Briefing MONTHLY #72 | April 2024

Yen v Yuan | Economic outlook | Australia’s ASEAN rank | Korea stalemate | India: diaspora + poll | Vietnam’s showdown

Illustration by Rocco Fazzari.

PASSING LANE

Analysing the changing economic relationship between Australia and its two largest Asian economic partners – Japan and China – over the past few years can almost get as complex as the evolution of the languages of those two countries.

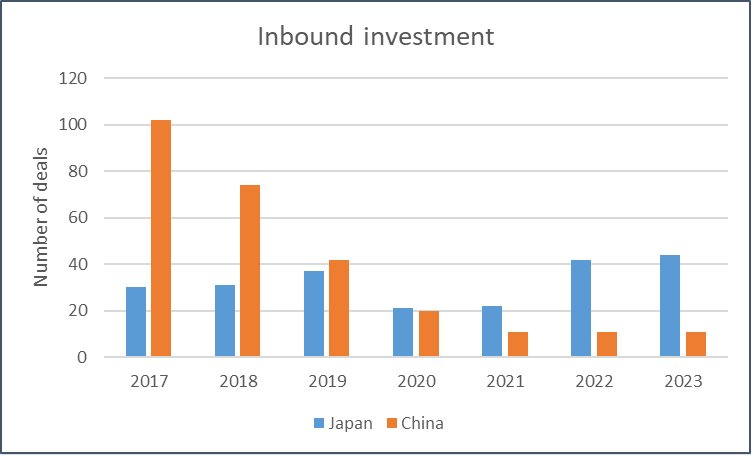

Exports to China have been rising despite its trade restrictions on various agricultural products and Japan has slipped behind the United Kingdom as a cumulative source of foreign investment despite more high-profile Japanese deals. But this chart (below) tells the story of a real tipping point in foreign direct investment, which is often seen as the glue for a more enduring relationship than trade.

It is drawn from the annual surveys of investment from the two countries by Herbert Smith Freehills/Australian National University (Japan) and KPMG/University of Sydney (China). They don’t neatly line up due to different approaches. There are questions about the amount of reinvestment by incumbent investors and the financing role of Japanese and Chinese banks. But the surveys do provide a more real world (and faster) take on this vital link to Asia than the Australian Bureau of Statistics data. Seven years ago, there were almost four times as many Chinese deals than Japanese. Now the situation has reversed. See: DEALS AND DOLLARS.

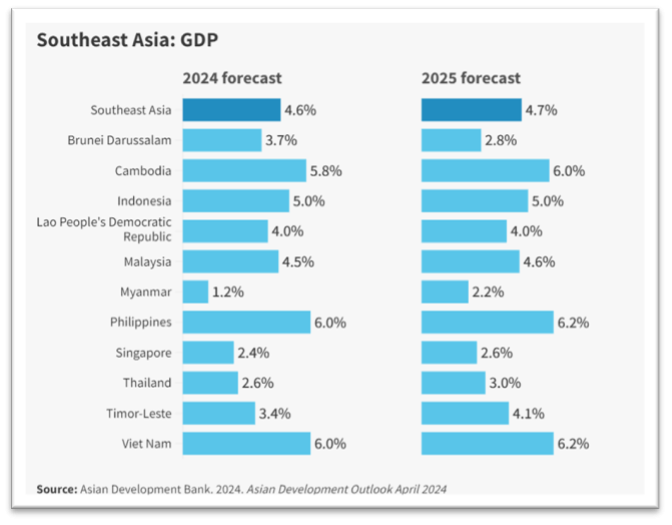

It is economic update season for some of the institutions with a focus on Asia. The topline growth forecasts from the International Monetary Fund, the Asian Development Bank and the ASEAN +3 Macroeconomic Research Office on average suggest a declining trend from 4.8 per cent last year, to 4.6 per cent this year, and then 4.5 per cent next year. But we look at the more interesting new themes in the body of their reports.

And this is the peak time for Asian voting during this bumper year of elections globally. South Korea’s President Yoon Suk-yeol faces lame duck status after failing to win the National Assembly poll. See NEIGHBOURHOOD WATCH. Indians are only starting their six-week voting process with a campaign row over the role of the Muslim population. See: ON THE HORIZON. Meanwhile, the Maldives has continued its tilt towards China away from its traditional partner India with a landslide win for the People’s National Congress.

However, the Australian government is likely more focused on the Solomon Islands where pro-China Manasseh Sogavare is trying to secure a rare sequential term as prime minister.

Greg Earl

Briefing Monthly editor

NEIGHBOURHOOD WATCH

SOUTH KOREA: lame duck leader

Korean voters have taken their President Yoon Suk-yeol to the brink of political impotence with the lowest support for a ruling president’s party in the legislature in the democracy era.

The conservative People’s Progress Party won only 108 out of 300 National Assembly seats which means the President has only just avoided the opposition parties having the two thirds majority that could be used for impeachment. Presidents have suffered mid-term backlashes from voters before, but never this bad. The previous left-wing president Moon Jae-in’s Democratic Party won 180 seats at the mid-term election in 2020 during the pandemic.

The result means Yoon will serve his full five-year term without the majority needed to pass laws severely limiting his ability to deal with domestic issues during a cost-of-living crisis and questions about the country’s economic dependence on manufacturing.

He is likely to continue taking a high profile on foreign policy matters where he has more presidential power and has backed a stronger role for Korea in the US-led global security alliance. However, questions are already being raised about whether the opposition parties will now try to curtail his efforts to repair relations with Japan which had been a key part of his foreign policy.

Curiously, Yoon’s decision to appoint former defence minister Lee Jong-sup as his country’s ambassador to Australia in early March, despite him facing corruption allegations, played a small part in Yoon's failed election campaign. Although the issue was little reported in Australia, the appointment was talked up as an upgrading of relations with Australia, but Lee was forced to return to Korea and quickly resign as ambassador to ease election pressure on Yoon.

- At The Korea Herald, Wang Son-taek says Yoon will need to take a more bipartisan rather than confrontational approach to foreign policy if he is to leave any presidential legacy.

SOLOMONS: crunch time

Small country with a big election Picture: Tavuli News

The Solomon Islands’ role as a growing Chinese bridgehead in the South Pacific appears to be in the hands of around a dozen freshly elected Members of Parliament who will determine the country’s new prime minister.

Outgoing pro-China leader Manasseh Sogavare is facing a considerable battle to remain in control of the country with his OUR Party only winning 15 seats in the 50 seat Parliament. That is the largest single party outcome, but less than half the group of MPs he led in the last parliament.

The two main opposition parties, led by aspiring prime ministers who have opposed the country’s tilt towards China and are seen as potential coalition partners, hold 16 seats between them. They are Matthew Wale’s Democratic Party with 11 seats and Peter Kenilorea’s United Party with six seats. But former prime minister and businessman Gordon Darcy Lilo, from a single seat party, is seen as a possible compromise alternative leader.

With half the MPs new faces in Parliament, 11 official independents and four small parties, the result will depend on a complex battle for influence as the four potential prime ministers seek support.

Australia provided assistance in logistics and voter registration, training for electoral officials and voter awareness initiatives via a $25 million aid package and the deployment of additional Australian Federal Police and Australian Defence Force personnel to help deliver safe and secure elections.

- Terence Wood, of the Development Policy Center, explains how an anti-incumbent feeling might have brought Sogavare unstuck rather than his support for China.

VIETNAM: power struggle

After losing two presidents in a year, Vietnam’s National Assembly chair Vuong Dinh Hue visited China in early April in symbolic show of what seems like a fading quality of modern Asian communism – collective leadership.

But sending one of the traditional four pillars of Vietnamese leadership – party secretary, president, prime minister and legislature chief – to a country where one man rule under President Xi Jinping prevails only seems to highlight how Australia’s newest close interlocutor in Asia faces some transition risks.

President Vo Van Thuong was suddenly removed in March after only one year in office despite being seen as one of the likely successors to ailing General Secretary Nguyen Phu Trong, 79, who is now in a rare third term as top leader, like Xi. The change comes amid a multi-year corruption crackdown in what was the region’s fastest growing economy and ahead of the next Communist Party Congress in 2026. The ferocity of the corruption crackdown was underlined this month by the death sentence over a $15 billion bank fraud case for real estate tycoon Truong My Lan, one of the country’s richest women.

Hue’s swift removal as president follows the equally sudden departure of his predecessor Nguyen Xuan Phuc in January last year. As prime minister since 2016 and as an economic reform advocate, Phuc had been a key figure in Australia’s enhanced economic engagement policy with Vietnam which tends to skirt around the country’s opaque leadership structure.

By late April this battle for power took a new twist with the arrest of a key assistant to Hue, National Assembly Office deputy head Pham Thai Ha, for abusing his power for personal gain.

- Nguyen Khac Giang, at Fulcrum, says the anti-corruption campaign is undermining good government by forcing staff out of the public sector.

ECONOMICS: from AI to aging

ADB principal economist John Beirne launching the ADB Outlook at an Asia Society Australia Executive Briefing hosted by HSBC in Sydney on April 11.

Counting chips: Asia already produces 80 per cent of the world’s semi-conductors but the rise of artificial intelligence has divided two of the region’s top manufacturers. The Asian Development Bank Outlook’s special focus on AI says South Korea is doing much better than Taiwan because it specialises in microprocessor and memory chip production.

Although Taiwan is the world’s biggest semi-conductor maker, it has a more diverse computer sector customer base than Korean companies. As a result, Korean semi-conductor exports were up 35 per cent last year driven by AI demand, while Taiwanese exports were only up 12 per cent. But the analysis says both countries risk losing market share due to concern about China tensions and Southeast Asian countries may benefit from some production shifting there.

Longevity dividend: Asia’s declining demographic dividend due to ageing gets a lot of attention these days, with the overall ASEAN plus 3 (China, Japan and South Korea) total working-age population projected to shrink in the second half of this decade. But the ASEAN +3 Macroeconomic Research Office’s latest focus on longer term regional issues argues this is not all bad news.

It argues that the region’s population is also living longer and with the right policies can produce a “longevity dividend” to maintain economic growth. This could see 200 million people re-enter the regional workforce by the middle of the century. “By implementing appropriate, well-designed, and well-targeted policies - such as by employing smart technologies, encouraging more women to join the labour force, and reforming social protection systems – there can be positive gains to growth from an aging population,” the agency argues.

Risky neighbours: Just when Australia often celebrates having significant economic links to fast growing, large emerging market economies including China, India and Indonesia, the International Monetary Fund is warning that these countries are also a bigger risk to global economic stability.

In its World Economic Outlook analysis of the rising power of the 10 emerging market members of the Group of 20 major economies, the agency says they now average six per cent annual economic growth, 30 per cent of global economic activity, and one quarter of trade. But it says these countries also now “have emerged as an important source of global and regional spillovers, which are only set to grow as these economies continue to integrate further into finance and trade.” So, it says countries with strong linkages to these economies, like Australia, should build appropriate buffers and policy frameworks to insure against these potential negative shocks.

ASIAN NATION

THE ASEAN GAP

Source: Briefing MONTHLY/ISEAS Southeast Asia Report 2024

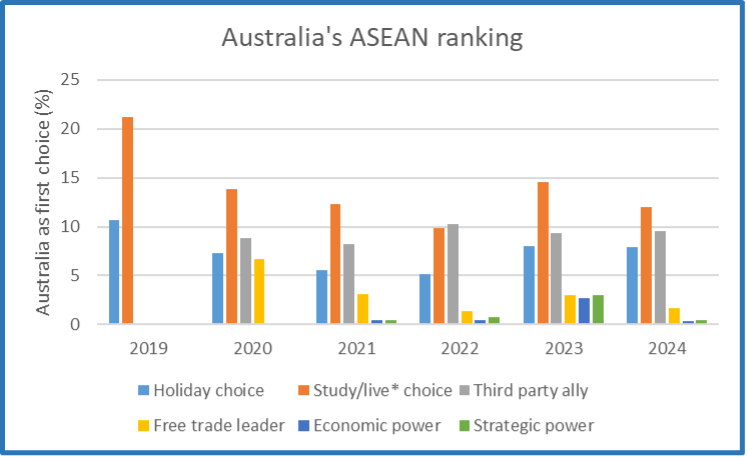

The latest survey of Southeast Asian opinion leaders by the ISEAS-Yusof Ishak Institute has underlined how Australia is in a race against time to maintain its influence in the ASEAN region as the ten member countries grow and attract more attention from foreign interlocutors.

This survey is mainly focused on Southeast Asian attitudes to the many big issues facing the region led by this year’s topline finding that China has edged out the United States for the first time if the regional countries have to make a binary choice in a showdown between the two major powers. But buried away in the detailed results is what amounts to the only relatively consistent opinion survey of how the region views Australia, conveniently coming just after the Australia ASEAN Summit in Melbourne.

In a new question this year, with particular relevance for Australia’s much vaunted status as ASEAN’s first Dialogue Partner in 1974, the survey has produced a ranking of the strategic relevance of the11 existing partners. Australia’s ranks at only seven with a mean score of 5.51 out of 11 squeezed between the United Kingdom and Russia.

It is particularly notable that Australia’s first place ranking as the region’s free trade advocacy leader sits at only 1.7 per cent compared with 6.7 per cent five years ago. This is despite having a 14-year-old high quality plurilateral trade deal in the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA) and regularly devoting aid resources to ASEAN countries participating in trade initiatives such as the Indo-Pacific Economic Framework.

And despite all the efforts to present Australia as a sophisticated economic partner, the country’s best performance is arguably as the first choice for a holiday which is trending up at 7.9 per cent and above its long-term average.

It is notable how South Korea is rising up the ranks of partner countries, possibly due its perceived economic success, compared with India, which has stronger cultural links in parts of Southeast Asia. This arguably heightens the importance for Australia of deeper and wider economic links to bolster its value as a broader partner.

- For a detailed look at the findings on Australia this year see The Lowy Institute’s The Interpreter.

SAVING MYANMAR

Julie Bishop with then President U Thein Sein in 2014 Picture: Business Today

Former foreign minister Julie Bishop may well have been handed more than just a holding brief as the United Nations special envoy on Myanmar with significant shifts in the balance of power on the ground in the country.

UN Secretary-General Antonio Guterres said Bishop had extensive policy, legal and senior management experience and through her career as foreign minister from 2013 to 2018 had “strengthened engagement with regional partners and led international negotiation efforts, including the first-ever United Nations Convention on the Law of the Sea conciliation.”

Foreign Minister Penny Wong said the government welcomed the appointment and the special envoy played a vital role in sustaining international attention and supporting co-ordinated efforts towards a peaceful resolution in Myanmar.

Bishop takes the job at a time of increased fighting between the military government and the disparate opposition groups, raising questions about the stability of the military regime. There have also been reports that jailed democracy leader Aung San Suu Kyi has been moved from prison to house arrest and that one of the few holdover officials from her government in the military – vice-president Henry Van Thio – has stood down.

A rare online survey of public opinion involving almost 3000 people in more than 200 townships across the country by the Blue Shirt Initiative provides an insight into the mood towards some form of settlement that Bishop will be working with. It found 56 per cent backed a military action led solution as somewhat or very effective, 39 per cent backed dialogue between military and political forces, and 37 per cent backed mediation by the international community.

INDIAN COUNTRY

Fifty-eight per cent of Victorians engage with someone of Indian background at least weekly mostly at shops or at work, and 51 per cent think the Indians make a positive contribution to the local community.

But almost 80 per cent of Victorians don’t know if Indians hold leadership positions in the community in which they live, while only 14 per cent were aware of Indians holding such positions and thought they did a good job.

These findings from a survey conducted by the Australia India Institute provide an interesting insight into the role of and engagement with what is now Australia’s largest foreign-born diaspora, apart from people born in Britain. However, Indians are forecast to overtake the British born cohort this decade and possibly then overtake the larger cohorts of people with Chinese, Italian, and German backgrounds (rather than being born in those countries) who have been migrating to Australia in numbers for longer than Indians.

The report funded by the Victorian government observes: “The positive perceptions of the survey respondents suggest the Indian diaspora and its transnational social networks can be leveraged to enhance and strengthen Victoria’s trade, economic, social and cultural relations with India. There is room, however, for broader conversations on issues of leadership at higher levels of business and political representation.”

Indeed, it comes at a time when Indian background people are making a push into politics in Australia particularly in New South Wales and Western Australia. Ironically this is not the case in Victoria, which has the largest Indian background population, but has only one elected Indian politician at all three levels of government. The survey found some basis for this push into politics with 23 per cent of respondents saying there were not enough Indians in leadership roles in their community, while 59 per cent didn’t know and 16 per cent thought they had sufficient representation.

- See: Australia’s Indian diaspora: ‘Very aspirational and ambitious’ in The Australian Financial Review

DEALS AND DOLLARS

RISING YEN

Japanese investment in Australia has decisively returned to the broadening and intensifying trend seen before the pandemic with a record number of new investments last year.

Despite the diplomatic tensions over the Albanese government’s energy transition policies, the economic relationship has entered a new synergistic phase with some trading companies shifting out of fossil fuels and into renewals; more new and smaller companies coming in seeking emerging Australian expertise; more partnerships with a view to future investment; and more purchases of consumer products businesses.

The annual Herbert Smith Freehills (HSF) survey says: “In an uncertain economic and geo-political world Australia is a lower-risk and higher reward market for Japanese companies which are cash-rich but face a decreasing customer base.” It says the increased investment is underpinned by closer government ties, tourism back to pre-pandemic levels, and record attendance at the bilateral business conference.

There were 53 transactions, including 44 inbound purchases, with more majority acquisitions as the Japanese companies took broader positions in the relevant supply chains or adjacent markets to achieve market expansion in Australia as growth prospects narrowed at home. For example, Kirin’s $1.9 billion purchase of Blackmores followed its earlier purchases of brewing and food businesses.

The report also highlights how behind the scenes of the announced purchases, Japanese bank financing of these Japanese investments and others is a little recognised trend in the flow of Japanese money into Australia. For example, the Japan Bank for International Cooperation has now provided 887 loans totalling more than $30 billion since 1951 into Australia.

The HSF survey does not produce a value for the 2023 inbound deals because the value of many of the transactions is undisclosed. But one possible proxy measure is that the Foreign Investment Review Board approved Japanese investment of $14 billion in 2022-23 which was more than two times the average value of the previous two years.

FALLING YUAN

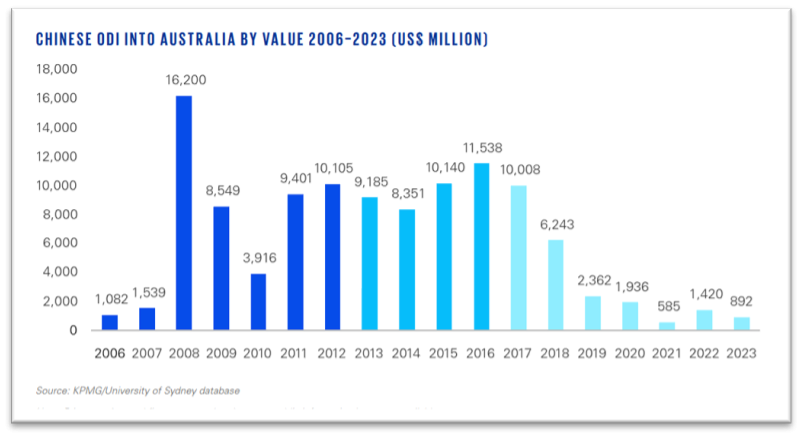

Chinese investment into Australia fell 36 per cent to $1.34 billion last year although the number of transactions remained steady at 11, but well below the average over recent years.

After an upturn in the value of investment in 2022, the latest data continues a long downturn in the value of investment since the diplomatic relationship turned south around 2017. But it also correlates with a major shift in outward Chinese investment to the emerging market world through the Belt and Road Initiative and away from developed economies.

The latest KPMG/University of Sydney survey shows the healthcare (42 per cent) and agriculture food/agriculture sectors accounted for the bulk of the investment in a continuing shift away from the mining and real estate investment which once dominated.

The survey says there is some sign of increased interest in greenfields investment in some areas of renewable energy manufacturing and industrial machinery which have longer term potential and avoid the regulatory challenges of mergers.

This is the 20th anniversary of this survey which has now usefully charted the rise and fall of Chinese investment in Australia through some quite different economic and diplomatic circumstances. There were 667 completed transactions during that period valued at US$113 billion ($175 billion). That compares with the Australian Bureau of Statistics 2022 combined China and Hong Kong cumulative total investment figure of $217 billion and direct investment of $59 billion.

The survey identifies three distinct periods of investment. The resources boom (2006-12) saw Australia become the largest recipient of Chinese investment in the world with 95 per cent of the investment from state owned enterprises (SOEs) and 20 per cent of deals worth more than US$500 million. The second phase (2013-16) was the diversification period with private companies eventually matching SOEs with a shift into new industries, but smaller transactions. The contraction period (after 2017) actually saw the most transactions but no major infrastructure investments.

AUSTAL v HANWHA

South Korean manufacturing conglomerate Hanwha is pushing ahead with a $1 billion takeover bid for Australian naval shipbuilder Austal despite being bluntly rejected by the company’s Board which said it would not even negotiate since the bid would be rejected by the Australian and US governments.

Austal operates five shipyards in the US, Australia, the Philippines and Vietnam with a reported order book of $11 billion as countries boost their naval power. It is likely to benefit from the large flow of work that will become available as part of the AUKUS submarine agreement between Australia, the US and the United Kingdom.

Hanwha is building up its shipbuilding business and is counting on a sympathetic hearing from the Australian government which has talked up deepening defence ties between Korea and Australia and greater involvement by foreign defence contractors in Australian industry to boost its efficiency.

DATAWATCH

ASEAN'S OUTLOOK

DIPLOMATICALLY SPEAKING

Who is leading the Quad right now? An honest and correct answer would be nobody. This means there is a serious lack of quadrilateral consultation or co-ordination concerning the strategic challenges in the broad Indo-Pacific region – we are not consulting each other about China.

- Former Japanese ambassador Shingo Yamagami (The Australian, April 8)

ON THE HORIZON

About 970 million people are registered to vote Picture: AFP

INDIA VOTES

Indian Prime Minister Narendra Modi has gone into his third national election campaign with the tailwind of the International Monetary Fund forecasting this month that the country will overtake Japan to become the world’s fourth largest economy next year.

Modi has talked up the idea of becoming the third largest economy during his expected third five-year term in office from winning the seven-phase election for which results are expected on June 4.

However, Modi appears to be favouring divisive political rhetoric to increase voter turnout as the campaign gets under way, rather than outlining new economic plans to build on his past reforms. Some observers say the Bharatiya Janata Party (BJP) election manifesto offers little guidance on future economic policy.

Modi has set an ambitious goal of the BJP-led National Democratic Alliance coalition winning 400 seats in the 543 seat Lok Sabha compared with 350 in 2019. The disunity in the sprawling opposition Indian National Developmental Inclusive Alliance (INDIA) of about two dozen parties could prove the key factor if Modi reaches that target.

But the campaign has begun with Modi being accused of hate speech by the opposition after a speech in which he said that Muslim “infiltrators” would be given India’s wealth if the opposition parties gained power. Some analysts have said this could be an attempt to boost voter turnout especially in the Hindu community amid some concern about complacency and poor turnout since Modi is widely expected to win.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. For more information please contact [email protected].