China Executive Brief | China’s Post-COVID Macro Playbook

China Executive Brief

READ NOW

The outlook for H2 growth in the PRC is bleak. While not in a nosedive, the economy is preparing for greater risk. Reflecting post-COVID, post-Trump realities, Beijing is tacitly pursuing a least-worst strategy in macro-economic and trade policy. Tech innovation and smarter industries will propel an ultra-large domestic market; high consumption will realise national self-sufficiency. But, counter to Xi’s wishes, reliance on exports is still growing.

Key Takeaways for Australian Leaders

- Boom times for China’s economy are over. Current policy settings foreshadow a plateauing economy with gradually falling growth rates. Slower, more equitable economic growth is the new normal with the policy of dual circulation central to China’s pivot towards a more sustainable economy, more resilient to external shocks and pressures.

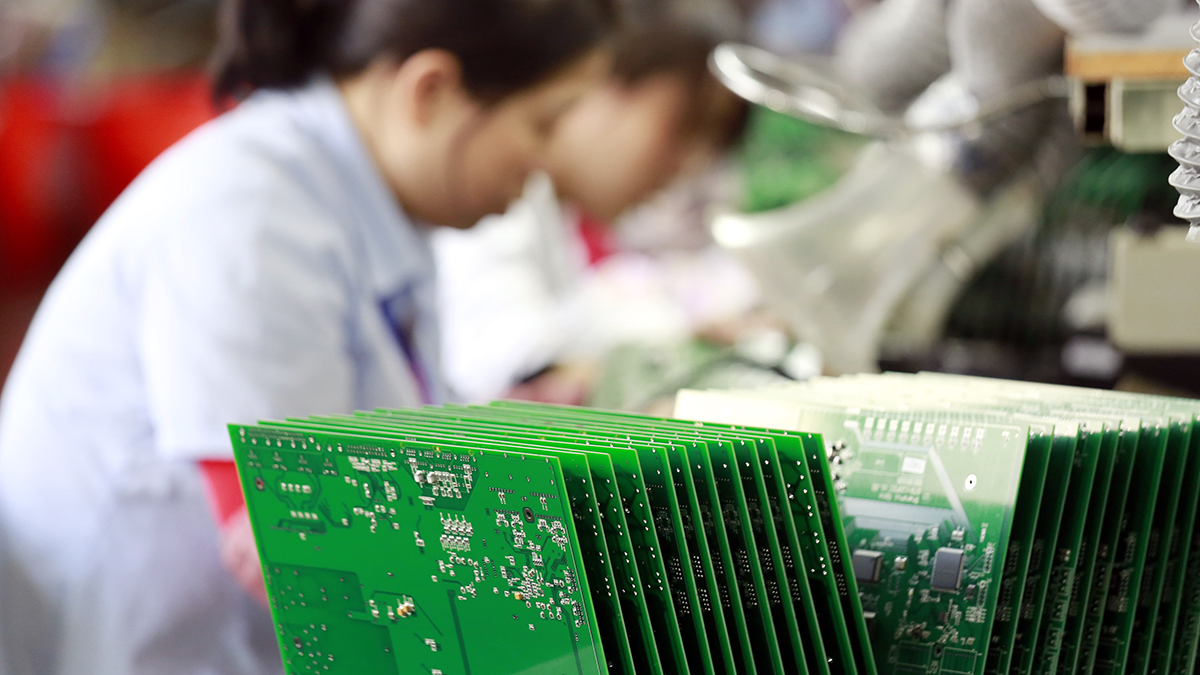

- Despite the ambition to lessen China’s reliance on foreign exports, trade data suggests that the volume of goods imported into China continues to grow. COVID-19 and commodity price hikes have confirmed China’s reliance on global commodities and tech hardware for the short- to medium-term.

- International tech companies are required to play by domestic rules. China’s tech crackdown seeks to ensure major domestic players, such as Alibaba and Didi, do not operate independently from the state. In most sectors, China will look to ‘national teams’ to be vetted to compete internationally.

- China’s Belt and Road Initiative (BRI) allows China to set the terms of trade and standards, including for digital economy across Asia and BRI signatory nations. BRI nations fall under dual circulation’s domestic loop and will be prioritised in trade and supply chains. This evolving trade order should be monitored closely by Australian exporters, investors and consultants.

- Australia was the source of 60 per cent of China’s one billion tonnes of imported iron ore in 2020. However, targets are in place to decrease China’s reliance on imported resources by meeting domestic demand through local sources (iron ore, scrap metal, pig iron) while diversifying supply through Russia, Myanmar, Kazakhstan, Mongolia and African nations.

- China’s consumption story is far from over. China will continue to be a market too large for business to ignore. China’s punitive trade measures, Australian agricultural and health products, as well as tourism and education services, are still highly competitive in China. But their success in the Chinese market is dependent on geopolitical and political forces, largely beyond the exporters’ control.

Read and download 'China's post-COVID Macro Playbook' now.

China Executive Briefing is an initiative of Asia Society Australia and China Policy to provide up-to-date, impartial and accessible analysis of China’s economic policies and trends and their implications for Australia.