ASPI Climate Action Brief: South Korea

By Betty Wang and Meera Gopal

Background

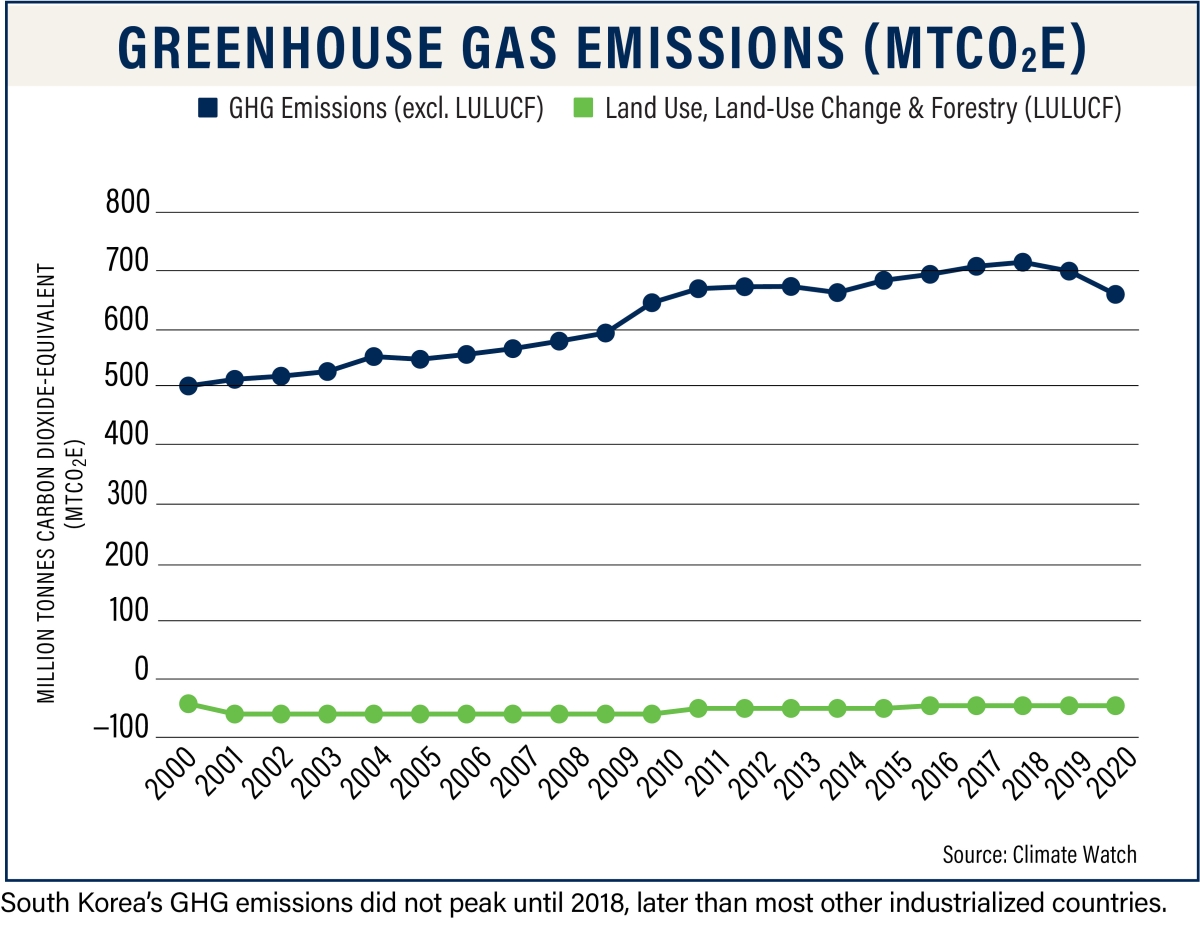

South Korea has developed rapidly since the 1960s, leading it to become the fastest-growing country in the OECD in terms of carbon emissions. Today, it accounts for 1.28% of annual global emissions and ranks as the fifth-largest greenhouse gas (GHG) emitter in Asia. Yet South Korea was also one of the first countries to commit to comprehensive emissions reduction policies. In 2008, South Korea adopted the first phase of its Energy Master Plan (2009–2020), a set of practical measures to implement the basic national development strategy. The government also dedicated 111.5 trillion won (US$83.3 billion) in funding for research and development of renewable energy equipment and technologies.

After South Korea announced at the 15th Session of the Conference of the Parties (COP15) in Copenhagen in 2009 that it would reduce its GHG emissions by 30% below its business-as-usual (BAU) levels (equating to a 4% reduction below 2005 levels), the country enacted a framework law in 2010 to clarify the country's medium- to long-term climate strategy. That legislation introduced South Korea's emissions trading system (K-ETS), which initially covered the power, industry, buildings, waste, and transportation sectors. The operationalization of the K-ETS was facilitated by another law in 2012. South Korea thus became the first country in East Asia to implement a national emissions trading scheme.

In 2015, ahead of COP21 in Paris, South Korea updated the country's emissions reduction target to reduce GHG emissions by 37% below BAU levels by 2030 – a significant leap from the target set out at Copenhagen. South Korea then adopted targets to increase renewable energy power output to 20% by 2030 as part of its Renewable Energy 2030 Implementation Plan released in 2017; the plan called for significantly ramping up new capacity of photovoltaic and wind energy. South Korea addressed its reliance on coal in another plan released in 2020, which included a mandate to suspend coal plants not yet under construction and retire existing coal plants early.

To cope with the economic losses caused by the COVID-19 pandemic and a rising unemployment rate, in 2020, the South Korean government issued a five-year national strategic plan called the "Korean New Deal." As part of this plan, it proposed the "Green New Deal," which aimed to transition the country to a low-carbon economy through green infrastructure transformation, low-carbon and decentralized energy, and innovation in green industry. The South Korean government is expected to invest 73.4 trillion won (US$55.1 billion) in green initiatives by 2025.

Following an initial announcement in 2020, South Korea passed the Carbon Neutrality Bill into law in August 2021, becoming the 14th nation to legislate a carbon neutrality agenda. The law, which went into effect in March 2022, requires the government to reduce GHG emissions by at least 35% from 2018 levels by 2030. It also established the Presidential Commission on Carbon Neutrality and Green Growth to oversee national carbon neutrality transition planning. The year 2021 also saw the beginning of the third phase of the K-ETS, which now covers 73.5% of South Korea's total carbon emissions.

South Korea made a number of further commitments in 2021 around COP26. The country signed the Global Methane Pledge to reduce methane emissions by 30% by 2030, the Statement, and the Glasgow Leaders' Declaration on Forests and Land Use. The government also updated its Nationally Determined Contribution (NDC) to target a 40% reduction in GHGs from 2018 levels by 2030. In addition, South Korea submitted its Long-Term Strategy (LTS) to achieve carbon neutrality by 2050.

Recent developments

In 2022, South Korea's climate policy took a significant turn under President Yoon Suk-yeol's administration. The new government announced a different pathway for the country's decarbonization, putting a much heavier focus on nuclear power and less emphasis on renewable energy. The new policy direction for carbon neutrality also emphasizes the importance of enhancing research and development for emerging green technologies. Additionally, the policy underscores strengthening international collaborations, especially with the United States and other significant nations.

Reflecting the new administration's latest energy policy, the 10th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) released in 2023 unveiled new targets for electricity generation in 2030 and 2036. The BPLE raised the share of nuclear power generation to 32.8% by 2030, up from 25% in the previous plan issued in 2020, but it decreased the renewable target to 21.6% from 30.2%. However, it is noteworthy that the planned share of coal in 2030 also decreased – to 19.7%, almost a 10-point drop from the previous target of 29.9%.

In March 2023, the Presidential Commission on Carbon Neutrality and Green Growth released its first work plan, which includes the first annual and sector-specific reduction targets introduced by President Yoon. While the overall 2030 emissions reduction target remains the same, the plan reduces the ambition of industrial sector emissions reductions to 11.4% from 2018 levels by 2030, compared to the previous target of 14.5% set in late 2021.

Apart from transforming the power sector – which accounted for half of total emissions in 2020 – South Korea has also committed to electrifying transportation, which contributes 15% of total emissions. As the fifth-largest automobile manufacturer in the world, South Korea will increase production of electric vehicles to account for 12% of global electric vehicle market by 2030, according to the Ministry of Trade, Industry and Energy's 2022 Mobility Innovation Road Map. This will boost global electric vehicle production to 3.3 million units by 2030, up from 254,000 units in 2021. The government has pledged to provide tax incentives and other support measures amounting to about 95 trillion won (US$66.03 billion) by 2026.

Reading between the lines

South Korea's 2021 enhanced NDC is more ambitious than its previous update in 2020, which essentially took the BAU-based target from 2016 and transformed it into an absolute emissions reduction target. However, analysis by the Climate Action Tracker shows that a reduction of at least 59% by 2030 from 2018 levels would be needed to align with the Paris Agreement's 1.5 degrees Celsius limit. Details on international credit purchasing and land use, land-use change, and forestry (LULUCF) also need more clarity.

In terms of energy transition, South Korea's power mix still relies heavily on fossil fuels, with coal, natural gas, and oil as the primary sources of electricity generation. Data from 2021 shows that coal still accounts for a significant portion of electricity generation (36%), followed by nuclear and natural gas. Renewable energy sources, such as wind, solar, and biofuels, make up a relatively small portion of the energy mix.

The 10th Basic Electricity Plan, unveiled in early 2023, marked a significant shift in South Korea's energy policy. President Yoon reversed the nuclear phaseout policy of the previous administration, which had sought to decrease the number of nuclear plants in operation. While nuclear power is a low-carbon energy source, it is more expensive compared to renewable energy, and its expansion requires further safety procedures, such as operational safety, nuclear waste disposal, and other risk prevention measures. South Korea had more than 24 gigawatts of nuclear-installed capacity by the end of 2022, with an additional four gigawatts under construction. The share of renewables in total power production, on the other hand, has been reduced significantly compared with the target for 2030 set in South Korea's 2021 enhanced NDC. This shift in policy direction could slow down the country's progress toward decarbonization and clean energy transition.

South Korea still needs to establish a clear road map for phasing out coal and halting overseas coal financing to achieve its 2030 target. The government under the previous administration undertook the planned shutdown of 10 units in 2020, with provisions for protecting the workforce. Despite such measures, coal still accounts for the largest share in the power generation mix. In 2022, South Korea had 56 domestic coal-fired power units and four under construction. The country has pledged to stop financing overseas coal plants, but the specifics of this pledge remain unclear. A month after the announcement, South Korea's Ministry of Economy and Finance outlined exceptions for retrofitting carbon capture and storage and approved transactions. This ambiguity could undermine the effectiveness of that pledge.

What to watch for next

Despite the national government's recent backsliding on renewable energy targets, local governments and businesses in South Korea are still aiming for 100% clean energy by 2050. For instance, Samsung released a road map to achieve 100% clean energy by 2050 in 2022, and almost 30 major businesses in South Korea have joined the Climate Group's RE100 initiative, demonstrating the potential for private sector leadership in South Korea's energy transition. Additionally, corporate sourcing of renewable electricity is emerging as a significant market for renewable energy, emphasizing the increasing role of businesses in driving sustainable energy solutions.

Although interest-group pressure succeeded in watering down the emissions reduction target for industry, green technologies such as green hydrogen and carbon capture, utilization, and storage (CCUS) are receiving significant attention. Hydrogen and CCUS could be pivotal means for industrial decarbonization in South Korea. However, there are lingering concerns about the sources of hydrogen and the techno-economic viability of CCUS. Although South Korea has an existing Basic Plan on hydrogen, the current hydrogen road map focuses more on "gray hydrogen," which is still fossil fuel oriented. As the price of green hydrogen has continued to drop over the past two years, South Korea could leverage this opportunity to accelerate the decarbonization of its industry sector.

The K-ETS will remain the central policy mechanism guiding decarbonization throughout South Korea's national economy. A key development to watch is the K-ETS Phase 4 allocation plan, which includes cap setting, free allocation, auctioning, and auction revenue recycling. Further developments in the carbon market are expected, such as rule-based market stability measures and third-party participation in the market. One of the most important design choices is the auction share, given the huge potential of the K-ETS to generate climate finance from auction revenue. Korea could follow the European Union by implementing full auctioning for the power sector, if there is full pass-through of carbon costs to retail electricity prices.

International climate cooperation is a specific goal of President Yoon's five carbon-neutral policies, and it is expected to remain a top priority for South Korea in the coming years. The country will likely actively utilize the Green Climate Fund and the Global Green Growth Institute, both of which are based in South Korea, to strengthen international cooperation. Through 2023, South Korea is expected to contribute over $300 million to the Green Climate Fund. The country's recent collaboration with Indonesia on energy transition reflects this commitment to international cooperation in areas such as coal phaseout, energy storage, and construction of clean energy infrastructure.

However, South Korea's focus on reducing GHG emissions overseas and promoting the exchange of resources is largely driven by plans to leverage Article 6 of the Paris Agreement to meet South Korea's commitment in its NDC. This poses a risk of delayed domestic actions, as some of the committed emissions reductions could be achieved by purchasing carbon offset credits from overseas mitigation projects. While this approach could help meet South Korea's targets on paper, it might further reduce the urgency for tangible domestic changes and innovations in carbon reduction.

South Korea has also taken long strides in engaging with the United States on climate and energy issues. In 2021, the two countries committed to align their policies on international financing efforts to reach global net zero emissions. The commitment to increased bilateral engagement was reinforced in May 2022, when President Joe Biden visited South Korea. At the trilateral meeting between the United States, Japan, and South Korea in August 2023, while security concerns dominated discussions, the three countries also strengthened their commitments to accelerate clean energy transition and boost clean energy and energy security cooperation. Further partnerships, such as the Resilient and Inclusive Supply-chain Enhancement, can be expected to create a more inclusive global economy in which developing nations can benefit from reducing their reliance on fossil fuels and taking advantage of more clean energy resources.