Accelerating Climate Ambition and Economic Growth in Asia: How Can Green Hydrogen Be Harnessed to Address Both?

By: Raunaq Chandarashekar and Meera Gopal

A major challenge for Asia’s climate progress is decarbonizing its industries while sustaining economic growth, particularly amid growing concerns about slowing economic momentum. One way to address this dilemma is to harness alternatives to fossil fuels for industrial applications that drive economic growth while reducing emissions. “Green hydrogen” (green H2),[1] or hydrogen produced using renewable energy, is a fossil fuel substitute that has piqued the interest of industrial powerhouses around the world. The United States, the European Commission, and Asia’s four largest economies — China, India, Japan, and South Korea — have all developed strategies to harness the potential of green H2. Its applications in DRI (direct-reduced iron) steel, ammonia, and methanol are especially promising, as there are few viable alternatives for low-carbon production in these industries.

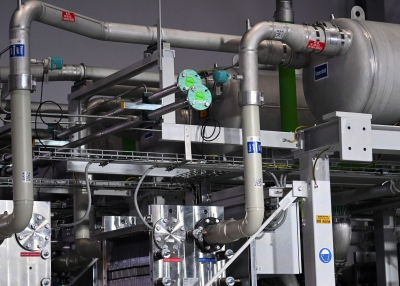

To realize this potential, however, countries need policy ecosystems that are conducive to the manufacture of electrolyzers — devices used to produce green H2. In April 2024, the Asia Society Policy Institute (ASPI) published a report commissioned by the High-level Policy Commission on Getting Asia to Net Zero that features analysis from Global Efficiency Intelligence. The report assesses the market potential for green H2 electrolyzers in Asia’s four largest economies based on the following parameters:

- It assesses green H2 demand for three priority applications — the production of DRI steel, ammonia, and methanol — that are historically high-emitting and hard to abate.

- It projects the market potential for the electrolyzers required to meet this demand, forecasting three decarbonization scenarios through 2050: a business-as-usual scenario, an advanced policy scenario, and a declared net zero scenario based on countries’ current net zero targets. Table 1 highlights the market potential for electrolyzers under the declared net zero scenario projected in the analysis.

Table 1: Electrolyzer Market Potential for Green Hydrogen required for DRI Steel, Ammonia, and Methanol Production by 2050 under Declared Net Zero Scenarios for China, India, Japan, and South Korea

Collectively, under the declared net zero scenario, the electrolyzer market potential across the four countries is projected to expand as follows:

- From $8 billion in 2030 to $87 billion by 2050 at a combined compound annual growth rate (CAGR) of 13% for green H2 DRI steel production

- From $7 billion in 2030 to $49 billion by 2050 at a combined CAGR of 10% for green ammonia

- From $13 billion in 2030 to $43 billion by 2050 for green methanol

Examining the similarities and differences between these countries’ national green H2 policies can shed light on how each country is positioned to seize market opportunities as the conversation about global standards and supply chains continues (see Overview of Hydrogen Policies in China, India, Japan, and South Korea).

Overview of Hydrogen Policies in China, India, Japan, and South Korea

China

Country Policy: Medium and Long-Term Strategy for the Development of the Hydrogen Energy Industry (2021–2035)

Scope: To build a clean, low-carbon, and low-cost multi-component hydrogen production system; focus on the development of renewable energy to produce hydrogen; and strictly control fossil fuel energy to produce hydrogen

Key Components and Targets:

- 50,000 green H2 fuel vehicles on the road and H2 refueling infrastructure by 2025

- 100,000–200,000 tons of renewable-based H2 by 2025

- Uses in other sectors such as energy storage, electricity generation, and industry

Definition of Green Hydrogen: China has not outlined a clear, specific definition of green or clean H2 based on source or emissions. The policy states that it will focus on building clean, low-carbon, and low-cost multi-component H2 production systems; emphasize the development of renewable energy to produce H2; and strictly control fossil fuels used to produce H2.

India

Country Policy: National Green Hydrogen Mission, 2022

Scope: To make India the global hub for production, usage, and export of green H2 and its derivatives and to enable India to assume technology and market leadership in green H2; the mission highlights energy independence and decarbonization of the economy as its main goals

Key Components and Targets:

- Capacity to produce at least 5 million metric tons (MMT) green H2 per year by 2030, with potential 10 MMT per year growth in export markets

- Green H2 in ammonia productionGreen H2 petroleum refining

- Blend green H2 in city gas distribution systems and steel manufacturing

- Green H2 -derived synthetic fuels to replace fossil fuels in mobility, shipping, and aviation

Definition of Green Hydrogen: India has devised an emissions-based standard for green H2 and defines it as having well-to-gate emissions less than 2 kilograms (kg) CO2 per kg of green H2produced.

Japan

Country Policy: Basic Hydrogen Strategy, 2023

Scope: To develop, demonstrate, and industrialize technologies for manufacturing and utilizing hydrogen, ammonia, e-methane, and synthetic fuels

Key Components and Targets:

- Increase supply of H2 and ammonia to 20 million tons by 2050

- Reduce H2 supply cost to JPY 20 (USD 0.13) per normal cubic meter by 2050

- Expand water electrolysis equipment with Japan-made parts to 15 gigawatts (GW) globally by 2030

- Attract public investments of more than JPY 15 trillion (USD 97.4 billion) to H2 and ammonia supply chains by 2038

Definition of Green Hydrogen: Japan references both low-carbon and clean H2 in its policy and defines clean H2 as having well-to-gate emissions of 3.4 kg CO2 per kg of H2 produced. The policy states that Japan will subsidize H2 projects based on these thresholds rather than the “color” of H2. Furthermore, for ammonia, it outlines a gate-to-gate threshold of 0.84 kg of CO2 per kg of ammonia produced.

South Korea

Country Policy: Hydrogen Economy Roadmap, 2019

Scope: To develop a hydrogen economy with hydrogen-based energy conversion technologies such as fuel cells to reduce dependence on the carbon economy and to foster future industries and eco-friendly energy sources

Key Components and Targets:

- Produce 6.2 million H2 fuel cell electric vehicles and 1,200 refueling stations by 2040; 41,000 H2 buses by 2040

- 15GW of H2 fuel cells for power generation by 2040; 2.1GW capacity for building and homes for 940,000 households

Definition of Green Hydrogen: South Korea’s clean H2 certification system has established a threshold of 4 kg CO2 per kg of H2 produced.

The Declaration of Intent on the Mutual Recognition of Certification Schemes for Renewable and Low-Carbon Hydrogen and Hydrogen Derivatives was a key outcome of the COP28 meetings held in Dubai in 2023. Signed by more than 30 countries, including Japan, India, and South Korea, the declaration identifies cooperation on developing consistent green H2 standards as an important step in creating global supply chains and signals the intention of major economies to invest in green H2. Indeed, consistent standards are crucial to establish a wider set of bilateral and multilateral agreements for shared knowledge, technologies, and best practices. To achieve this, governments need to frame guidelines in consonance with one another for maximum impact.

For starters, a consistent, globally recognized definition for green H2 is needed; currently, the definition varies across jurisdictions. India, Japan, and South Korea have all opted for different emissions-based standards, while the European Commission’s definition explicitly categorizes the use of renewable energy for H2 as “green.” Such divergences can create supply chain hurdles while also complicating certification processes. Furthermore, in the absence of a clearly defined scope for green H2 production and deployment, countries risk feeding the “hydrogen hype” and reducing the scope of targeted investments in sectors that align with their specific climate ambitions and in which green H2’s benefits have been demonstrated. In the United States, for example, energy companies are already expressing skepticism about the seemingly inadequate regulatory framework, which is likely to stymie the potential green H2 market.

To catalyze green H2 ’s climate-economy co-benefits, the ASPI report contains a comprehensive list of recommendations for stakeholders, including policymakers, industry and manufacturers, investors, and think tanks. Specifically, countries need to consider a suite of policies:

- Targeted incentives in the form of subsidies and tax credits on both the supply and demand sides to spur the production and application of green H2

- Efforts to ramp up technical literacy and research and development to better understand where green H2 can be applied and scaled

- Consultation with stakeholders such as technical and research institutions, industry, and civil society to develop a supportive regulatory framework

- Establishment of green H2 hubs that bring together the research and development, manufacturing, and infrastructure in zones where incentives can be effectively deployed to attract domestic and foreign investments

The report highlights the varying potential across these four countries. China and India exhibit the highest potential for both electrolyzer manufacturing and green H2 application, buoyed by their relative size in population and land. While Japan and South Korea have comparatively lower potential, particularly for green H2 applications in the three sectors studied, they boast notable potential for electrolyzer manufacturing. At the same time, there is an opportunity to form mutually beneficial trade relationships among these major green H2 producers. For instance, India and South Korea have been in talks to explore cooperation on green H2 and its derivatives.

The next part of this two-part series explores the emerging green H2 policy landscape in India. It relies on takeaways from the ASPI report and a recent launch event in New Delhi, which included an expert panel discussion and a multistakeholder roundtable.

***

End Notes

[1] Hydrogen (H2) is a widely used industrial element that can substitute for fossil fuels as a clean-burning feedstock. While hydrogen burns cleanly, its life-cycle emissions can vary dramatically depending on how it is produced. Several H2 production methods have been developed, leading to a color spectrum in which the colors denote the type of hydrogen. Black, brown, and gray hydrogen (produced using black coal, lignite, and natural gas, respectively) are the highest emitting and the most widely used at present. In contrast, green hydrogen, which is produced using renewable energy, burns cleanly and has low life-cycle emissions.

About the Authors

Raunaq Chandrashekar is a Climate Intern at the Asia Society Policy Institute

Meera Gopal is a Senior Program Officer, Climate at the Asia Society Policy Institute