Briefing MONTHLY #3 | January 2018

TPP - 1 = ? | Asian growth pressure | North Asia summit looms | New China split emerges

TPP: 12 - 1 = ?

US President Donald Trump has only added to the complexity of this calculation with a State of the Union Address which provided no clarity on whether he is about to start a trade war with China or alternatively look more favourably on the Trans-Pacific Partnership (TPP). In a normal presidency this might mean that trade was being overtaken by other priorities. But in this one probably suggests the White House doesn’t know how to square its anti-trade campaign rhetoric with the economic recovery now underway in the US. The revival of the TPP less than a year after it was dumped by Trump has underlined how Asian countries seem to be more open to new trade integration than either the US or Europe where tension over the North American Free Trade Agreement and Brexit still dominate the agenda. This point was underlined before the decision of the TPP-11 to go ahead without the US by the latest report from the Asia Society Policy Institute which outlines how Asian countries have pushed ahead with trade deal talks despite the protectionist alarm parked by Trump. But now Trump’s suggestion at the World Economic Forum he might reconsider the TPP has raised questions about whether the TPP-11 will really forge ahead or settle into a holding pattern to see what the Trump Administration does. Australia is having a bet both ways with Trade Minister Steve Ciobo telling the Asia Society in San Francisco that he is ready to engage with the US but will bring the new style TPP into force.

ON THE HORIZON

ASIAN GROWTH PRESSURE

The World Bank is forecasting that potential economic growth in east Asia will decline a bit more than one percentage point to six per cent over the next ten years largely due to the maturing Chinese economy. This will be down from about eight per cent at the beginning of this century when China’s potential growth was about twice the rest of the region. Now the trend is towards convergence with growth potential in the ex-China countries improving in the past three years led by commodity exporters. Meanwhile in South Asia potential growth is forecast at 6.8% over the next decade which is about where it has been in recent years compared with more than seven per cent ten years ago. The long-term forecasts are contained in the Bank’s latest Global Economic Prospects report which has forecast a continuation of the recent global recovery for two more years. While Asian growth rates continue to lead the world in percentage terms they have not generally been upgraded like the US and Euro areas.

MONETARY MEN

Potential turnover at the top of Asia’s two most important central banks just as the US Federal Reserve tightens monetary policy will be a somewhat unusual risk factor this year. That’s because People’s Bank of China governor Zhou Xiaochuan has been in his job 15 years and now stands out as the outspoken great survivor of a cathartic period in the country’s economy. Bank of Japan governor Haruhiko Kuroda has been in his job for a much shorter five years but in many ways is the real change agent in country’s recent Abenomics economic reforms named after Prime Minister Shinzo Abe. Zhou has reached retirement age and has underlined his expected departure in March with a series of recent warnings about financial risks in China. Kuroda is much more likely to become the first BoJ chief to be reappointed since the 1950s especially since the government is not looking for any significant change in monetary policy. Central bank chiefs in South Korea and Indonesia also end their terms this year but will likely be reappointed.

SEEKING INDIA

Aspirations raised by last year’s Foreign Policy White Paper and the revived Quadrilateral group for stronger relations with India face a bottom line test in March with the planned completion of a new Indian economic strategy. The study by former Department of Foreign Affairs and Trade secretary Peter Varghese will be an independent report rather than government policy but it is being carefully curated with input from both governments. After the failure to secure the bilateral trade agreement rashly promised in one year by Prime Minister Tony Abbott in 2014, the Varghese document will also be interesting for what it says about economic diplomacy in an era where trade agreements are becoming increasingly politically difficult. This interview with Indian economic adviser Rajiv Kumar in The Australian hints at differences over what the strategy should focus on.

ASIA STARTS UP

The shift in global economic gravity to Asia is set to take another significant step this year with the region likely to overtake the US as a source of venture capital. The bulk of global venture capital investment growth occurred in Asia last year for the first time putting the region close to overtaking the US in total. According to PwC/CB Insights US$74.5 billion was raised in the US last year compared with US$70.9 billion in Asia. Only a year ago the US VC market was estimated to be about twice as large as Asia. According to India-based Venture Intelligence Indian VC market may have hit US$20 billion in in new capital last year possibly overtaking China.

ASEAN NOW

The momentum towards economic integration in South East Asia took a significant step forward in January with the full integration of Cambodia, Laos, Myanmar and Vietnam into the regional tariff abolition regime. The four newest members of ASEAN were given a delayed introduction to the ASEAN Economic Community abolition of tariffs on all but limited sensitive products in 2015. The biggest change will be the removal of relatively high tariffs on car imports into Vietnam. But the move will shift the focus more to the still high non-tariff barriers within ASEAN and for external partners such as Australia. The move comes ahead of the summit of ASEAN leaders in Sydney in March which will involve a push by the Turnbull government to increase Australian business connections with South East Asia, as the world’s third growth centre after China and India (see Looking east below).

NEIGHBOURHOOD WATCH

NORTH ASIA SUMMIT LOOMS

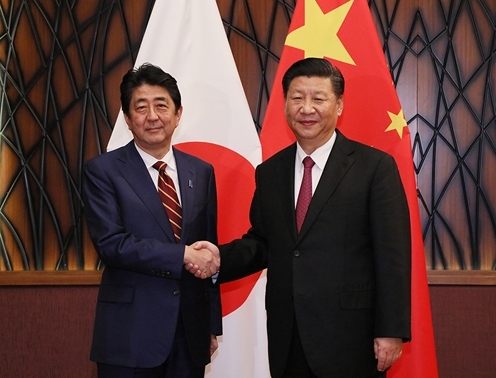

Chinese President Xi Jinping and Japanese Prime Minister Shinzo Abe brought along a lot of historic baggage when they came to power in 2012 as the scions of powerful political dynasties. The fact they have still not made a bilateral visit to each other’s country since then says it all. But some carefully chosen words on sensitive issues and lower level shuttle diplomacy in recent months may have paved the way to a three-way summit in April for Xi, Abe and newer South Korean president Moon Jae-in. Increased economic cooperation is being touted as the agreed territory for the summit with all three leaders more focussed on regional economic integration in the Donald Trump era. These tri-lateral meetings were annual events in the five years to 2012 but haven’t been held since 2015.

LOOKING EAST

Indian Prime Minister Narendra Modi has set a potentially embarrassing benchmark for his Australian counterpart by attracting ten South East Asian leaders to his country for a national day summit on January 26. National day visits by foreign leaders are common in India but this was an unusually large delegation. And it comes just two months before the Association of Southeast Asian Nations (ASEAN) leaders are due for their first collective visit to Australia. Turnbull has a lot invested in what will be the biggest diplomatic event in Australian since he became prime minister and Australia has a more extensive program planned than what happened in India. Nevertheless, the India event has given some substance to India’s Look East policy. It has also underlined how the ASEAN leaders are getting used to being wooed by other major countries these days.

ASIAN NATION

NEW CHINA SPLIT EMERGES

The Federal government appears to have moved to stabilise relations with China after last year’s tensions over influence peddling by distancing itself from assessments in the latest US National Defence Strategy. Both Foreign Minister Julie Bishop and Prime Minister Malcolm Turnbull have pointedly failed to endorse the US view that China and Russia pose a greater risk to international security than Islamic terrorism. Indeed, Bishop says: “We have a different perspective on Russia and China, clearly. We do not see Russia and China as posing a military threat to Australia.” But this interesting public difference with the US has not come without signs of strategic confusion within the government with both Defence Minister Marise Payne and deputy Prime Minister Barnaby Joyce each earlier broadly endorsing the US view.

SUMMER SUMMIT

Holding an annual leaders meeting in the January holiday season raises the risk of excessive expectations in a slow news week. But this now seems set to be a feature of the Japan relationship with Malcolm Turnbull travelling to Tokyo this year amid reports of a new visiting forces agreement. That addition to the burgeoning bilateral security relationship is still to come but the meeting with Prime Minister Shinzo Abe was still notable for the way the two leaders handled the elephant in the room: China. Turnbull appeared to step back from the more strident language of late last year. But Abe, one of the more accomplished world conservative leaders these days, also demonstrated how he has clothed his early nationalism in more pragmatic economic policies. This interview in The Australian Financial Review has some interesting insights into his thinking on regional infrastructure. This Nikkei Asian Review article explains Abe’s new pragmatic diplomacy.

DEALS AND DOLLARS

PRETTY PICTURE

The US$40 million funding round that made graphic design company Canva Australia’s first US$1 billion start up since software company Atlassian received crucial support from the Chinese arm of one of Silicon Valley’s top investor Sequoia Capital. Sequoia Capital China joined existing Canva investors Blackbird Ventures and Felicis Ventures to make Canva a unicorn. Sydney-based Canva raised its first funds in 2013 and now one the world’s fastest growing software companies.

MAKING DOUGH

Grain handler CBH Group has lost the executive who built its innovative joint venture in South East Asia after a recovery in profits from the $100 million investment. Interflour chief executive Greg Harvey has left the Singapore-based joint venture between CBH and Indonesia’s Salim Group to spend more time with his family in Perth. CBH’s profit share from the venture increased about ten fold last year to $3.7 million after a sharp fall in 2016. But Interflour did not actually return a dividend to CBH because the profit was used to fund a new malting plant in Vietnam and a new flour mill in the Philippines.

WANDA EXITS AUSTRALIA

One of China’s biggest property developers Dalian Wanda has ended months of speculation about its Australian assets by announcing they have been sold as part of a push to cut its foreign debt. It’s hotel and apartment tower projects in Sydney and the Gold Coast were sold for $1.1 billion to the Australian-Chinese developer Yuhu Group. Chinese regulators told banks to stop lending money to Dalian Wanda for some foreign investments as part of the general clampdown on excessive offshore investment.

RISK REDUCTION

QBE has become the latest financial services company to review its Asian investments amid some pressure from analysts to sell some of them. In a forecast of a $1.2 billion loss for 2017, the company’s new chief executive Pat Regan indicated the Asian businesses made losses last year along with the North and South American divisions. He said the group would also be writing less “high hazard” risk policies in Asia, although it would be continuing with its businesses in Hong Kong and Singapore. Last year IAG also indicated it was considering pulling back from Asia.

PAPUA MINE DEAL

Long running tensions between the Indonesian government and Freeport McMoRan over the ownership of the Grasberg copper miner in Papua may be resolved by Rio Tinto selling its minority share to Indonesia. While Rio is not commenting on the negotiations, Freeport chief executive Richard Adkerson confirmed the negotiations in an analysts briefing. Rio wants to sell its stake because it doesn’t meet the company’s environmental policies. But this would reduce the amount Freeport would have to divest in order for Indonesia to gain a 51% stake in the mine.

CHINESE HEALTH FOCUS

Chinese investment in Australian healthcare is running at about the same level as investment in the much larger US health sector, according to new data. The annual KPMG-University of Sydney survey of Chinese investment has found that mostly private Chinese companies have invested $5.5 billion in 16 health sector projects in the past three years since the ground breaking $1.4 billion investment in Swiss Wellness in 2015. Most of the money has gone into health supplement and service delivery projects with an emphasis on export potential. In the latest deal in February health supplements group By-Health has boughtMelbourne probiotics manufacturer Life-Space Group for almost $700 million.

DATAWATCH

LOOKING UP: ECONOMIC GROWTH FORECASTS (%pa)

|

||||||||||||||||||||||||||||||||||||||||||||||||

Source: World Bank Global Economic Prospects 2018 report.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. Exclusive partnership opportunities are available. For more information please contact [email protected]

Read previous issues and subscribe >>

Copyright © 2018 Asia Society Australia, All rights reserved.