Briefing MONTHLY #65 | August 2023

Aid redesigned | Thailand’s deal | Malaysia’s divide | PM’s travels | Shrinking China | Subs debate

Animation by Rocco Fazzari.

STATECRAFT RISES

The third leg of a new approach to regional relations slotted into place this month with the Albanese government’s new development aid policy embracing a whole of government effort to deal with deteriorating strategic circumstances.

This follows the Defence Strategic Review embracing aid and diplomacy and the May Budget using the language of “investing in all elements of our statecraft including diplomatic power, trade and development”. And so, the new aid policy measures – which range from more emphasis on climate change to greater use of creative financing tools – are characterised as “one of our tools of statecraft, an effective development program is key to building regional resilience.”

Indeed, statecraft is an ever-expanding catch-all concept as a government which promised a new approach to Asia amid some of the most uncertain strategic circumstances for decades has sought to do this at a time when voters are more focused on the cost of living at home. And so, during a vociferous Labor Party conference debate on nuclear submarines, Foreign Minister Penny Wong was even able to add trade unions to the international relations effort: “I know these unions well. I know that they are very clear about the national interest in making sure their members and the workforce contribute to our (defence) capability, and I have no doubt they will do that.” See: ASIAN NATION.

Expect to hear more about combining the three Ds - of diplomacy, development and defence - as Prime Minister Anthony Albanese embarks on another regional trip next week to take in the East Asia Summit in Jakarta and the Group of 20 leaders meeting in New Delhi. But aid analyst Terence Wood has the sharpest take on trying to do more strategically with limited extra resources: “Unless Australia is planning to chase China out of the Pacific with feminist wind turbines built by the World Bank, this just doesn’t seem possible.”

This month’s Briefing MONTHLY also looks at two other notable zeitgeist changes.

Albanese’s trip will include a meeting with Philippines President Ferdinand Marcos Junior in Manila to bolster ties with a country that gets less attention than many other neighbours. Many Australians found the return of a Marcos to the Malacañang Palace last year hard to accept. But with fragile new coalitions of old warlords in Thailand and Malaysia, and even Singapore’s government facing corruption scandals, Marcos, with a six-year term, looks more like a stable bet.

Meanwhile, Treasurer Jim Chalmers says China’s ailing economy is keeping him awake at night in a telling shift from the dominant narrative of China as a military threat. See: NEIGHBOURHOOD WATCH.

Greg Earl

Briefing MONTHLY editor

NEIGHBOURHOOD WATCH

US ALLIES: phone talk

The Philippines may have hung up on China, but the US, Japan and South Korea have underlined a new north Asian atmosphere of cooperation by agreeing to a hotline to manage security challenges.

The three countries held their first trilateral meeting apart from brief contact at international gatherings since 1994 in a significant reconciliation between Japan and Korea underwritten by the Biden Administration. President Joe Biden underlined the importance of the gathering by making Japan’s Prime Minister Fumio Kishida and Korea’s President Yoon Suk-Yeol the first foreign leaders he has invited to the Presidential retreat at Camp David.

The recuring tensions over historical grievances between Japan and South Korea get little public attention from Australian governments despite their stature as key export partners. But US officials have been persistently working on a reconciliation as both countries have experienced pressure from China.

The phone hotline will be more significant if it fosters behind the scenes, new ties between the Japanese and Korean leaders rather than with the US. But its announcement on August 18 made a highly symbolic contrast with the Philippines decision to abandon a year-old parallel connection with China to deal with South China Sea tensions.

“It no longer exists… It hasn’t provided so much benefits for us. We didn’t gain anything from this,” a Philippines official said. Meanwhile White House coordinator for Indo-Pacific Affairs Kurt Campbell said: “We’re going to invest in technology to have a three-way hotline for the leaders and others inside their governments to communicate.”

More importantly after the tensions between Japan and Korea, the three countries agreed to trilateral leaders’ meetings, “unprecedented” defence cooperation, and cooperative work on more resilient supply chains for new technologies. The plan for an annual Trilateral Indo-Pacific Dialogue has obvious parallels with the Quad meeting between the US, Japan, India and Australia.

US National Security Adviser Jake Sullivan said after the meeting: “One area that President Biden has particularly emphasised from his first conversations as president with both of these leaders was how to build stronger Japan-ROK ties and how that is in the fundamental national security interests of the United States.”

- With all three leaders suffering flagging domestic public opinion support, Kim Sang-Woo writes in The Korea Herald that the summit ambitions now depend on the durability of the current rare amity between South Korea and Japan.

MALAYSIA: two parties rise

Malaysia has emerged from six state elections more divided than ever despite Prime Minister Anwar Ibrahim narrowly surviving the de facto test of his leadership because no state actually changed hands.

But the growing emergence of the Chinese-based Democratic Action Party (DAP) and the Islamicist Parti Islam SeMalaysia (PAS) as the country’s two most successful vote winning machines has underlined a deepening ethnic divide.

Anwar, who only came to power last November after decades as a political chameleon both in and out of office, now appears to face yet another difficult choice over how to position himself amid a fractured political center.

The unusual simultaneous vote in six states across mainland Malaysia was seen as a test of Anwar’s ability to craft a more liberal centrist coalition by teaming up with the once dominant, but now discredited, United Malays National Organisation (UMNO). Anwar was the rising star of UMNO in the 1980s, but was forced into opposition in 1998 and jailed over an alleged sex scandal, before joining with his former UMNO colleague and prime minister Mahathir Mohamad to force UMNO from power for the first time in 2018.

Since then, the dominant Malay community vote has split across around five parties including Anwar’s more multi-racial Peoples Justice Party (PKR). But the state elections have shown how it now seems to be drifting towards the most conservative PAS. Importantly, this is partly driven by more younger votes being drawn to PAS after the voting age was lowered for last year’s national election, a change ironically championed by the Mahathir/Anwar 2018 reform government.

Anwar’s Hope Coalition (Pakatan Harapan) which has morphed into a unity government with UMNO won 94 out of 132 seats in Negeri Sembilan, Penang, and Selangor, but previously held 116. However, it suffered a serious setback in wealthy Selangor, around Kuala Lumpur, where PAS made noticeable progress.

Meanwhile in Kedah, Kelantan, and Terengganu, the National Alliance (Perikatan Nasional), led by Anwar’s former UMNO colleague and rival Muhyiddin Yassin, won a massive 108 out of 113 seats. This was mostly due to PAS, rather than Muhyiddin’s Bersatu Party, with PAS having an 83 per cent success rate and a virtual wipe out of the entire assembly in Terengganu.

Political analyst Wan Rohila Ganti told an Asialink webinar the way PAS had won seat seats in liberal Penang “was something serious. The current unity government shouldn’t see it as something temporary.” She said PAS had learned from the way the DAP dominates the Chinese community and had made itself more attractive to middle class, modern Muslims “who are not poor. They go to the malls, the theatre, etc.”

- At Channel News Asia, Lee Hwok-Aun explains how Anwar is now politically trapped over how to manage the country’s many preference policies for ethnic Malays.

THAILAND: revenge v reconciliation

Homeward bound … Thaksin with his sister Yingluck, who was also forced out as prime minister, in Singapore.

When former policeman, ex-prime minister and now prisoner Thaksin Shinawatra paid his respects to the country’s King as he stepped out of Bangkok Airport on August 22, he only added a new twist to the near two decades of sometimes deadly division that has racked the country since he was forced from power in 2006.

Have his populist supporters (loosely seen as “red shirts”) who have won most elections over that time, but failed to hold power long, now got the measure of the military/royalist elites (loosely known as "yellow shirts") who forced Thaksin, 74, from power? Or has that elite co-opted the ageing populist upstart who start life in a wealthy (but not Bangkok) family anyway?

The answer may not be clear until military appointed 250 member Senate reaches the end of its five-year term in a year and its power to determine prime ministers (and thus government composition) comes under review.

In the meantime, former businessman Srettha Thavisin is the country’s new prime minister at the head of a government led by latest manifestation of the Thaksin political movement the Pheu Thai Party, with Thaksin’s daughter Paetongtarn by his side. But the sprawling coalition government will have ministers from the two military parties, which once ruled but did poorly in the May election, in a grand compromise.

Thaksin is most unlikely to spend significant jail time for alleged offences that forced him into to exile 15 years ago. But he is presumably expecting a Royal pardon for helping broker a compromise that keeps the military somewhat in power without another coup and the new reformist popular Move Forward Party in opposition.

Move Forward may still be the ultimate long-term winner given its overwhelming youth support. But despite being regularly reported as having won the election – when it really won a plurality of seats in a multi-party assembly requiring a coalition government - it will have to reflect on the art of compromise in Thailand’s idiosyncratic form of democracy.

Meanwhile, although Pheu Thai will dominate the new Thai ministry, the expected appointment of six deputy prime ministers points to a messy time ahead.

- Gwen Robinson argues at Nikkei Asia that the latest compromise has prompted a “pervasive sense of betrayal and growing contempt for wheeler-dealers”.

CHINA: turning Japanese

Treasurer Jim Chalmers has ranked China’s economic turmoil alongside Australia’s rising interest rates as the key things he is watching in a shift from the security lens that has dominated China relations in recent years.

The past month has seen a boom in new comparisons between Japan’s 1990s stagnation due to an ageing population and the deflation of a financial bubble and China’s current circumstances, with the unnerving kicker that China is facing this at a lower level of per capita wealth.

A rare Chinese state-media report on the country’s demographic decline appeared to confirm the county’s total fertility rate - the average number of babies in a woman’s lifetime – may have fallen to 1.09 last year, from 1.30 in 2020. That is below the 1.26 rate for Japan, which is often seen as the benchmark country for ageing as a socio-economic challenge.

Meanwhile, the latest economic data shows China is experiencing deflation in an otherwise inflationary world, real estate prices are falling while debt remains high, company profits are falling, local government debt is often seen as a “timebomb”, and concern is rising about inadequate responses by economic regulators.

Questions are also growing about the accuracy of economic data in the world’s second biggest economy with, for example, the government this month halting publication of data on soaring youth unemployment.

As Prime Minister Anthony Albanese still seems intent on visiting China this year to stabilise bilateral diplomatic relations, Chalmers has warned: “They’re (China) dealing with slowing growth, they’ve got deflation, there are concerns in their property sector and to some extent in their banking sector. Their exports have slowed as well. We still expect ... for the Australian economy to continue to grow but that growth will be substantially weaker.” Australian companies are also divided. See: DEALS AND DOLLARS.

Despite the intensification of references to a Japan-plus style of stagnation in a poorer, more authoritarian country, there is still a deep division amongst external commentators over China’s economic outlook.

Stephen Roach, a long term investment banking China bull, says the country is pursuing a whack-a-mole economic approach which is only creating more problems. But another long time Chinese economy expert Nicholas Lardy says the country is not trapped by a severe cyclical downward spiral that will persist for years.

- Former Bank of Japan governor Masaaki Shirakawa says China can avoid Japanification with prompt action on bubbles and population.

ASIAN NATION

Source: DFAT

VEXING CIRCUMSTANCES

Australia’s new development aid policy formalises three broad trends which have been under way for several years through Coalition and now Labor governments.

Budget funding remains curtailed below global benchmarks which only adds to the momentum for the growing use of non-cash tools such as concessional debt, equity investments to encourage more private participation, and partly self-financing activity such as the Pacific labour scheme.

The focus on Australia’s closest neighbours in the Pacific and Southeast Asia and to a lesser extent South Asia at the expense of other parts of the developing world is embedded further.

And the idea of integrating aid more closely with the diplomatic and defence wings of international relations policy is made absolutely explicit, to some extent downplaying the moral and poverty reduction objectives of traditional aid.

And so, the policy says: “Our region faces vexing strategic circumstances. The security and economic dynamics that have held for decades are shifting. 22 of our 26 nearest neighbours are developing countries, and some remain fragile. Progress has been uneven and can be eroded quickly — as shown by the pandemic. Corruption, fragility, and poor governance continue to hold some countries back.”

The Pacific is framed as having longstanding bonds with Australia but facing rising challenges from climate change and debt which will require Australia to respect local priorities.

Southeast Asia is framed as a region with shared security and economic interests with Australia and opportunities for cooperation on protecting development gains with joint investments.

South Asia is framed as a region with growing ties to Australia where climate change and social inequality are cramping opportunities, but Australia can provide assistance in education, resilient cities and infrastructure.

In key policy initiatives Australia will progressively increase the proportion of aid with climate change and gender objectives; provide multi-year funding to support more civil society aid partnerships; improve aid project evaluation; develop a new humanitarian strategy; and use more blended finance to draw in more private funding including through the creation of a new entity Australian Development Investments.

HARD LABOR

Labor’s first national party conference in government for 12 years started with a 42-page draft statement on Australia’s Place in a Changing World which touches on many aspects of relations with Asia.

But it more importantly finished with an extra 32 point statement on Enhancing Australia’s National Security which reflected the public divisions over the AUKUS submarine agreement but contains no specific reference to Asian relations.

It rhetorically refers to diplomacy and development aid before defence spending; recommits to a nuclear free Pacific; talks up defence cooperation partnerships but only specifically mentions the US; and emphasises that wherever defence assets come from, they will be always subject to sovereign decisions. Perhaps most strikingly given tensions with China over Taiwan, the statement says: “Labor believes that Australia’s acquisition of submarines does not involve any ante facto commitment to participate in, or be directed in accordance with, the military operations of any other country.”

In contrast to the government’s normal reluctance to nominate China as a direct military adversary, Defence Minister Richard Marles seemed to suggest during the debate that the 2030 was his timeframe for needing to curtail China’s ability to exert serious military power.

The somewhat heated conference debate between party members and government representatives was largely triggered by former Prime Minister Paul Keating’s vociferous opposition to the government’s embrace of AUKUS. As a result, the current ministers are steadfastly reaching back further in the party’s history to claim an AUKUS mandate by referencing other former Labor prime ministers. This includes Andrew Fisher founding the navy, John Curtin introducing conscription and Gough Whitlam unifying the military services.

But the potential for former elder party figures to still unsettle neighbouring countries over AUKUS was underlined outside the conference debate by former foreign minister Bob Carr suggesting the submarine project would financially and diplomatically “crowd-out” other forms of nation building.

See DIPLOMATICALLY SPEAKING.

ASEAN TRADE

Australia has upgraded its trade agreement with Southeast Asian countries ahead of the release of its strategy on long term business and economic engagement with the region.

The new agreement, which still needs to be ratified by member country legislatures, contains additional commitments on services and investment rules and will also strengthen supply chain resilience and digital technology adoption. It will also include new commitments on sustainable and inclusive trade, and facilitate enhanced cooperation on environmental protection, the green economy, labour issues, and women’s economic empowerment.

The 13-year-old ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) sits above the network of bilateral agreements Australia has with most of the ASEAN countries. It provides some basis for regarding the region as a somewhat unified market rather than simply individual countries as most Australian companies do.

How the new strategy deals with the issue of whether Southeast Asia is a regional market or a series of individual country opportunities will be interesting to see.

DEALS AND DOLLARS

JAPAN STEPS ON THE GAS

Two major Japanese investors appear to have ignored concerns about Australia’s carbon emission policies by spending $763 million to buy into Woodside Energy’s $16.5 billion Scarborough LNG project in Western Australia.

The purchase by trading companies Sojitz Corporation and Sumitomo Corporation appears to indicate that not all Japanese energy buyers have lost confidence in Australia as a long-term supplier of LNG after government changes to preserve domestic gas and impose net zero emissions rules for new gas projects.

Japanese officials and commentators have been stepping up criticism of Australian policies this year. The biggest Japanese gas investor Inpex has even suggested Australia is endangering global security by boosting the outlook for competing suppliers such as Russia.

But under the agreement the two diversified trading giants will buy a 10 per cent stake in the Scarborough gas field and they have signed up for LNG purchases. They have also agreed to collaborate with Woodside on clean energy ventures such as hydrogen and carbon capture and storage.

TIMOR: More carbon, less ASEAN

Energy company Santos has signed a carbon capture and storage (CCS) agreement with Timor Leste which could provide a new revenue stream for the country as it faces up to the looming exhaustion of its sovereign wealth fund.

The two partners have agreed to explore opportunities to co-invest in carbon capture and storage projects, including at the Santos-led Bayu-Undan gas field in Timor’s maritime territory, adding to existing agreements Santos is working on to produce carbon-abated gas.

The head of Timor-Leste’s national oil company António de Sousa has said that using old infrastructure to store carbon could be a new revenue source as Timor tries to win investor support for processing new gas production at home rather than in Darwin.

Santos chief executive Officer Kevin Gallagher said the proposed Bayu-Undan CCS was positioned to provide carbon management services to the broader Asia Pacific and “could be an exciting new industry for Timor-Leste, putting it at the leading edge of the global energy evolution and generating revenue, local jobs and business opportunities for the nation.”

The agreement comes amid a series of broader developments with the Albanese government placing tougher net zero rules on new Australian gas development but also allowing the offshore storage of carbon waste which could help the Timor/Santos agreement.

Meanwhile as Timor seeks more support from Australia to process its own new gas amid concerns about a fiscal crisis by 2030, there are new signs of post-election internal instability with new Prime Minister and former independence leader Xanana Gusmao threatening to back away from joining the ASEAN group. There have been differences within ASEAN about the expansion, but President Jose Ramos Horta says his country will still join by 2025.

BATTERY BLUES

Mining company Chalice has questioned the federal and state moves to cooperate with Indonesia over critical minerals because it competes with Australian nickel companies and produces an inferior version of the mineral.

Chief executive Alex Dorsch told The Australian Financial Review that environmental problems in the Indonesian nickel supply chain were known in the battery minerals supply chain, including carmakers and their customers.

The federal and Western Australia governments have respectively signed or mooted critical minerals agreements with Indonesia just as the company has been seeking a large investor for its large nickel sulphide and platinum group elements near Perth.

Mr Dorsch said some carmakers were troubled by environmental issues unfolding in Indonesia’s nickel laterite operations which were largely controlled by Chinese investors. But there were few other large nickel suppliers. Wyloo Metals owner Andrew Forrest has also criticised Indonesian nickel producers when his private company bought WA producer Mincor Resources saying: “We are going to give the market a choice between clean nickel and dirty nickel.”

Dorsch said he was disappointed that the Albanese government left nickel off its official list of critical minerals. Indonesia has been pressing Australia to facilitate the development of an Indonesian electric car industry by providing Australian lithium to pair with Indonesian nickel.

POLLINATING INDONESIA

Indonesia’s sovereign wealth fund has teamed up with Sydney-based climate change investment group Pollination to explore nature-based solution investments as Indonesia tries to increase its role in carbon credit trading.

The two have signed a memorandum of understanding to identify investment opportunities and to develop nature-based projects, which aim to conserve, protect and restore vital ecosystems such as rainforests, peatlands and mangroves.

Indonesia Investment Authority chief executive Ridha Wirakusumah said: “With INA’s focused approach to green energy and transformation, coupled with Pollination’s profound expertise in climate change solutions, we see a tangible pathway to generate meaningful carbon credits and foster nature-based investments.

Pollination chief executive Martjin Wilder said developing the opportunities in Indonesia would be vital to global net-zero efforts.

“We are extremely optimistic about Indonesia’s ability to initiate and host the high-quality projects that global investors are actively seeking and to execute them at a scale that will be required,” he said.

INA says it has US$8 billion already invested in “future focused” industries including green assets and expects expand across all asset classes to $US25 billion in coming years. Some of that will come from monetising protection of the nation’s vast rainforests.

With possibly 20 per cent of the global stock of potential nature-based investments, Indonesia sees prospects of generating export revenue by trading credits with buyers that are generating unavoidable carbon emissions or causing damage to landscapes.

CHANGING CHINA

Annual results from two of Australia’s more Chinese consumer sensitive companies have provided an insight into what a rollercoaster the country’s volatile economic circumstances pose to Australian business.

Infant formula producer a2 Milk Company has warned that it faces challenges with China’s birthrate at a record low. The company’s chief executive David Bortolussi said that despite Chinese market shrinking in value this year, he expected to increase market share and achieve low single-digit group revenue growth. But he conceded that economic conditions in China remained difficult with the birth rate falling to historic lows and the baby formula market declining significantly. China comprises more than half of the world’s infant formula market and generates most of a2 Milk’s sales and profits.

But winemaker Penfolds is delaying allocating its premium vintage to countries for several months in anticipation of Chinese trade sanctions on Australian wine might be lifted. China excluded more than $1 billion in Australian wine exports with tariffs in 2020.

Chief executive Tim Ford said it was good practice for Penfolds to keep its options open on the potential for a China export reopening, given the advances made in diplomatic relations, and tariffs being lifted on barley in July. “It’s prudent to give ourselves some flexibility,” he said.

DIPLOMATICALLY SPEAKING

"We have to analyse the world as it is rather than as we would want it to be. We have to bring our defence capabilities up to speed and AUKUS is central to that."

- Prime Minister Anthony Albanese speaking at the ALP National Conference.

"If we take submarines off the table, we will never have left our country more exposed and that will undermine the whole idea of Australian self-reliance, which is at the heart of our platform."

- Deputy Prime Minister and Defence Minister Richard Marles.

"By having strong defence capabilities of our own, and by working with partners investing in their own capabilities, we change the calculus for any potential aggressor. This is why we are committed to AUKUS."

- Foreign minister Penny Wong

"When Menzies was arguing for appeasement and tried to cut defence funding, John Curtin was the one who argued for a massive increase in investment in our Air Force and Navy to deter aggressors in our region. So delegates, do you want to be on the side of John Curtin or do you want to be on the side of Pig Iron Bob Menzies?"

- Defence Industry and International Development Minister Pat Conroy

"These are matters of legitimate concern in parts of the Australian community, including among Labor members and branches, and within the Labor movement … We must continue to bring that kind of searching and sometimes difficult debate to these matters, which more than some other topics, frankly, require greater scrutiny rather than less and should never ever be advanced on the basis that they are the decision-making preserve of some defence and security establishment."

- Labor MP Josh Wilson, the only MP to oppose AUKUS at the conference

DATAWATCH

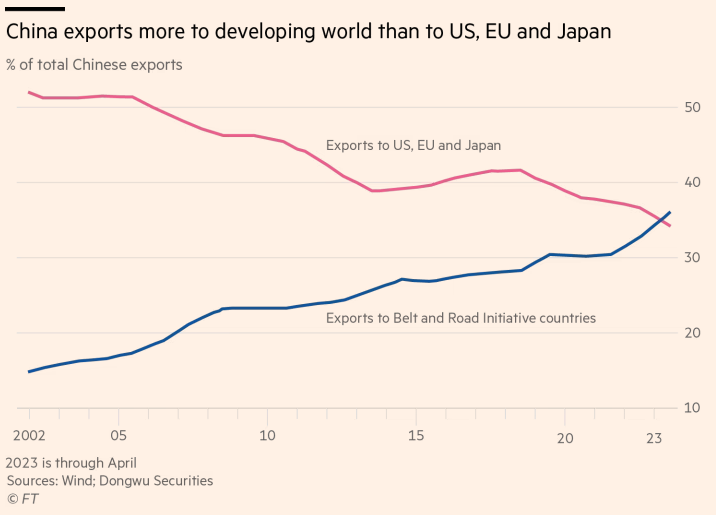

Source: Financial Times

China’s exports to the Global South have overtaken exports to the developed world for the first time underlining its increasingly heightened focus on relations with those countries.

ON THE HORIZON

Anthony Albanese meeting Ferdinand Marcos in Thailand last year.

VISITING THE NEIGHBOURS

Prime Minister Anthony Albanese will bolster the bilateral relationship with the Philippines when he meets President Ferdinand Marcos for talks during a three country Asian visit next week.

The Philippines has tended to get less attention from Australia compared with some other large Southeast Asians nations despite being Australia’s fourth largest source of migrants. But Australia has been stepping up defence ties, in particular, as the country searches for new partners in its maritime territory tensions with China. Education ties are also growing as some Filipino students look towards Australia rather than the US.

The Philippines visit is being squeezed in between the annual summits for the Association of Southeast Asian Nations (and its associated East Asian Summit) in Jakarta on September 6-7 and then the Group of 20 major economies summit in New Delhi on September 9-10.

The ASEAN Summit visit is likely to be focused on promoting Australia’s plans for a special meeting of Southeast Asian leaders in Melbourne next March and the release of a report on economic relations with Southeast Asia over the next two decades.

President Joe Biden will face some questions yet again over the US commitment to Southeast Asia due to his decision to not attend the East Asia Summit and only go to the G20 Summit. Vice-President Kamala Harris will attend instead. Meanwhile, Russian President Vladimir Putin will not attend either event due to international arrest warrants over the Ukraine invasion, following on from his failure to attend the recent BRICS Summit in South Africa.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.