Briefing MONTHLY #14 | February 2019

Special focus: Remaking trade | Rebuilding aid. Plus: China business

Trade, Tourism and Investment Minister Simon Birmingham, speaks at Asia Society Australia's Leaders on Asia event on the back of signing the landmark IA-CEPA. Picture: Julia Bergin/Asia Society Australia

TRADE: STRANGERS NO LONGER?

There is no pithier way of characterising the uneven relationship between Australia and Indonesia than the 1991 book title Strange Neighbours. But a striking part of the strangeness - the lack of a strong formal economic relationship - was removed this week when the long-delayed trade deal between the two countries was signed. This has been almost a decade in the making and finally brings Indonesia (Australia’s closest Asian neighbour) into line with six other Asian countries with which Australia has a bilateral trade pact. Australia’s thin economic links with Indonesia have some rational foundations – the two countries have long been essentially competing commodity exporters. But the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA) is based on the emerging new complementary economic relationship between the two countries spanning services, labour movement and integrated supply chains. It also emphasises economic cooperation more than some other trade deals, possibly opening new avenues for economic integration. And with Indonesia forecast to be the world’s fourth largest economy, it is long overdue. Trade Minister Simon Birmingham has now set a new benchmark for success in the relationship by suggesting that Indonesia should move up the list of Australia’s trading partners from around 15th now to around four in line with its forecast global economic stature over the next decade. Speaking at an Asia Society Australia lunch two days after signing the agreement in Jakarta, he said the government had been confident about completing the deal this month despite the tensions last year over Australia’s Israeli embassy location review and election pressures in each country. He said that focussing on the mutual benefits of the agreement in both countries - especially the vocational upskilling arrangements - had gotten it over the line.

See the text of the IA-CEPA here.

Read the Minister's speech to Asia Society Australia here.

See past BRIEFING MONTHLY coverage of Indonesia here and here.

TRADE: BEYOND US V CHINA

Asia Society Policy Institute trade commissioners Kim Jong-Hoon and Mari Pangestu in discussions at Asia Society Australia. Picture: Julia Bergin/Asia Society Australia

Put six of the world’s more experienced trade negotiators in one room for several days to sort through the world’s problems, and the answer is? Well, it’s not so clear. The Asia Society Policy Institute (ASPI) Trade Commission held its third annual meeting in Australia in February to produce independent ideas about how to navigate through the dynamic yet troubled Asian trade landscape. With stock markets swooning amid rumours from the US-China negotiations, it was not surprising that particular fissure in the system tended to dominate public discussions. But what the group of former senior trade negotiators from the US, China, Japan, Australia, South Korea and Indonesia also talked about in the private sessions provides a more interesting insight into the state of the world trade system – particularly viewed through an Asian lens.

TPP: The rebadged Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) was viewed as the most important other regional development apart from the US-China talks. There was a positive outlook about more countries joining the 11-member group but caveats about how quickly this could happen.

RCEP: The proposed 16-member Regional Comprehensive Economic Partnership negotiations continue to struggle with elections in Thailand, Indonesia, India and Australia affecting the ability to make short term progress. And beyond that, there were concerns that this negotiation may have gone as far as it can, perhaps requiring a pragmatic conclusion.

WTO: The ASPI group has previously not focussed closely on World Trade Organisation issues in order to maintain its Asia specific focus. But reflecting growing concern in Asian countries (which depend on trade more than many other countries) about challenges to the WTO it received elevated attention in the Australian meetings. This included concerns about a logjam in the appeals system, how to manage state-owned enterprises and the status of developing countries. With no significant agreement in a quarter of a century apart from the Trade Facilitation Agreement, there was much discussion of how to spur more cooperation by like-minded groups of countries. But there was no consensus on how far Asian countries may be prepared to move away from a WTO-first approach.

Technology: An important issue on the agenda was how to reconcile the slow-moving and bureaucratic culture of trade deal negotiations with fast moving new technology development. With the growth of autonomous vehicles, additive manufacturing and artificial intelligence, the panel wrestled with which trade rules should be the focus of necessary updates, and whether such updates need to be expanded beyond trade. Asian countries are key players in old and new technology trade and how these issues are resolved will have an important impact on Asian growth.

The ASPI trade panel is chaired by former US deputy trade negotiator Wendy Cutler. It includes (from left) former Japanese Ambassador Yoichi Suzuki; former Indonesian trade minister Mari Pangestu; former Australian Ambassador Peter Grey; former South Korean trade minister Kim Jong-hoon and China Institute of WTO Studies dean Tu Xinquan. The panel report is expected to be published in May. Picture: Julia Bergin/ Asia Society Australia

TRADE: ASIA’S OPTION B

China’s Asian neighbours are benefitting from some trade diversion due to its growing trade tensions with the US. But not enough to offset the broader impact of the row between the two global economic powers, according to new modelling by Australian and Indonesian economists. The modelling uses real tariff reductions under negotiation within the Regional Comprehensive Economic Partnership (RCEP) group (as of last November) to assess whether this 16-member proposed trade group could offset the costs of the US-China tensions. It finds lower gains to world growth from RCEP than past studies and estimates that the costs of a serious US-China trade war would be three times greater to the world than the RCEP gains. It finds that the biggest winners from RCEP are Vietnam, Korea and Thailand. With new doubts about whether RCEP can be concluded as promised this year (see ASPI above) the study warns: “It is also feared that the US-China trade war may pull the global economy into different blocs and that ASEAN will be put in a difficult position as it may urge nations to pick a side. If that happens, it may have implications going forward for the RCEP negotiations.” But the study by University of Queensland’s Renuka Mahadevan and Indonesian finance ministry official Anda Nugroho has some interesting findings on India, the country seen to be holding back RCEP negotiations. It finds that joining RCEP will produce a trade surplus for India and significantly smaller welfare losses than if it decides to exit the proposed group.

THE END OF “AID” (… except for the media headlines)

Cooperation or coopetition…Chinese academics explain their country’s aid agenda at the conference

Five years after the Department of Foreign Affairs and Trade did what bankers would call a reverse takeover by absorbing an aid agency about three times its funding size, a curious thing has happened. With the enlarged DFAT now at the frontline of Australia’s new battle for influence in the Pacific with a notional $3 billion extra in grant, loan and export credit money, cooperation is the new buzzword. That’s not just rebadging “aid” as “development partnership” to avoid western colonial overtones. It is also a new effort to preserve the remaining specialist development expertise inside DFAT and the frontline locally engaged embassy staff after the cathartic takeover of AusAID. It also means drawing more on independent development practitioner ideas as Australia looks for ways to quickly muscle up with China without lapsing into some of its failures. It is a sign of the times that the annual (but now very retro sounding) Australasian Aid Conference at the Australian National University is looking for a new venue after a record 600 attendees this year from around the world. DFAT secretary Frances Adamson set the scene with a reflective speech which observed that just as the Morrison government has splashed more cash in the sector “the donor recipient relationship era is now passing away.”

Here are the highlights:

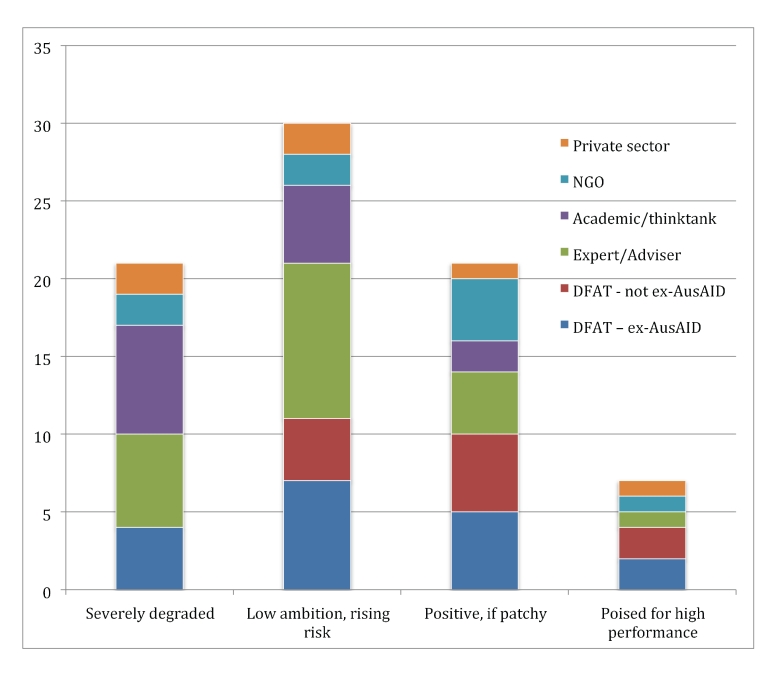

Five years on (1): This independent report on the integration of AusAID into DFAT by former AusAID executive Richard Moore has arguably passed the first test for such a document. It has irked Frances Adamson by suggesting development cooperation requires longer term thinking than traditional diplomacy. But it will also irritate integration opponents by suggesting aid practitioners are more comfortable with the integration than the vocal academic critics; AusAID was over-extended in 2013; and integration contributes to a more coherent foreign policy which suits the times. But with eye-catching data like 2000 years of expertise being lost from DFAT ranks since 2013, the review suggests that the relatively efficient integration so far is now facing a chasm. The tail of well-designed old projects is ending. The recipient/partners are becoming more demanding. And while project control has now been decentralised to embassies and more outside contractors, long term success will probably depend on Australia carefully targeting fewer projects over a longer time period in fewer countries. Moore recommends some major changes to make development cooperation more effective.

How the AusAID integration is working:

Source: Interviews conducted by Richard Moore for his integration review

Five years on (2): Meanwhile a three yearly survey of development cooperation experts suggests a continued strongly negative view of the 2013 integration although there is a noticeable improvement in sentiment since the nadir of the process in 2015. Only 17% of people surveyed think the aid program is improving compared with 10% in 2015 and 78% in 2013.

The China challenge: It says something about China’s rise that it probably explained a record turnout at an otherwise obscure Australian conference. And the appearance of three young female Chinese academics to explain the Belt and Road Initiative (BRI), China’s new over-arching development finance institution, and its Pacific ambitions only underlined the point about how Chinese policy is in a state of flux. Finance ministry academic Jinghang Jia downplayed the suggestion a BRI 2.0 remake was underway but went on to say her country wasn’t explaining its aid activities very well, needed more help from global agencies along with countries like Australia and even welcomed scrutiny of poorly performing projects. The panel members even raised the idea that Australia might be better placed to maintain roads in Papua New Guinea if China built them. They conceded China’s development activities had been driven by a range of different commercial motives over many years but said this would now become more coordinated. And they suggested that the emergence of non-government organisations at the domestic level in China might eventually be a feature of its foreign aid activities.

Navigating Troubled Waters Through the China Looking Glass. Animation: Rocco Fazzari. View it here.

Soft power: It is unusual to see the head of a government review suggest that it may well be better in the long term if the subject doesn’t get much public attention. But that’s how William Byrne, the DFAT official in charge of a soft power review, sees his task: if Australia really does exert soft power we won’t have to talk about it. The review is a sensitive issue in an aid context because the practitioners are worried that their primary aim of poverty reduction may be supplanted by other national imperatives. Byrne says aid is a soft power asset but rather than twisting priorities, soft power will emerge from doing aid well in the eyes of the partner countries.

ASEAN in the middle: The development aid cutbacks since the end of the last Labor government have seen a shift in Australia’s spending priorities towards the Pacific and away from South East Asia. This is despite ASEAN being elevated as a more important diplomatic priority and the focus of the annual Australia Now marketing campaign this year. For example, France and Germany have overtaken Australian spending in Indonesia. Richard Moore’s integration report has offered a useful new perspective on this contradiction. He says the conventional wisdom that countries such as Indonesia don’t need Australian “aid” anymore misses the point that how or if they mature into middle income countries will be crucial to Australia’s economic and political security. So, Australia should shift from an aid focus to a highly targeted middle income development partner approach, perhaps with a new research institute for this purpose.

New age caring: Sitting in a lecture theatre literally packed to the stair treads for a discussion on Pacific labour mobility underlined one of the new realities of the aid business: cash isn’t the only currency. Judging by the attendance, the newly expanded Pacific Labour Scheme, now available to businesses across Australia apart from the major cities, is the new frontline of aid with economic integration replacing Budget spending. Foreign worker remittances exceed trade and foreign investment flows in some small countries and this may well be the most effective part of Prime Minister Scott Morrison’s “step-up,” despite the headline grabbing $3 billion. The fascinating question now is whether Pacific workers are a partial solution to Australia’s aged care crisis.

NEIGHBOURHOOD WATCH

NEW MOON FADING

Perhaps the big loser from the sudden end of last weeks US-North Korea summit in Hanoi was South Korean President Moon Jae-in, who has played a key role in laying the groundwork for the process. Until last year the leaders of the South and North had only twice met in 2000 and 2007. But in the past five months they have met three times and left leaning Moon had been preparing to use a successful Hanoi summit to move his own reconciliation policy forward with a visit to Seoul by Kim Jung-un and new economic cooperation projects. Moon has built his reconciliation policy in the vacuum left behind on the conservative side of South Korean politics by the corruption convictions of the last two conservative presidents. But now the rebranded Liberty Korea right wing party has a new leader and is rising in the opinion polls as Moon’s support suffers amid a weak economy. With an election looming next year for the legislature, Moon’s capacity to take risks on North Korea policy is looking more constrained. However in the first post-summit move to maintain the reconciliation process the US and South Korea have scaled back annual large scale military exercises.

THAILAND’S MACRON?

Thais appear to be going to their long-awaited election to end military rule on March 24 with the same malaise affecting more mature democracies – voter disdain for major parties. A Bangkok Post poll in early February found 66% of voters undecided despite the election being delayed six times during five years of military rule. Voter support was relatively even between the three main political groups – exiled former prime minister Thaksin Shinawatra’s Pheu Thai party, the military’s Palang Pracharath and the Bangkok establishment former ruling Democrats. Look out for a Thai version of France’s Emmanuel Macron with millennial tycoon Thanathorn Juangroongruangkit’s Future Forward doing remarkably well in the poll.

US: IN OR OUT?

It is the big question that never goes away. How is the US placed in Asia? Here’s the state of debate.

- Sheila Smith, from the Council on Foreign Relations, predicts a year of erratic decisions on regional issues from the White House.

- But John Lee, from Sydney University’s US Studies Centre, says Donald Trump has a coherent strategy for dealing with China which is working.

- And Hugh White from the Australian National University suggests Australia is quietly hedging against a future reduced US role.

FESTIVAL OF DEMOCRACY

INDIA: FAMILY RULES

It says a lot about the power of dynasties in Indian politics that the Congress Party thinks it is a good campaign tactic to pit the scion of the country’s best known political family against a leader who has broken out of the dynastic mould. Prime Minister Narendra Modi rose from a family of tea sellers to the country’s top job. But Congress has now energised the still undeclared April/May election by suddenly giving Priyanka Gandhi a top party job and responsibility for the populous Uttar Pradesh state, where Modi is expected to stand as a candidate. Priyanka is widely compared to her grandmother and former Prime Minister Indira Gandhi, although her father Rajiv and great grandfather Jawaharlal Nehru were also both PMs. Judging by the her first appearances, it is a good tactic. Although what it does for the image of her brother Rahul, the official Congress campaign leader, is another thing.

INDONESIA: ALL ABOARD

It has been a long wait, but Jakarta’s Mass Rapid Transit line officially opens in March promising to ease the city’s traffic congestion. The question is how much it will boost the re-election prospects on April 17 of President Joko Widodo, who ended years of delays to start the construction when he was Jakarta governor. Infrastructure was a feature of the second presidential election debate with Jokowi striving to reel off his achievements. The president is criticised by some academics for trying to recapture former dictator Soeharto’s “father of development” image. However, Indonesia’s infrastructure construction has leapt ahead under his leadership despite missing ambitious targets and voters are starting to benefit.

DEALS AND DOLLARS

CHINA BUSINESS BATON CHANGE

China Pushes the World. Animation: Rocco Fazzari. View it here.

The latest profit figures from some of Australia’s more China sensitive companies have illustrated how picking consumption trends is becoming more complex. Younger generation demand for premium baby formula has boosted a2 Milk Company’s latest results offsetting concerns that China’s declining birth rate would be a headwind. But a decline in the role of the daigou (or fly-in, fly-out) shoppers has seen vitamin company Blackmores suffer a sharp profit fall as competitors have gained ground in a more regulated vitamin distribution system. Wine company Treasury Wine Estates suffered its own marketing channel snafus in 2013 but has recovered strongly with a product which continues to be seen as premium. Meanwhile casino operator Crown Resorts has seen revenue from wealthy Chinese gamblers sink due to the slowing economy and the anti-corruption crackdown it appears to have underestimated.

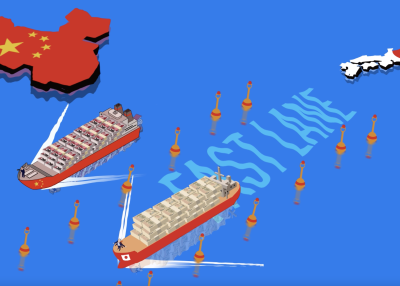

US IN THE PASSING LANE

Approved investment from the US has overtaken China for the first time since 2012-13 with a fall in the value of Chinese investment across all sectors. The Foreign Investment Review Board annual report for 2017-8 reported approved Chinese investment of $23.7 billion down from a record of $47.3 billion in 2015-6, while US investment increased to $36.5 billion from $$26.5 billion in 2016-7. The report also hints at further changes to investment rules to support national security along lines being pursued in the US and United Kingdom. See this Australia China Relations Institute briefing on Chinese real estate investment.

MACQUARIE’S REGIONAL OUTLOOK

Macquarie Group is playing down market nervousness about the impact of the US-China trade row on Asian growth by endorsing the long-term growth potential of China, Japan, Korea, Taiwan and India. About 12% of Macquarie revenue is booked in Asia, but beyond that measure Asia is becoming a growing source of capital for its infrastructure funds. The company talked up infrastructure opportunities across the region, including renewable energy and roads, at a February investor briefing.

SMEs ON THE ASIAN ROAD

The Commonwealth Bank is backing a new project to improve the skills of small and medium enterprises (SMEs) to build trade and investment pathways into Asia. The Asialink Growing with Asia project helps SMEs assess their readiness to enter Asian markets with an online tool and practical resources. The next phase of the project will involve a detailed scorecard on Australian business performance, and recommendations on how SMEs can better compete and achieve growth in Asia.

INSURING WITH JAPAN

Japanese life insurer Daido Life will start offering life insurance in Australia from March through its 14.9% investment in local company Integrity Life. The move continues a Japanese push into life insurance started by the Dai-ichi Life purchase of TAL in 2011 and followed by Nippon Life buying MLC Life Insurance in 2015.

KIRIN SALE DEADLINE

Japanese food giant Kirin is pushing to sell its Australian food and drinks business by the end of March according to this report in The Australian which suggests the mixture of assets is proving hard to sell in one lot. The sale will be a significant retreat from the otherwise strong flow of Japanese investment into Australia.

DIPLOMATICALLY SPEAKING

“Development is a difficult and high-risk endeavour. We work in complex environments where institutions may be weak and our counterparts may have limited exposure to best practice. The reality is that investments and programs will not always go to plan.” DFAT secretary Frances Adamson

DATAWATCH

BISHOPLOMACY

Retired foreign minister Julie Bishop, who leaves the federal Parliament in May, will be best remembered for the New Colombo Plan. But she also embraced the 2013 Budget-imposed integration of her department and AusAID with aplomb. Here’s how her three key aid initiatives will be remembered.

WHAT WE ARE READING

ARE WE ASIAN YET? Australian Foreign Affairs, Issue 5 (Schwartz Publishing)

Historian David Walker has long been one of the most thoughtful writers on a subject which this relatively new and welcome journal has made the theme of its latest edition. And that’s because Walker brings a perspective on Asian engagement that is not commonly found in the contemporary world of politicians claiming diplomatic triumphs and commentators prognosticating about the future. He can look back to a rich history of Australians engaging with Asia in business, culture and politics. As he writes in AFA: “Perhaps we should spend less time gazing anxiously into the unknowable future and more time examining the knowable past.” Then we might appreciate that Asia is “a shifting idea, defined by the time and circumstance in which it is discussed or envisioned, rather than by geography.” Writer Linda Jaivin says that absorbing China’s modern culture, from Wolf Warrior II to Carsick Cars, without falling into the propaganda machine will be part of being really Asian. And Sarah Teo, in Singapore, argues the view of Australia from Asia will be a key part of answering the question posed by AFA. This is not the first time a journal or essay collection has asked this question. And it won’t be the last.

ON THE HORIZON

MALAYSIA’s TRANSITION

November will mark 20 years since then Malaysian Prime Minister Mahathir Mohamad beat off an election challenge from a new opposition group led by his former deputy Anwar Ibrahim. It will also be well past the halfway point in the roughly two year transition period the two men agreed on for handing over the top job after the surprising win they managed from opposition at last May’s election. So, it’s not surprising supporters of both men seem to be getting anxious about how the transition timetable is going to work leading to reports about shoring up of their respective support within the ruling Pakatan Harapan coalition government. Given they have been government partners, bitter rivals and then pragmatic opposition campaigners, it will be fascinating to see what is next.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. Exclusive partnership opportunities are available. For more information please contact [email protected]

Read previous issues and subscribe >>