having performed badly as global players through this crisis, countries such as Australia will have to pay even more attention to building bonds and institutions with other like-minded countries.

The curse of ‘The Lucky Country’: In search of economic antidotes to COVID-19

(McKinsey & Company. Published May 4)

This analysis ponders an intriguing question about Australia’s world beating management of the COVID-19 outbreak: the population is still only in the middle of the pack internationally on the outlook for the recovery. Indeed, according to the McKinsey polling, Australians are only half as optimistic as Americans, where many more people have died, and less than half as optimistic as Chinese where the virus started. “We are struck by this juxtaposition,” say the authors arguing that an exploration of the relative lack of optimism is “important to ensure that the population’s concerns do not unduly weigh down the country’s capacity not only to recover but also to innovate and prosper after the crisis.”

Disruptive Asia: Sustainability of the Asian Century

(Asia Society Australia. First published May 19 and continuing)

In another example of how some institutions are already looking beyond the pandemic, the fourth edition of Asia Society Australia’s annual essay collection goes back to the future to examine how Asia (and Australia) are managing making economies and societies sustainable.

“COVID-19 has demonstrated that social and economic development is unsustainable if it increases vulnerability to the kind of humanitarian and financial crisis we are currently going through. In Asia we find great hope but also cause for some concern,” executive director Thomas Soem writes in an introduction to the first four of the essays released.

But agfood entrepreneur Jaleh Daie joins the dots between the crisis of the moment and the return of the crisis over climate change in an essay which raises questions about how the increased geo-political tensions and lack of cooperation over COVID-19 may make dealing with climate change more difficult. “It is too early to know how long the current misalignments may last and what fall-outs will impact food exporting nations such as Australia. Still, to achieve monumental goals, international coordination and cooperation are essential,” she argues. She wonders whether the world may be shifting to a back-to-basics focus, in which economic expansion might take a back seat to securing food supplies and protecting public health. But this will still create new opportunities for investors who can turn these challenges into businesses.

Towards a Quad-Plus Arrangement

(Perth USAsia Centre. Published on April 21)

This contribution to post-pandemic strategising draws on a little-publicised March teleconference of officials from Australia, Japan, India, the US, Vietnam, South Korea and New Zealand about COVID-19 to suggest continuing cooperation. Rajeswari Pillai Rajagopalan argues that this meeting of the four members of the well-established Quadrilateral group of countries, with three non-members, shows how the pandemic could reshape international cooperation.

She says: “Efforts to coordinate responses to COVID-19 by the Quad-Plus countries may be a means to expand the original formulation at a pace that would be comfortable to potential new members and without eliciting a Chinese rebuke. It would be hypocritical for China to oppose countries collaborating on COVID-19 when it has itself made precisely such calls. But such cooperation also sets the stage for further Quad dialogue on other problems these countries face, potentially including security problems.” But she underlines how the Quad group faces questions about its unity of purpose when only the Indian government announced this meeting had happened and made no actual reference to the Quad.

Mobilising the Indo-Pacific Infrastructure Response to China’s Belt and Road Initiative in Southeast Asia

(The Brookings Institution/Lowy Institute. Published April 30)

While the COVID-19 crisis has subsumed most of the airtime for discussion about regional development aid spending priorities, this analysis suggests that attention will soon return to the broader rivalries over infrastructure that held sway last year. Roland Rajah says: “Policymakers are currently focused on containing the health and economic damage of the virus. However, as the priority shifts to the post-crisis recovery, this inevitably will see focus return to the sustainable infrastructure agenda – with Southeast Asian governments looking for willing partners to assist.”

The report argues that the current approach taken by Australia and its partners – the US and Japan – in charting alternatives to the Belt and Road Initiative is not credible because they can’t mobilise private capital to match the Chinese program. And at the same time, Southeast Asian countries will always be tempted by the faster, less risk-averse and more responsive BRI promise.

US-China Economic Distancing in the Era of Great Power Rivalry and COVID-19

(University of Sydney US Studies Centre. Published May 4)

This report forecasts an expansion of the diversification, disentangling and decoupling of trade supply chains from China due to the severe impact of the virus in the US. But notably, as Australia tentatively goes down this path after trade disruptions with China, it warns the lowering reliance on China will be “difficult or impossible to shift” and so will only be gradual. Nevertheless, John Lee writes: “When the pandemic eventually passes, ‘normal’ functioning of the global economy will not be like it was before. ‘Made in China’ will still be ubiquitous with respect to many common products, but the days of ‘Trust in Beijing’ are quickly passing.”

He also steps up the idea that companies should take the national interest into account in their trade and investment decisions by arguing that “the maximisation of profits using the most cost-efficient way to source parts, components and expertise will no longer be seen to be axiomatically in the national interest.”

ON THE HORIZON

VIRTUAL INDIA SUMMIT

Prime Minister Scott Morrison is set to meet his Indian counterpart Narendra Modi in early June to pursue several closer relationship initiatives which were put on hold when a planned January summit was disrupted by the bushfires. But the earlier initiatives on military base and technology sharing, enhanced education ties, and some enhanced trade ties may be overshadowed by new pandemic related cooperation.

More cooperation between India and Australia over supply chains in areas such as medical supplies and critical minerals have gained greater significance due to both the COVID-19 lockdown and China’s more assertive approach to trade with Australia.

Both India and Australia were fast to introduce new restrictions on foreign investment early in the lockdown period which appear to be aimed at opportunistic Chinese takeovers, although they have each discreetly not targeted China. India is a prime market to potentially take more barley exports from Australia after the Chinese dumping action, although agriculture exports remain a sensitive area as the two countries try to find practical pathways to greater two-way trade after the failure of free trade talks.

Morrison pioneered replacement online summits with Singapore’s Lee Hsien Loong in March. But this will reportedly be Modi’s first such bilateral summit, although he played a key role in promoting the online summit of the Group of 20 nations leaders also in March.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

We are grateful to the Judith Neilson Institute for Journalism and Ideas for its support of the Briefing MONTHLY and its editorial team.

Partner with us to help Briefing MONTHLY grow. For more information please contact [email protected]

This initiative is supported by the Judith Neilson Institute for Journalism and Ideas.