Briefing MONTHLY #9 | August 2018

Morrison’s Asia | Mahathirism is back | India’s new champion | 140 years of Asian art

Coming and going … Newly returned Malaysian Prime Minister Mahathir Mohamad meeting then Foreign Minister Julie Bishop in Kuala Lumpur on August 2.

MAHATHIR AT 100

Malaysian Prime Minister Mahathir Mohamad passed his first 100 days back in office facing the same question that greeted his surprise election victory in May: is this old or new style Mahathirism? The case for the old reflects the implementation so far of only about two out of ten key (and unrealistic) election promises, some off-script hankering for old favourites like a national car and apparent wavering on when he might actual handover to old rival turned putative successor Anwar Ibrahim. The case for the new reflects some big changes in Malaysia: a Chinese finance minister, election and anti-corruption commissions reporting to Parliament rather than the PM like in the old days and the no holds barred pursuit of the 1MDB financial scandal. The GST has been dumped but not yet replaced by a narrower sales tax leaving a gaping fiscal hole. Chinese-funded infrastructure projects have been put on hold in a bid to stave off a foreign and national debt blowout - but this will damage the investment climate. See the new prime minister’s first 100 days speech here. Mahathir was always a chameleon who defied easy categorisation in an evolving economic and political landscape. But it says a lot about the stature of this nonagenarian statesman in a region of uninspiring leaders that analysts are already again debating what Mahathirism means. Khoo Boo Teik, of the Institute of Southeast Asian Studies, says the old nationalist-capitalist project can’t be rebuilt in its former image although there will be some reappearances. But he says: “Instead of imposing authoritarianism again … Mahathir has shown an uncharacteristic commitment to democratic and institutional reform.” Cheng-Chwee Kuik and Chin Tong Liew argue at the Lowy Institute’s The Interpreter that a Mahathir Doctrine in foreign policy will be about “recalibrated equidistance.” But recalibrating Malaysia’s affirmative action policy for ethnic Malays will be the real test of this new government because the current policy has failed most Malays while alienating others. Jayant Menon says on East Asia Forum Mahathir has already recognised these failures but change can only be gradual. Meanwhile Capital Economics (soft paywall) says the long term outlook for Malaysia’s economy has brightened.

ASIAN NATION

JAKARTA CROSSING

Prime Minister Scott Morrison will be cementing a new prime ministerial convention when he visits Jakarta briefly on Friday. His predecessors Paul Keating, Kevin Rudd and Tony Abbott all made their first trip abroad as prime minister to Indonesia (John Howard had to cancel his plan at the last minute). But as welcome as this routine is in publicly reinforcing Australia’s modern geostrategic reality, symbolism only counts so far. All Morrison’s fellow travellers eventually found that Indonesia matters more to Australia than vice versa. That’s a chasm that will only widen as Indonesia grows larger and a policy challenge the new prime minister should understand from the start.

BISHOPLOMACY

Outgoing Minister for Foreign Affairs Julie Bishop was canny enough to write her legacy into the record books almost from day one and now already has about 10,000 protegees to keep the flame alive. The New Colombo Plan will be her enduring contribution to Australian engagement with the region - both as an education and diplomatic initiative - and should be sustained by future governments. Bishop also suffered her biggest potential setback in her first year with the massive cuts to the aid budget (which had begun under Labor) but managed to diligently work through this blow to her regional credibility. The aid agency integration into the rest of the Department of Foreign Affairs and Trade has resulted in lost expertise but also allowed some better integrated policy making which suits the new geostrategic circumstances. Perhaps more importantly Bishop managed to maintain aid spending in the South Pacific which was always going to be the part of the world where Australia’s clout would really be judged. A somewhat underappreciated legacy of Bishop’s time as foreign minister has been the addition of ten new diplomatic posts – mostly in Asia – in recognition of the way diplomacy has to extend beyond the traditional perfume capitals. And in parallel as Australians travel deeper in the world Bishop has overseen a more coherent consular assistance strategy than had often prevailed in the past. She has also opened DFAT up to the outside world from deep dives into policy with universities and thinktanks to a wider interpretation of its role from fashion diplomacy to economic diplomacy.

RESETTING THE RESET

The biggest foreign policy question left over from the government leadership change is whether former Prime Minister Malcolm Turnbull’s effort to stabilise relations with China will prevail. Turnbull used this speech at the University of NSW on August 7 to calm more than a year of tensions with China by saying Australia welcomed university research collaboration with China and wanted to work with its Belt and Road Initiative infrastructure project. That speech was preceded by this article in The Monthly by Turnbull’s former speechwriter John Garnaut about his role in “resetting” Australia’s approach to a more assertive China. Foreign Investment Review Board chairman David Irvine, a former Beijing ambassador and intelligence official, followed up with this speech about how Australia will now take a firmer and more nuanced approach to foreign (read Chinese) investment, especially in infrastructure. In response, Asia Society Australia’s senior leadership team – Warwick Smith, Doug Ferguson and Philipp Ivanov – welcomed Turnbull’s speech arguing that rather than being a reset, it was “entirely consistent with the Turnbull government’s long-maintained position of welcoming and respecting China’s rise.” But the China relationship was revealed as a factor in the Liberal leadership battle when former international development minister Concetta Fierravanti-Wells accused Turnbull and former foreign minister Julie Bishop of failing to support her when she criticised Chinese infrastructure development in the South Pacific as building “roads to nowhere.” The dying Turnbull government also quietly issued a decision severely limiting Chinese telecommunications company Huawei from participating in Australia’s 5G telecommunications network despite some expectations Turnbull’s earlier speech might have pointed to a compromise. The new Prime Minister Scott Morrison has now inherited the next controversial Chinese foreign investment decision over whether to allow Hong Hong-based CKI’s $13 billion takeover of gas pipeline giant APA. Underlining the China factor in the leadership tussle, Fierravanti-Wells had earlier suggested that a government led by leadership contender Peter Dutton would have rejected the CKI bid. The new rules on foreign investment in infrastructure outlined by Irvine (see above) followed Morrison’s controversial 2016 decision as Treasurer to reject a CKI investment in electricity company Ausgrid, but he then allowed a CKI investment in the Duet gas pipeline the following year. Morrison’s elevation has received a sceptical response from China with the influential Caixin magazine portraying him as a man with a record of blocking Chinese investment.

NEIGHBOURHOOD WATCH

VICE-PRESIDENTS RULE, OK

Indonesia may well be following the Philippines down the path of alternating between technocratic and populist presidents as its near 20-year-old post-Soeharto system evolves. But now the two neighbouring flag-bearers of democracy in Southeast Asia are sharing some similar uncertainties over the role of their vice-presidents. Indonesia’s number two is at least elected on the same ticket as the president (with an election due next year). But the Philippines has built in a constitutional improvised explosive device with a vice-president elected separately to the president. This has led to Filipino president Rodrigo Duterte excluding his deputy and potential successor Leni Robredo from Cabinet meetings and challenging her election. He is now backing the losing vice-presidential candidate Bong Bong Marcos (son of the country’s former dictator Ferdinand Marcos) as a replacement vice-president … and even perhaps president. Meanwhile in Indonesia President Joko Widodo, 57, has been forced to choose a conservative Muslim cleric Ma’ruf Amin, 75, as his running mate in a concession to the rising influence of Islamic political forces in the country. Ma’ruf comes from the generally moderate Muslim group Nahdlatul Ulama. But as the head of the peak Indonesian Ulema Council, he played a key role in the downfall last year of Jakarta governor Basuki Purnama, who was a long-time Widodo ally. Running these two Asian democracies isn’t getting any easier.

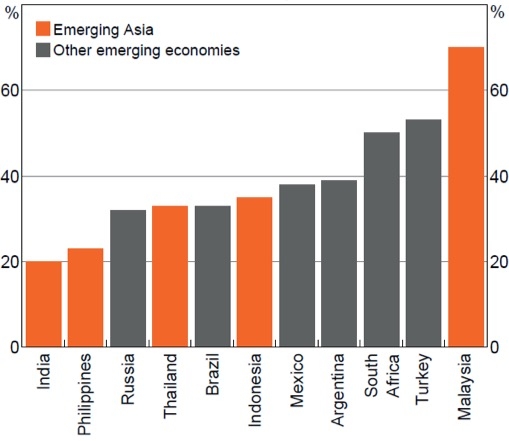

RBA BACKS REGIONAL STABILITY

External debt (share of GDP)

Source: World Bank

The Reserve Bank of Australia has given Asia’s emerging market economies a relatively positive assessment amid the capital outflows hitting many other parallel countries around the world. Its latest Statement on Monetary Policy contains a special focus on how the key Asian emerging markets (India, Indonesia, Thailand, Malaysia and the Philippines) are managing the uncertain global environment, noting that they are collectively equal to Japan as an export market for Australia. It says they have managed the new situation better than many other countries because they have built better financial institutions and systems since the 1998 regional financial crisis. They are generally better prepared now with lower foreign debt and better foreign reserves. But the RBA warns that they may be more vulnerable to other shocks. “Reflecting the region's strong economic and financial linkages to China, a significant increase in trade protectionism and/or a sharp slowdown in Chinese economic growth represent downside risks to regional economic growth that bear close monitoring,” it says.

DEALS AND DOLLARS

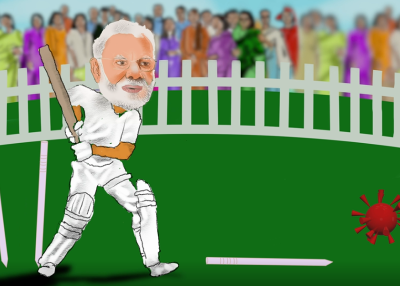

PASSAGE TO INDIA

Macquarie Group’s appointment of Shemara Wikramanayake as its new chief executive has provided a serendipitous boost to the new India economic engagement strategy being promoted by former top diplomat Peter Varghese. Wikramanayake, who happens to be of Sri Lankan background, is set to become the go to face for whatever campaign the Federal Government now pursues to raise India’s status as a major future economic partner for Australia. And she seems inclined to take on the task declaring that those few Australian companies that have had success in India need to now take on a mentoring role for others. She told a Committee for the Economic Development of Australia (CEDA) that Macquarie Group had built its Indian business which now employs 1300 people with a mix of “baby steps” and patience. “It has got to be a patient and long-term commitment with local partners and local staff,” she said of a business which has about $3 billion invested via three funds. Perhaps not surprisingly as Varghese consulted Wikramanayake on his recommendations, the Macquarie is a case study in a new approach to India. It has focussed on sectors where India is seeking investment and expertise like energy and infrastructure and states which are also open to new ideas.

YEN TO BUILD

Despite their undoubted expertise at home Japanese companies have played only a modest role in Australia’s domestic infrastructure construction boom. Europeans, Koreans, and Chinese competitors are more active. A Japanese government–backed mission in July was the latest effort to redress this hole in the bilateral business relationship, with Ambassador Sumio Kusaka ruefully noting how Japan’s low birth rate meant that its big and skilful construction companies now had to go abroad to survive. One notable curiosity for the Japanese participants was the emergence of the Unsolicited Proposal in the Australian infrastructure space as a means of getting projects moving.

HEALTHSCOPE EXITS ASIA

Healthscope has sold its Asian pathology business to funds managed by TPG Capital Asia for $279 million to allow it to focus on its Australian business which is facing a takeover. The business comprised 39 pathology laboratories across Singapore, Malaysia and Vietnam that operate under the Gribbles Pathology and Quest Laboratories brands. TPG Australia head Joel Thickins said he would use the business to expand in Asian with health being one of four sectors TPG was targeting in Asia.

BEELINE FOR BEIJING

Australia's best-known honey producer Capilano is hoping to tap into the huge Chinese market with a proposed $200 million deal with a private equity firm to go private. Managing director Ben McKee said private ownership was better than a public listing for a company that needed a large investment to achieve significant sales in China after success in parts of Asia. The $190 private equity deal with private equity fund Wattle Hill and agricultural investor ROC Capital is being backed by core Capilano shareholder Kerry Stokes.

MILKING IT

Infant formula and milk company a2 Milk Company has navigated through the access challenges for many food companies into China with a doubling of its net profit. The company said increased availability of its infant formula in China helped lift its market share from 2.8% in 2017 to 5.1% in 2018 with the product now in about 10,000 "mother and baby stores" in China, compared to about 3800 previously.

DRINKING BUDDIES AGAIN

Treasury Wine Estates says that it has resolved a clash with several wholesalers in China which earlier this year triggered a 10 per cent slide in its share price. The company posted a 34% net profit increase to $360 million which is says puts it on track to becoming one of the world’s top growing consumer goods companies.

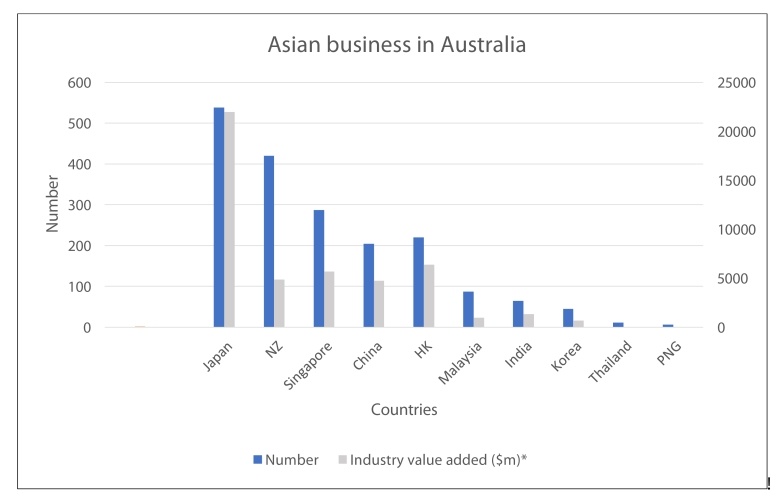

DATAWATCH

Source: Australian Bureau of Statistics

The Asian business presence in Australia still largely lags businesses from North America and Europe according to new data calculated by the Australian Bureau of Statistics (ABS) for the first time in 15 years. The survey identified almost 1500 majority Asian owned businesses operating in Australia out of almost 10,000 foreign businesses - or only 15% of the total. But those businesses constituted 21% of the total industry valued added (IVA) of the foreign businesses. The special data analysis provides more detailed information on the operations of foreign businesses than the annual release on foreign investment stocks although the hierarchy of countries is broadly the same. It was commissioned by the government to defend the value of foreign investment. It does this by showing that while the number of foreign owned businesses only amounts to 0.5% of the businesses in Australia they account for 20% of IVA and employ 8.7% of the workforce. The ABS warns against making comparisons with its last detailed foreign business analysis in 2001 but, notwithstanding this, the comparisons are hard to resist. For example, there 347 Japanese businesses then and 538 now. In 2001 there were only five Chinese businesses and 440 from Hong Kong, and overall the Greater China numbers don’t seem to have changed. Today there are 204 from China and 220 from Hong Kong. Singapore is the big improver with 287 businesses today compared with 47 then.

GALLERY

These Ming Dynasty Sino-Tibetan deity figures are two of only eight known in the world and were only authenticated in 2016. Photo by Marinco Kojdanovski, MAAS collection.

REFLECTIONS OF ASIA @ Powerhouse Museum, Sydney

When curators were sifting through 10,000 rarely displayed items from Asia collected over more than century by the Museum of Applied Arts and Sciences they found crates containing two large bronze pieces. Given that the crates were in different storage locations and had different collection dates, no one realised they were two halves of the same incense burner produced by a famous Meiji Japan bronze maker Fujiwara Shigeyoshi. They now stand reunited as the largest piece in the museum’s most comprehensive display of its Asian treasures ever mounted. Reflections of Asia is scheduled to remain open for 18 months partly because the curators hope to get feedback from scholars and other collectors about pieces that were acquired so long ago that they don’t have a detailed provenance. But it is also a well-timed contribution to the national conversation about Australia’s relationship with Asia because of the way it highlights how some Australians were fascinated by Asian aesthetics as long as 140 years ago and building collections, some of which were acquired by the museum. Because of the Museum’s focus on applied arts, the collection also provides an interesting insight into how Asian cultures that are still often seen as insular today actually responded remarkably fast to the Western demand for Asian art. For example, it includes a display of Japanese satsuma ware bowls for export which are more elaborate than those traditionally used at home. And in the early 1700s Chinese porcelain makers were already canny enough to produce armorial plates carrying the family crests of European families.

WHAT WE ARE READING

CHINA’S 40 YEARS OF REFORM AND DEVELOPMENT edited by ROSS GARNAUT, LIGANG SONG and CAI FANG, (ANU Press)

According to the Confucian Analects 40 is a good age to perceive truth and end doubts. In that spirit the Australian National University’s China Economy Program has assembled 41 international experts to mark the 40th anniversary of the decision to open up the country’s economy in 1978. It is a large volume (published online) ranging from historic reflections to contemporary policy issues with insights into every aspect of what is already the world’s largest economy by one measure. But in contrast to the Confucian wisdom about being able to make settled judgements this far on, the essays contain some quite diverse explanations for what has happened. Melbourne University’s Ross Garnaut emphasises the role of individuals such as Deng Xiaoping, Hu Yaobang and Zhao Ziyang in driving a new agenda 40 years ago. Others argue bigger social and institutional forces were at work. World Bank official Bert Hofman identifies a unique reform process in which post-Cultural Revolution local government decentralisation “turned the country into a laboratory for reforms.” Similarly, Princeton University’s Gregory Chow says the 1978 decisions were inevitable due to economic reforms occurring in other Asian countries, because after years of failed economic planning Chinese officials knew things had to change and Chinese people were ready to make changes for their own benefit.

ON THE HORIZON

FIRST AMONGST EQUALS

Prime Minister Shinzo Abe’s ambition to become his country’s longest serving leader faces a curiously Japanese test in late September. The Liberal Democratic Party changed its rules earlier this year to allow a party president to seek a third three-year term (from the current two term limit) - just in time for Abe to do so and remain prime minister. Abe faces an electoral college of 810 split equally for the first time between Diet members and local party members. He has strong support amongst the Diet members, has overseen a relatively solid economic performance and is arguably now the world’s most substantial center-right political leader. But his general public support remains quite fickle which raises questions about how well he will have to do in the vote - which he is expected to win against former defence minister Shigeru Ishida - in order to fend off future challenges. He has now served the third longest continuous term and has served the fifth longest overall time in office. By the end of 2019 he will be the country’s longest serving prime minister since the Meiji reform era.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. Exclusive partnership opportunities are available. For more information please contact [email protected]

Read previous issues and subscribe >>