Briefing MONTHLY #26 | April 2020

COVID costs | China poll shift | Turnbull's Asia | Plus: Asia Briefing LIVE

Long wait… Indonesia’s virus strategy has created uncertainty. Photo by Pisauikan on Unsplash

The disputed and fragmented COVID-19 lockdowns in countries as diverse as Indonesia and Japan have underlined how the human impact of the pandemic in Asia is still unfolding. But the contours of the broader costs of the crisis in the region are starting to emerge from the very different economic stimulus spending approaches to the crunch facing universities in Australia.

In Datawatch: another healthy benchmark from Taiwan.

In Neighbourhood Watch: Can South Korea manage two crises at once?

In Asia Briefing Live: Poll reveals tougher attitude to China

SPENDING: A MIXED PICTURE

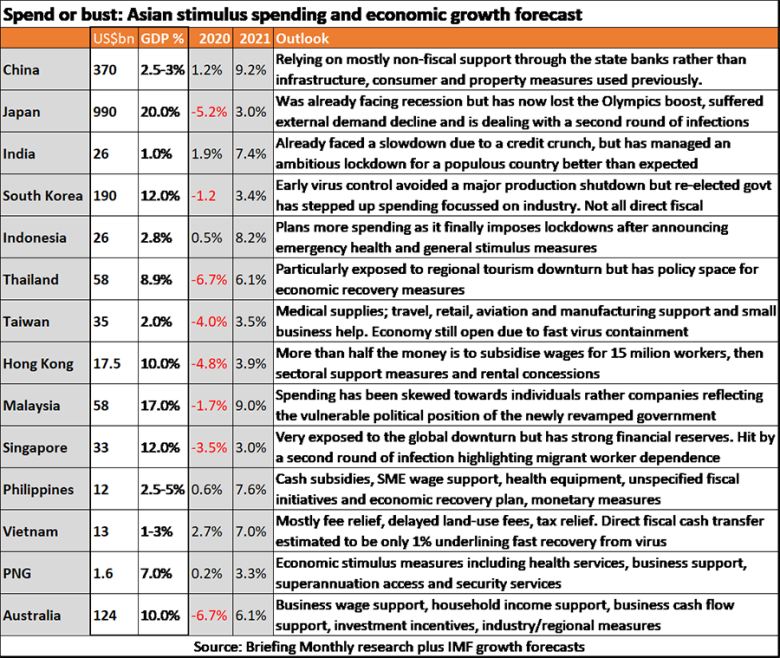

Asian countries both lead and lag the global trends in government spending to fend off an economic downturn from the pandemic, reflecting diverse financing capacities, variable virus experiences and different economic structures.

Singapore, Malaysia and Australia were relatively early fiscal stimulus spenders and have now progressively committed to spending above 10 per cent of GDP. Japan and South Korea have joined the fiscal rescue race later in the process after early confidence they had the pandemic under control. But Korea’s new spending also reflects a newly confident re-elected government, while Japan’s reflects a sudden rise in cases. China stands out for relatively low spending as a share of GDP at less than a third of what it spent during the 2008 global financial crisis.

Unlike Australia’s relatively straight forward new spending, not all these country actions are as large as they look and they are not always directly comparable. This is because they often either bring forward other programs, involve more regulatory measures than spending, or involve various sorts of credit guarantees.

The two countries claiming the largest stimulus by GDP share – Japan and Malaysia, which are both debt constrained – appear to have overstated the actual on-budget new spending the most. This will reduce the ability of their programs to immediately offset the economy-dampening containment measures now under way and possibly slow a return to stronger growth. Vietnam’s measures mostly involve fee relief and tax deferral, rather than spending. Nevertheless, it is a striking measure of the success of Vietnam’s containment approach that it has been able to return to more normal activity without much actual new spending. Meanwhile the Philippines measures include substantial amounts of unspecified future action.

- This South China Morning Post article wraps up the growth of fiscal spending in Asia

DEMOCRACY: STRONGMEN MOVE

Concern is rising that democracy will become another victim of the coronavirus epidemic, as several authoritarian leaders use health-related emergency powers to stifle opposition groups.

Fifteen pro-democracy activists have been arrested in Hong Kong as China has moved to curb the territory’s special autonomy and is suspected of being behind a reshuffle of the city’s government. Hong Kong’s street protests have evaporated as the pandemic has forced people to stay home, possibly undermining democratic protest momentum ahead of the anniversary of the protests in mid-year and the September city elections. Meanwhile, democracy activists say that governments in Thailand and the Philippines are using emergency powers to restrict criticism of pandemic management. In Cambodia, citizens and opposition activists have been arrested for raising concerns about the virus over social media after Prime Minister Hun Sen initially played down the threat. Opposition parties in Singapore are saying they will not be able to campaign properly if the government calls an early election amid a pandemic lockdown.

- In this Pearls and Irritations article, former foreign minister Gareth Evans calls on the Australian government to specifically oppose Cambodia’s state of emergency law because it has given such unrestricted powers to Hun Sen.

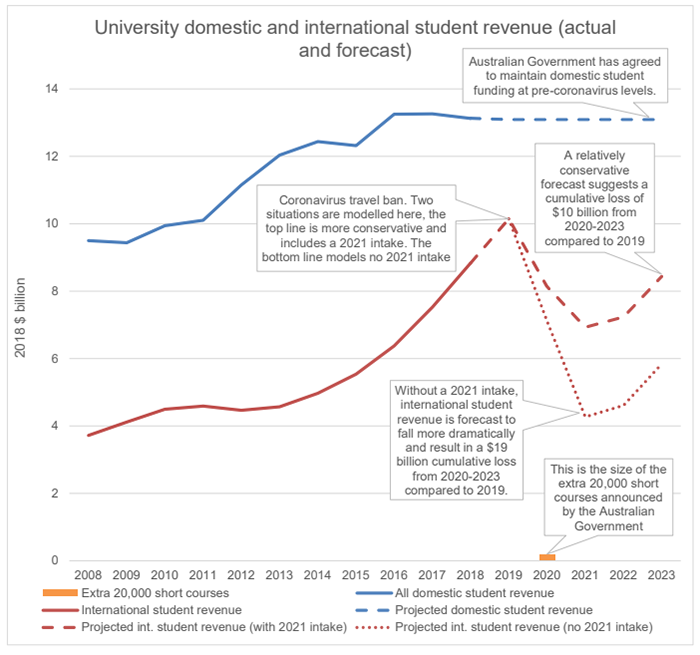

EDUCATION: UNIS UNDER PRESSURE

Source: Mitchell Institute

The impact of the COVID-19 border closures on Australia’s third largest export – education – has been underlined in two studies which demonstrate how crucial a return to some normality next year will be. Modelling by the Mitchell Institute at Victoria University suggests that universities are facing a cumulative revenue loss of $10 billion between 2020 and 2023, which compares with the sector’s surplus of only $1.5 billion in 2018. But a disrupted 2021 foreign student intake could almost double the revenue loss. And the study emphasises that the loss for the national economy could be $30-60 billion when the amount students spend beyond tuition fees is taken into account.

Meanwhile, a parallel study by ratings agency S&P Global notes that the government emergency relief measures have been modest for universities and don’t extend to foreign students. It suggests universities should be able to manage spending and liquidity to get through this year. But it warns that if the “duration of travel restrictions extends into 2021, the financial damage will be more severe and the pressure on (university) credit ratings will grow.” These reports underline how the government took a big gamble on Asian student loyalty when some ministers said at the height of the lockdown that they just should just go home.

- The universities will have to improve their online course delivery capacity to survive the crisis, according to this analysis by Tim Dodd in The Australian.

INVESTMENT: HEAT ON CHINA

JAPAN: As the Australian government considers how to achieve greater domestic economic sovereignty, a small Japanese textile company is set to become the flagship of a potentially watershed change in how Asia’s integrated production model will work in future. Iris Ohyama will be the first company to be paid by the Japanese government to shift its production of face masks from China back home to Japan. The company is planning to “reshore” its entire supply chain by drawing on a $3 billion fund the Japanese government has established as part of its recent coronavirus stimulus package. Japanese companies rely on China for 20 per cent of their materials, which is roughly the same as Australian companies. But the government has taken the unusual step of specifically identifying China in its reshoring subsidy scheme.

INDIA: India has been more coy in a parallel decision to require approval of new foreign investment from any country it shares a land border with. While China is not specifically identified, it is the only country significantly affected by the change, which echoes an Australian government decision to impose tighter scrutiny of all foreign investment as a result of the pandemic. Chinese investment in Indian consumer goods manufacturing and ecommerce start-ups has risen sharply in the past five years despite some diplomatic tensions between the two neighbours. While the official figure is US$8-10 billion compared with less than $2 billion five years ago, this recent Brookings Institution study suggests the total maybe as high as US$26 billion.

- This Nikkei Asian Review article explores how the pandemic might change the foundations of Asia’s integrated economy.

ASIA BRIEFING LIVE PREVIEW

Asia Briefing LIVE participants (clockwise from top left) Haidi Stroud-Watts, Bloomberg; Mark van Dyck, Compass Group; Belinda Hutchinson, University of Sydney; and John Meacock, Deloitte, discuss the regional economic outlook

DIVERSIFICATION DIVIDE

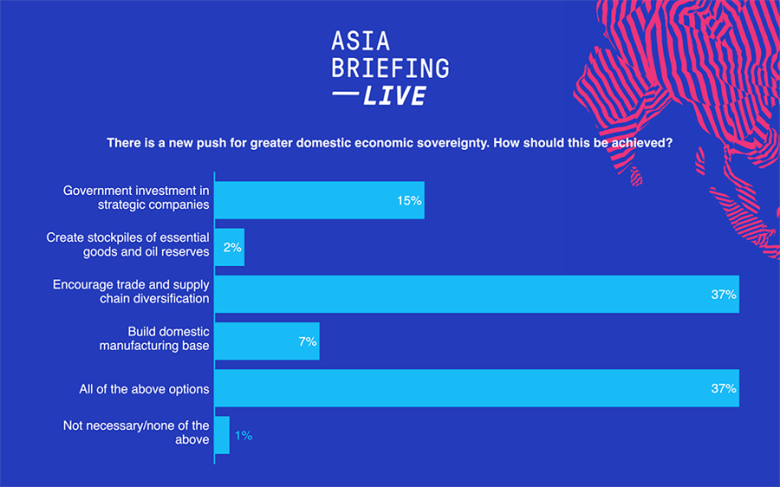

Australia faces a challenging task striking the right balance in the quest for domestic economic sovereignty which the Federal government has unleashed in the wake of the COVID-19 pandemic. The discussion and audience polling at this year’s Asia Briefing LIVE preview showed that while this is a key new issue on the national agenda, there is no clear consensus.

Our audience polling gave more support to the government buying equity in strategic companies, which has been rejected in the case of Virgin Airlines; but gave little support to stockpiling which the government has moved to do in the case of petrol. And while our speakers supported greater trade diversification, they were opposed to doing this in a strategy to reduce engagement with China.

“We need to make sure we have enough diversification for resilience, but I would be very concerned if we do back away from working with China,” said Deloitte chief strategy officer John Meacock. “I think China is a big opportunity. They are going to be growing quicker than others and are still going to be our most important trading partner.”

Compass Group Asia Pacific regional managing director Mark van Dyck said that his company’s operations in China were already almost back to pre-coronavirus levels, underlining how Australia needed to find a way to “separate the diplomatic and virus concerns from the trading relationship.”

University of Sydney chancellor Belinda Hutchinson said her institution had already been trying to diversify its international student base away from a dependence on Chinese students but found Chinese students valued the quality of Australian higher education, liked to be in a similar time zone to China, saw Sydney as safe, and did not typically come to the university as a backdoor way of migrating to Australia. She said that while the university was under financial pressure from the loss of about 18 per cent of foreign students, it believed applications from foreign students for next year were still strong.

Van Dyck said he was optimistic about Australia’s capacity to diversify and play a bigger role in the faster growing economies of the Asian region, but to do that it had to remain an open economy. “One thing that worries me at the moment are these calls that we should reduce trade with China. I think they are misguided and that’s not how trade works,” he said. He said that the best opportunities for Australia to diversify its economy at home and abroad were in advanced manufacturing, life sciences and the food industry, and all three of these sectors would get more of an emphasis in the recovery from COVID-19.

Meacock said the push for trade diversity and domestic economic resilience should be seen as a form of insurance policy against future unexpected shocks rather than a retreat to a more nationalistic way of running business. “I think if you look at it as an element of insurance it does make sense,” he said.

Wendy Cutler discusses COVID-19's impact on international trade with Ed Johnson, Managing Editor, Australia and New Zealand, Bloomberg News

Asia Society Policy Institute vice president Wendy Cutler said that many US companies had been moving to diversify their dependence on Chinese production before the pandemic by shifting factories to Vietnam, Malaysia and Bangladesh, but now they would be looking closet to home, with Mexico coming back into favour. “But some companies will still be keeping their supply chains there in China,” she said.

POLLS APART

The audience polling on how to achieve economic resilience saw the strongest support for all available options and the idea of encouraging business supply chain diversification.

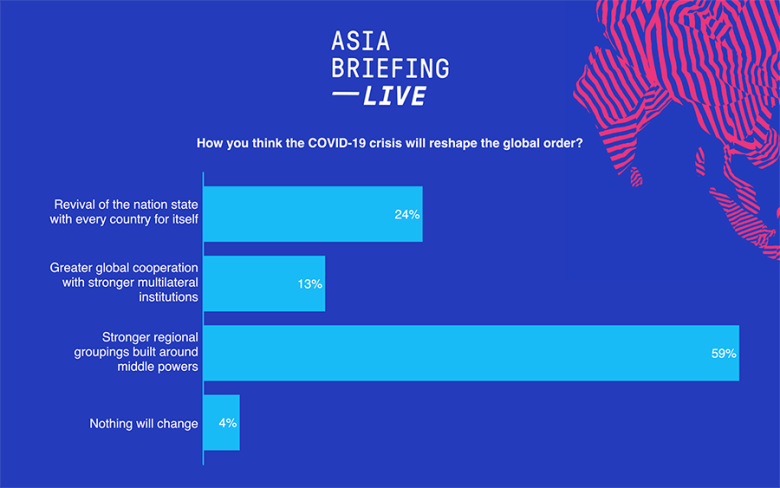

Meanwhile our audience participants took an interesting middle path on a poll question about how Covid-19 will reshape the global order. Fifty-nine per cent of respondents thought the world would see stronger regional groupings built around regional powers which would potentially open up some new opportunities for Australia which is an active participant in many regional groups. But the remaining participants were quite divided over the other alternatives with 24 per cent predicting the revival of the nation state and 13 per cent predicting greater global cooperation with stronger multilateral institutions.

MOOD CHANGES ON CHINA

Asia Briefing Live audience polling on how Australia should manage the China relationship has shifted significantly towards a more assertive approach by the Australian government amid new tensions between the two countries over Australia's support for an independent investigation into the origins of COVID-19. The Morrison government has come under attack from Chinese government and media commentators for supporting an inquiry and action to curb the sale of wild animals in wet markets. And Chinese ambassador to Australia Cheng Jingye has suggested Chinese consumers could boycott Australian products, adding unexpected fuel to the debate about the need for Australia to diversify its trade dependence on China. The polling underlined the growing tension between China as an important economy and concern about how to deal with its growing assertiveness. It was favoured as the country offering the best opportunities for Australian business (at 40 per cent) ahead of Indonesia (28 per cent) and India (24 per cent), which was similar to last year. Japan and South Korea were well behind at six per cent and two per cent.

But participants were split over whether Australia should accept China’s rising power (54 per cent) or push back against it (46 per cent) which is a significant shift from past years when there was much greater support for accepting China’s power and working with it at between 70 and 90 per cent.

And the parallel question on how the Australian government is handling the China relationship showed a rising level of support for the government, even though 55 per cent of respondents still said the government's approach to China had been clumsy and inconsistent. In the past two years a much larger three quarters of poll participants said the handling of China was clumsy and inconsistent. This year 40 per cent of participants gave at least some level of support to the government's China policy approach.

Asia Society Australia executive director, policy, Richard Maude says: "The Asia Briefing LIVE polling reflects the central dilemma of Australian foreign policy. The foreign and domestic policies of a more assertive, ideological and nationalist China are conflicting more often with Australia’s interests and values. This is shifting Australian public sentiment on China. At the same time, for all the talk of diversification, China will remain our largest trading partner and a significant source of our national wealth. Business leaders want to find ways to separate the economic relationship from the clash of national interests. But it suits China to keep the two strongly linked – it seeks to use Australia’s trade as a lever to force Australia governments to drop policies Beijing objects to.

"A more volatile and difficult to manage Australia-China relationship is here to stay. The space for cooperation still exists but has narrowed. And some elements of the economic relationship face higher degrees of risk. The white-hot geopolitics of the COVID-19 pandemic, and China’s aggressive response to calls for an independent review of the origins and course of the virus, are further proof of the widening gap between China and the West. A complete rupture would serve neither’s interest."

NEIGHBOURHOOD WATCH

HERMIT KINGDOM NO LONGER

Samsung, ‘Gangnam Style’ and now Parasite. South Korea has some good claims to global stature beyond its remarkable late 20th century economic development. But the country – or at least its officials – sometimes seem overburdened by a post-Hermit Kingdom obsession the country does not get enough recognition in the world. But they can hardly complain about this month.

President Moon Jae-in has just led his Democratic Party to a landslide victory in the National Assembly election, winning 180 seats out of 300. It may not have received much world attention given the COVID-19 crisis, but other national leaders will have noted how his deft management of the virus after a bad start has been backed by voters. The leaders of Singapore and New Zealand, who face imminent elections, will have paid attention, and perhaps even Prime Minister Scott Morrison.

Moon had been under pressure over failing economic and diplomatic initiatives and looked like seeing out his presidential term as a lame duck leader. Now South Korea, nestled alongside the virus epicenter in China, seems set to be a global case study in how to head off a sudden serious virus outbreak and then suppress it. Its success has been particularly built on early intensive testing and a rigorous system of tracking infected people and their contacts using a range of data sources.

And now Moon, with a reinforced mandate, seems set to possibly have to simultaneously manage some sort of power transition or showdown in North Korea due the mystery absence of Kim Jong-un. Not long ago a breakdown of order on the Korean peninsula had often been seen as the sort of sudden shock to Asia’s economic stability that COVID-19 has actually caused. Two shocks at once will really test Moon’s new stature.

- The pandemic-troubled US should be modelling its virus management on Korea’s use of technology, according to this piece from The Conversation.

- This piece from the Brookings Institution sets out an agenda for a more active South Korea on the world stage, which could make it a more attractive middle power ally for Australia.

- And this Bloomberg article assesses the candidates for a family succession in the world’s only quasi-communist dynasty.

DEALS AND DOLLARS

FLYING OUT

Australia’s food exports to Asia have been protected from the COVID-19 aviation shutdown with the Federal Government underwriting a network of 15 air freight service providers to maintain access to key markets. In the first three weeks more than 560 businesses have registered their interest in using the International Freight Assistance Mechanism and 55 freight flights have been organised. Federal Trade Minister Simon Birmingham says the new network will be crucial to coordinating international freight out of Australia until commercial passenger flights were restored. “Around 90 per cent of our air freight usually goes out in the bellies of passenger aircraft. With very few international passenger flights leaving Australia at present, our exporters are facing major hurdles,” he said.

BELL TOLLS FOR JAPAN POST

Less than five years after Japan Post paid $8 billion for logistics company Toll, speculation has emerged it wants to exit the investment. The Australian Financial Review reported that the formerly government-owned financial services company has investment bankers looking for the appropriate exit strategy. The Japan Post investment was the biggest single Japanese acquisition in Australia amid an increasingly diversified flood of Japanese companies buying Australian businesses looking for growth. At the time the purchase was seen as an example of how Japanese capital could take Australian expertise into third country Asian markets. But the business has been forced to make a series of write-offs and is now reportedly valued at only about half the original purchase price.

VIETNAM TAKEOFF

Qantas may be considering exiting its minority Jetstar Vietnam Air joint venture as it cuts costs to deal with the aviation downturn. The Sydney Morning Herald reported Jetstar as saying the airline was "in regular dialogue with our partner Vietnam Airlines about Jetstar Pacific, particularly given the challenges facing all carriers at present." Qantas owns 30 per cent of Jetstar Pacific in a 2007 joint-venture with Vietnamese Airlines which was part of strategy of building Asian presence through low-cost partnerships. But the Vietnamese aviation market has become more competitive since then with new entrants. VietnamNet reported the two owners have been in discussions for several months about Vietnam Airlines taking full ownership.

TURNING JAPANESE

The Japanese brewing company Asahi has agreed to establish a separate entity to sell three cider brands and the Australian rights to beer brands Stella Artois and Beck's. This will enable the company’s nine-month-old $16 billion takeover bid for Carlton & United Breweries (CUB) to go ahead under approval from the Australian Competition and Consumer Commission. Australia’s brewing industry is now substantially Japanese-owned, given Kirin owns the main brewing competitor Lion. The ACCC is requiring that the sold-off brands will retain access to the same shelf space as they have now under CUB.

DIPLOMATICALLY SPEAKING

"I have had my criticisms of the WHO (World Health Organisation) as have many other leaders, and I think they are very valid criticisms, we have got to remember also, while they may have had a few poor outings lately there are also some very important work they have been doing and I do want to make reference to it. The WHO has responded in our Pacific family here to over 300 requests from the Pacific, 68 shipments of PPE to 20 countries and territories, over 35 deployments to countries… I know they have had their criticism, and frankly I think it has been quite deserved, and of course we are frustrated, but they do important work here in the Pacific and we will keep working with them, but it won't be uncritical."

- Prime Minister Scott Morrison, 14 April 2020

DATAWATCH

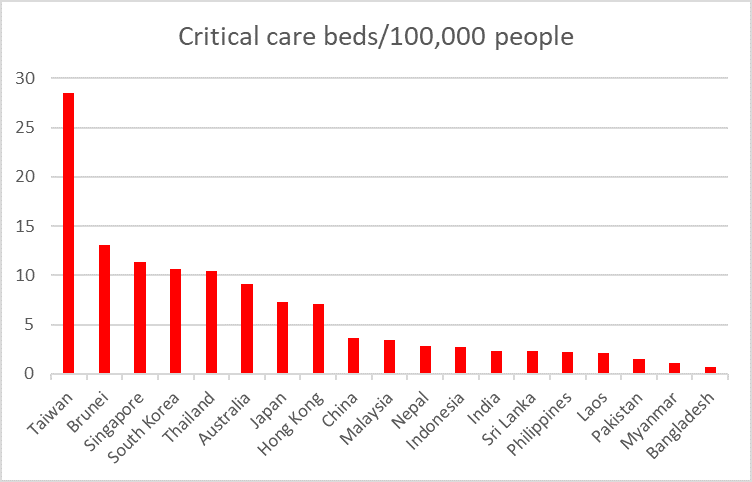

SICK BEDS OF ASIA

Source: Critical Care Medicine Journal (January 2020) The Australian figure is from a Wikipedia chart citing OECD data.

The chart is drawn from the largest ever survey of hospital beds across Asia and shows the availability of higher-level care beds in 2017 per 100,000 people. Critical care beds are defined as intensive care unit and intermediate care unit beds, although the study warns that there are some definitional differences across the region. While it notes there is a clear positive relationship between national wealth per capita and the number of critical beds, it also points out that there is a more striking variability across countries with similar levels of wealth per capita. Once again Taiwan is setting a regional benchmark.

WHAT WE'RE READING

A BIGGER PICTURE by MALCOLM TURNBULL (published by Hardie Grant Books)

For a man whose knowledge of Asia is rooted in a search for mining investments in the wild west of China in the early 1990s, Malcolm Turnbull’s time in power certainly ended ironically. The last policy initiative he implemented before losing the prime ministership in 2018 was banning telecommunications company Huawei from Australia’s 5G network, an action that has left the China relationship colder than for many years. But this book reveals a man more ready for diplomatic engagement than some recent leaders and with more practical experience in Asia (or maybe just China) compared with most of our politicians.

While it is dominated by Turnbull’s well-recorded highs and lows in domestic politics, it also provides an interesting quick record of an Australian leader navigating a changing region. China dominates befitting his background. But while he doesn’t resile from the policy actions which upset China – from the foreign influence rules to the Huawei ban – he still emerges as a man trying to reconcile early great optimism about the country with the realities of Chinese spying and assertiveness when he was in office. So, for example, he makes much of conversations with Xi Jinping and Li Keqiang about the obscure ancient Greek warcraft known as the Thucydides trap as if such arcane theory can restore the more accommodating China of earlier this century. And so, his previously undisclosed 2018 letter to Xi trying to repair relations says: “China and Australia are good friends. We share a region and our futures are inextricably linked. It goes well beyond our economic relationship. We are family.”

Turnbull says the right things about fostering deeper relations with India and Southeast Asia to offset the various risks of being dependent on China. But he disappointingly doesn’t bring forth any new insights into how to do this given his privileged access to the region’s high tables and personal capacity for engaging conversations. He seems flummoxed by the tension between India’s economic opportunity and the rise of Hindu nationalism, although, of course, he is not alone in that. And despite the 2018 summit of the Association of Southeast Asian Nations (ASEAN) in Sydney being Turnbull’s one and only own regional summit, he makes precious little of it. Instead he clearly prefers to fall back on the well-known strong personal relationship with Indonesia’s Joko Widodo and apparently warm relations with Singapore’s Lee Hsien Loong and Vietnam’s Nguyen Xuan Phuc. This may say something about ASEAN’s real collective value to Australia.

In the end, in the way of all legacy-burnishing former leaders, Turnbull is most keen to claim parentage of the revamped Trans-Pacific Partnership trade agreement after the Trump Administration walked out, and Australia’s Pacific Step-Up re-engagement with the South Pacific nations. These initiatives are more typically associated with Japanese Prime Minister Shinzo Abe (TPP-11) and Turnbull’s successor Scott Morrison (the Step-Up). But as Turnbull came to the prime ministership wanting to make his mark on the world stage, being able to write the first draft of history doesn’t hurt.

ON THE HORIZON

BACK TO MALAYSIA

If there is one regional leader for whom COVID-19 has proven unexpectedly beneficial, it might be Malaysia’s new prime minister Muhyiddin Yassin. The country’s Parliament convenes on May 18 for the first time since the chaotic collapse of the reformist Pakatan Harapan government in February amid a last-ditch grab for renewed power by Mahathir Mohamad. Muhyiddin came through the middle leaving Mahathir and the expected future prime minister Anwar Ibrahim on the sidelines.

Things are far from settled within Muhyiddin’s new Perikatan Nasional coalition because his own Malay-based Bersatu party is smaller than the two traditional Malay parties the United Malays National Organisation and Parti Islam. Both have been pressing Muhyiddin for more spoils even though he has already created an unwieldy 70-member ministry to buy loyalty. And it is still not clear exactly how many votes he commands in the Parliament, although at best it is only a bare majority. But Muhyiddin has the benefit of having splashed out one of the region’s larger fiscal spending programs to deal with COVID-19 and Malaysia’s containment program is looking better amid the difficulties in neighbouring Singapore and Indonesia.

It now appears that Anwar has conceded there will not be a no-confidence motion on May 18 due to the pandemic crisis which will give Muhyiddin more time to consolidate himself. But in the country’s even more faction ridden Malay politics these days, what would Anwar be seeking in return?

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. For more information please contact [email protected]

Read previous issues and subscribe >>