Briefing MONTHLY #10 | September 2018

Living with Indonesia Special | Start-ups, cantons, elections, and disaster relief | Plus the regular monthly wrap-up

The man behind the scenes of the Indonesia-Australia Comprehensive Economic Partnership Agreement…Thomas Lembong, former Indonesian Trade Minister, and Heru Subolo, Indonesian Consul General, at an Asia Society Australia and HSBC Executive Briefing last week. Photo: Julia Bergin/ Asia Society Australia

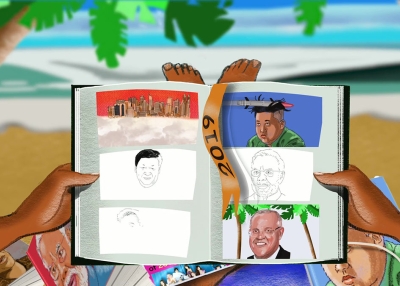

Australia and Indonesia have often been described as strange neighbours and the low level of two-way trade only adds to this impression. But Prime Minister Scott Morrison’s visit to collect not one, but two, new bilateral agreements has coincided with an upturn in the tempo of activity. This month’s BRIEFING MONTHLY reports on the new re-engagement which comes as Indonesia deals with the tragic aftermath of the Sulawesi tsunami.

SULAWESI TSUNAMI

Tom Lembong, who is the Asia Society Australia-Victoria Distinguished Fellow this year, has been asked by President Joko Widodo to coordinate private sector contributions to the Sulawesi rescue mission from around the world. He has asked foreign businesses to contact him at: [email protected] and @tomlembong. Asia Society Australia expresses its sympathy to the people of the tsunami affected areas and wishes Mr Lembong well in his coordination mission.

WHERE’S AUSTRALIA?

Digital entrepreneur Agung Nugroho sold his two-year-old online to offline ecommerce platform Kudo to the much larger South-East Asian ride hailing company Grab last year, with a nagging question. Having being partly inspired by an older online Indonesian logistics business Lazarda – then partly run by Australians – Agung noticed there were no Australian investors amongst those interested in recapitalising Kudo for growth. On a recent visit to Sydney he said he couldn’t understand why Australian investors were not more involved in the South-East Asian consumer tech boom when Australia had already successfully produced a company like Atlassian. “Vendors are not looking to Australia for ASX access to capital,” he said noting that Indonesians would be receptive to more Australian involvement in their tech sector. Bede Moore, who was originally involved in Lazarda but now runs Tech Sydney, says about US$3 billion has been injected into Indonesian start-ups in the past three years amid 70 per cent growth. “Here we are on the doorstep of Asia and there are these major forces rolling through the region,” he says of the risk that Australia is missing out. Kudo has drawn 1.4 million of Indonesia’s five million consumer focused retailers into an online sales platform, bringing many of them into ecommerce for the first time. Grab, part owned by Japan’s Softbank and China’s Didi Chuxing, has embarked on turning itself from a ride hailing service to a payments system across South-East Asia partly by buying ventures such as Kudo. The Singapore-based company is now in a race with Indonesian-based Go-Jek to become the dominant lifestyle app in the region with Grab diversifying while Go-Jek is more focussed on Indonesia’s large population. Agung says there are still many digital start-up opportunities in Indonesia although it is getting harder to break into the consumer lifestyle sector.

LEMBONG’S LESSONS

Indonesian investment minister Tom Lembong is well known for his outspoken views on what needs to change in Indonesia but on his latest visit to Australia he has been more reassuring about the outcome of next year’s presidential election. In an unusual move for an incumbent minister, Lembong has been suggesting that if there is a change of president next year, an administration led by former general Prabowo Subianto and banker Sandiaga Uno would not backtrack on Indonesia’s embrace of globalisation. He said both men had family or personal backgrounds in globalised business and understood that the country’s future depended on nurturing foreign business links. And if, as Lembong expects, President Joko Widodo is returned to a second and final term, the investment minister says bureaucratic reform could be high on his agenda due to his experience as a small businessman dealing with regulation. He says Indonesia is falling behind in using digital technology in government.

Lembong, a former investment banker and trade minister and the Asia Society Australia-Victoria Distinguished Fellow this year, also said:

- The IA-CEPA trade deal has nurtured old business links like the beef trade but also opened up important new connections in sectors like education and tourism.

- Australian universities and vocational training companies had a clear first mover advantage over other countries in taking advantage of the Indonesia’s embrace of foreign education providers.

- Indonesia is benefitting from its slower embrace of China’s infrastructure building Belt and Road Initiative because it could learn from other countries experiences.

- China’s rise should be accepted because a lonely and unsuccessful China would be much more scary than an economically successful China.

- Indonesia needs to cut back the role of state-owned enterprises in its economy because they are becoming too debt burdened.

- The Chinese buyout of Indonesia’s tech sector start-ups is not concerning because the dynamism of the sector in Indonesia means new platform opportunities will emerge over time.

MINORITIES UNDER PRESSURE

The Australian National University annual Indonesia Update arguably provides the best forum outside Indonesia for keeping track of the country and this year’s event identified growing constraints on various minority groups as the country enters a potentially volatile election campaign. This was underlined by a sweeping survey by historian Robert Cribb of how ethnic differences and discourse have long played a role in the country’s evolution such that “Indonesia is a society in which people are not hesitant about expressing racial prejudice.” But he argues a complex and subtle process of what he calls “cantonisation” now appears to be under way akin to the identity politics in the west. “To be a minority in a canton is a lot worse than being a minority in a larger entity,” Cribb says. “Indonesia was built on the idea of being part of a larger national stage. Implicit in the cantonisation process something very special about Indonesia is under threat.” Conference convenor Greg Fealy wraps up the key theme here.

AGENDA INDONESIA

- Indonesia will be under new global scrutiny in October with the decision of the International Monetary Fund/World Bank to take their annual meeting roadshow to Bali. The IMF has produced this new detailed report Realizing Indonesia’s Economic Potential which, amongst other things, backs up the Kudo story (above) with a quite positive analysis of digital economy developments.

- The embrace of more international trade diplomacy reflected in the IA-CEPA has prompted this collection of the papers Expanding Horizons: Indonesia’s Regional Engagement in the Indo-Pacific Era. It argues the country’s economic diplomacy is expanding and businesses are internationalising.

- With the IA-CEPA all but signed, the Australia Indonesia Business Council has hit the sweet spot with an annual conference at Surfers paradise on November 12-13 where the detail of the agreement will get its first major public disection.

- The Australia-Indonesia Centre’s Jakarta director Kevin Evans has produced an excellent guide to next April’s presidential and general election he has been outlining during a visit to Australia. President Widodo commands the support of more than 60 per cent of current elected members of the parliament and the largest party coalition. But Evans has a warning: “Voters are perfectly happy to split their votes. Many old hands have failed to get elected because they presumed creating a huge coalition of party support would guarantee a victory.”

NEIGHBOURHOOD WATCH

VOTED DOWN

China’s infrastructure building Belt and Road Initiative is running up against sustained resistance from a quarter that may not have been anticipated in Beijing: the electoral cycle in the region’s democracies. Malaysia's new leader Mahathir Mohamad has led this trend with his delays or cancellation of several BRI-funded projects amid warnings about new colonialism. But the tendency of the BRI lending to be wrong-footed by electoral regime change has been reinforced in the Maldives where authoritarian former President Abdulla Yameen has been roundly rejected after embracing Chinese finance for major projects. Chinese funded projects have also come under question in Sri Lanka and Pakistan after recent elections. But the big test may well be looming in Indonesia where the flagship Chinese-funded presidential project the Jakarta to Bandung high speed rail line is languishing and won’t be finished on time by next year’s election.

ABE’S NEW CLIMATE

Re-elected to an unusual third term as head of the Liberal Democratic Party and thus Japanese prime minister, Shinzo Abe is on track to become his country’s longest serving elected leader. He hasn’t wasted time reinforcing his status as a global statesman. He used this Financial Times oped to reclaim Japan’s Kyoto Protocol stature on climate change raising questions about what this could mean for Australian thermal coal exports. He used a meeting with US President Donald Trump to embark on a limited bilateral trade deal with the US despite earlier reluctance to go down the bilateral path. In October he will visit China for a meeting with President Xi Jinping which could reset the troubled relationship between the two countries.

MAHATHIRWATCH

Making up for 15 years away from the center of global diplomacy, Malaysia’s nonagenarian Prime Minister Mahathir Mohamad has used a visit to the US for the United Nations General Assembly to:

- Raise the prospect of intervention in Myanmar to resolve the Rohingya refugee crisis.

- Warn the world has to get used to the rise of China.

- Call for an end to the existing veto power in the UN Security Council.

- Blame Israel for the rise of Islamic terrorism.

- Suggest Malaysia could embrace a Japanese-style non-interventionist defence force.

Watch Prime Minister Mahathir Mohamad's recent conversation with Asia Society Policy Institute President, Kevin Rudd, in New York.

ASIAN NATION

VICTORIA’S NEW LOOK NORTH

Victoria has called on the Federal government to devote more resources to the harmonisation of occupational standards in South-East Asia in a new trade and investment strategy for the region. The strategy sets ten year targets to increase the value of professional services exports by 50 per cent, to double the number of South-East Asian students enrolments in Victoria, to increase visitor spending from Indonesia, Thailand, Malaysia and Singapore by 50 per cent and double the value of in-bound investment from the region. The State will expand its Victorian Government Business Ambassador Program from China, India and the US to Indonesia, Thailand, Malaysia, Singapore and Vietnam.

LA TROBE LAUNCHES ASIA SERIES

A new paper has called for Japan and Australia to join China’s Belt and Road Initiative (BRI) to help shape its rules and processes and to develop new regional diplomatic processes which are less beholden to China and the US. Cooperation in Contested Asia is the first of a series of new policy briefs from La Trobe Asia drawing on La Trobe University’s collaborators based in the region. It has drawn in security exports from Japan’s Kyushu University on the foundation stone of a Mathematics for Industry joint institute between the two universities. The paper argues that while Australia and Japan have developed a close security partnership since 2007, there is a lot more to be gained from more creative joint initiatives.

FUTURE 21

This time it was Australia's young paving the way to foreign policy reform. Entering its third year, Young Australians in International Affairs drew a crowd of bright young things for its annual conference in Canberra, Future 21. Joined by panels of Australia's leading policy thinkers and practitioners, participants unpicked the various challenges and opportunities confronting Australia in the midst of global change. Discussion covered everything from the much-loved U.S.-China nexus to women in peace and security, and the militarization and commercialization of space.

DEALS AND DOLLARS

BUILDING ASIA

Boral is considering buying back the US-owned half share of its four-year-old plasterboard joint venture which operates across Australia and much of Asia. Boral’s partner USG is subject to a takeover from Germany’s Knauf and Boral’s chief executive Mike Kane says he wants to buy back the business which generated $63m in equity income last year. USG Boral said Korea and China delivered strong top line growth in the last financial year financial year, offsetting pressures in countries such as Indonesia, Thailand and Vietnam. Meanwhile Bluescope Steel’s parallel Australian-operated building joint venture in Asia declared a $234 million increase in revenue to $2.719 billion with strong growth in China and India but weaker volumes in much of South-East Asia. The company partners with Nippon Steel & Sumitomo Metal Corporation in South-East Asia and Tata Steel in India.

NO B TEAM HERE

Some of the country’s highest profile food and health product exporters to Asia have reported positive annual results after challenges in the China market. Blackmores delivered a nine per cent increase in revenue to $601 million and a 19 per cent increase in profit to $70 million. The result was fuelled by a 22 per cent lift in sales to China to $143m. Sales in Asia, excluding China, were up 20 per cent at $82m. Chief executive Richard Henfrey said he had not seen the China business suffer any impact from talk of strained relations between the Australian and Chinese governments. Bega Cheese reported a 17 per cent revenue increase to $1.44 billion and 45 per cent rise in normalised pre-tax profit to $107 million, after adjustment for some major corporate restructuring. Export sales rose 29 per cent to $430 million. Chief executive Paul van Heerwaarden said Bega was well positioned to take advantage of food safety and nutrition, as well as growing Asian demand. Meanwhile Bellamy’s Organic announced 2018 revenue was up 37 per cent to $329 million and normalised pre-tax profit was up 65 per cent to $71 million. Bellamy’s has had problems getting certification from Chinese regulators this year for its products. But it has announced plans to enter the Vietnamese market this year, banking on similar macrotrends that have fuelled its Chinese business.

SCORCHED EARTH

Rare earths producer Lynas Corporation is facing a new setback to its processing plant in Malaysia with speculation that the country’s change of government will lead to a parliamentary review of the plant. Lynas mines rare earths in Australia but processes them in Malaysia making it an important strategic player in an industry otherwise dominated by Chinese refineries. It faced protests when it was building the Malaysian refinery in 2012 from activists who claimed it would damage the health of the neighbouring community. Those activists are now in government, but any review will be a test of Prime Minister Mahathir Mohamad’s approach to foreign investment and Malaysia’s strategic posture.

MORE IN THE PIPELINE

Hong Kong’s CK Group has been quietly doubling down on its agriculture investments in Australia despite the growing national security controversy over its bid to extend its gas pipeline investments. This The Australian Financial Review report says it has applications before the Foreign Investment Review Board to buy diverse farm sector assets adding another dimension to the debate about the purchase of gas pipelines owned by APA. CK Infrastructure suggests the Hong Kong-based group founded by Li Ka-Shing has rejected allegations it is beholden to China, but APA has warned any takeover will now be delayed by the turmoil in the Federal government. The Lowy Institute’s Richard McGregor argues here, in an interesting new twist, that a rejection of the pipeline purchase by a globalised HK company would be an own goal for the Australian government because it would in effect imply that HK no longer has regulatory independence from Beijing.

DIPLOMATICALLY SPEAKING

“I’ve had many calls from my counterpart foreign ministers who are very politely asking why I am no longer the foreign minister and what happened to the prime minister. There have been some rather unkind comments about Australia being the Italy of the South Pacific and the coup capital of the world.” Julie Bishop speaking on A Current Affair about her departure from office.

WHAT WE’RE READING

HELLO, SHADOWLANDS by PATRICK WINN (Icon Books)

Patrick Winn puts China’s infrastructure building Belt and Road Initiative in an unexpected new context in this highly personalised account of a new golden age of illegal drug trade across South-East Asia. He sees its roads and bridges as the final piece in a trade built on the availability of a restless youthful mobile disenchanted population to supply those very same people. It is very much a colourful from-the-grassroots account based around his visits to places like the methamphetamine production centers of Myanmar’s Kachin State to the seedy red-light district at Sungai Golok in southern Thailand which serves the needs of border-hopping Malaysian men amid a little reported brewing Islamic terrorist hotspot. With an American audience in mind, some of the Bangkok-based journalist’s backgrounding on how South-East Asia came to be the way it is can be a bit elementary. But he nevertheless provides a rich insight into the lives of people living outside the fashionable shopping malls of downturn Bangkok and Kuala Lumpur. With leaders like the Philippines President Rodrigo Duterte applying brutal extra-judicial solutions to the meth epidemic of modern South-East Asia with public support, Winn’s account raises some interesting questions about how much of the vaunted demographic dividend of a youthful ASEAN workforce is being wasted in makeshift meth parlours.

DATAWATCH

Source: International Telecommunications Union

ON THE HORIZON

FRANCOPHILES RULE?

Australia’s effort to build a new relationship with France in the South Pacific faces an important test on November 4 when New Caledonia votes on its future relationship with its colonial overlord. France’s revived claim to be an Indo-Pacific power is based on some tiny old island possessions, and would look a bit thin if it was to start losing them. But recent opinion polls in New Caledonia suggest that the majority of people won’t vote for independence in the referendum. The vote is the conclusion of a carefully phased transfer of power under the Matignon and Noumea Accords, which have delivered 30 years of peace after the 1980s civil turmoil. A stay vote will still probably require another vote on the nature of the continuing relationship and will not necessarily prevent another independence vote.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. Exclusive partnership opportunities are available. For more information please contact [email protected]

Read previous issues and subscribe >>