What To Watch During the Two Sessions

With the 20th Party Congress and Zero-COVID (finally) behind us, all eyes are on China’s annual Two Sessions, to begin on March 4th. China watchers and the outside world are looking for clues about the country’s political and economic future.

The Two Sessions, the annual gathering of China's National People's Congress (NPC) and the Chinese People's Political Consultative Conference (CPPCC), is a significant event on China's political calendar. It is an opportunity for the country's leaders to outline their priorities and plans for the coming year(s).

This year is particularly important, as it will see the institutional implementation of the 20th Party’s Congress report. Significant changes are expected to the makeup of the Chinese state’s leadership — and (re)arrangements of the State Council and relevant government organs, to institutionally weaken the State in favor of strengthening the Party. Key conceptual frameworks such as “Grand Security” (大安全) reflect the Party-state’s growing role in all major policy priorities. The meetings are worth watching carefully, as they carry significance for trends in personnel, politics, and policy in China and beyond.

Part 1: Personnel

Who’s Going Where?

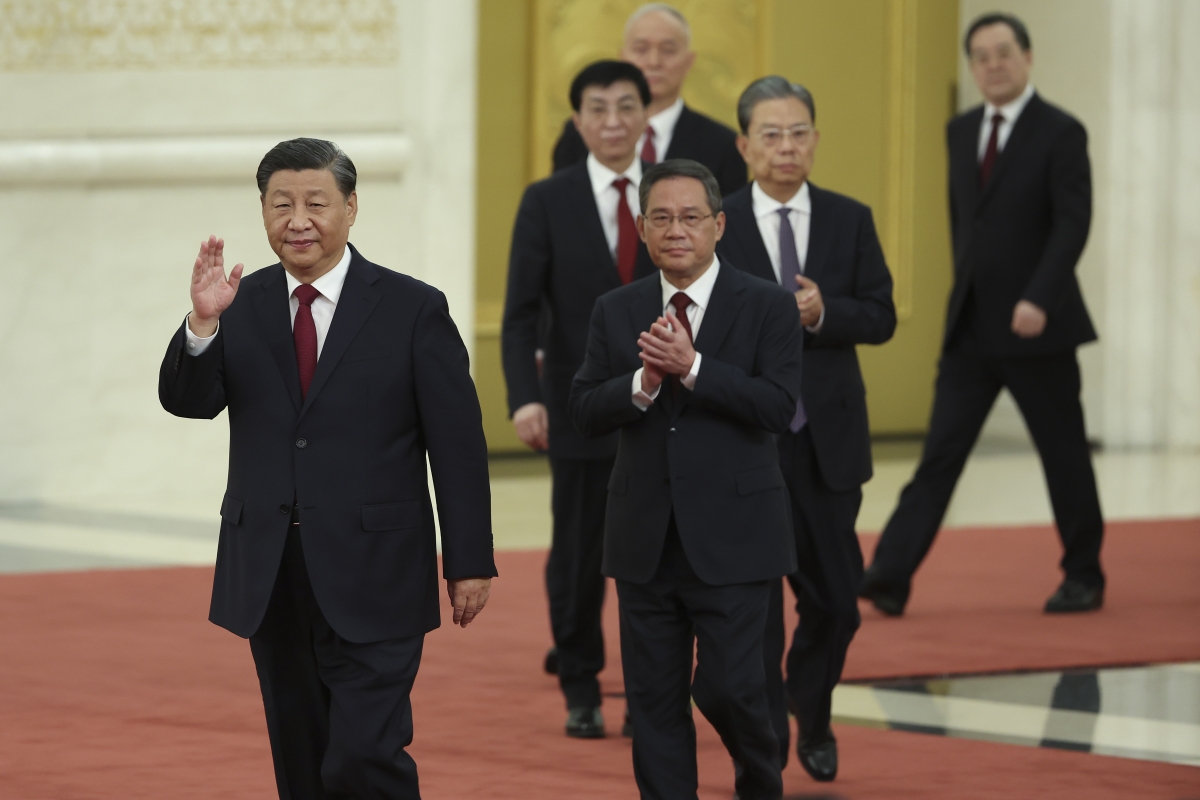

Top level appointments are the most important feature of the Two Sessions.

- Li Qiang, former Party Secretary of Shanghai, is set to be appointed Premier following his promotion to the No.2 spot on the Politburo Standing Committee (PBSC) last October.

- Ding Xuexiang, Xi's longtime de facto “Chief of Staff”, will become the Executive Vice Premier (EVP).

- Bucking tradition, neither Li Qiang nor Ding Xuexiang have any experience within the State Council system, which might indicate that ministers will become more important.

Moving On Up

The other three Vice Premiers are expected to be He Lifeng, Zhang Guoqing, and Liu Guozhong.

- It is likely that Ding Xuexiang, as EVP, will be responsible for the “day to day” operations of the State Council, as well as in fiscal coordination and technology.

- Ding’s early career experience in science and technology — and his rumored possible role leading a new central commission on science and technology — makes the position of EVP even more prominent given Xi’s determination for technological self-reliance.

- He Lifeng will take over Liu He’s finance portfolio. He Lifeng is known for his implementation capabilities; his years at the National Development and Reform Commission (NDRC) have gained him a deep understanding of China’s macroeconomy. In his role as Vice Premier overseeing economic, and financial policy, he’s also widely expected to also become the People’s Bank of China’s (PBOC) Party Chief. That would kneecap the PBOC’s independent monetary authority, further aligning monetary policy with fiscal policy for the Party’s priorities.

- Zhang Guoqing is likely to be responsible for industry and commerce. Zhang’s background in the military-industrial complex could hint at China’s increased reliance on state guidance and industrial policy to manage the economy and could also send signals on how the newly emerging Military Industrial Gang will shape policies.

- Meanwhile, Liu Guozhong will likely take over the agricultural portfolio from Hu Chunhua and public health from Sun Chunlan. Liu taking over public health, rather than fully handing it to Shen Yiqing (see below), could signal continued emphasis on health policies post-COVID.

Not a Done Deal

Given we are in the “new era,” of course, all these shifts could still evolve; and surprises are possible.

In addition to the Premier and Vice Premier appointments, the five State Councilors will also be reshuffled. Here is what we expect:

- Gen. Li Shangfu, who is subject to U.S. sanctions, is expected to become State Councilor and Minister of National Defense. The fact that he is subject to U.S. sanctions will make the task of advancing U.S.-China military-to-military relations more awkward than it already is.

- Shen Yiqin, a former Party Chief of Guizhou, is expected to be a State Councilor — and the body’s only female representative. Her promotion is unusual given she spent her entire career in one province; it could be read as an intentional move toward increasing female representation at the central level.

- Wu Zhenglong, who previously worked with Li Qiang in Jiangsu, is expected to become a State Councilor and Secretary-General of the State Council. In that role, he would work very closely with Li Qiang and likely enhance Li Qiang’s influence within the State Council.

- Qin Gang, the former Chinese Ambassador to the U.S. and now Foreign Minister, has been elected as an NPC delegate, putting him in line for promotion to State Councilor as well. If Qin Gang gets it, it will mean that he rose from a Vice Minister level cadre to a Deputy National Leader in the span of several months.

Missing Link

There is no clear candidate for the last State Councilor spot, who typically also serves as Minister for Public Safety. There are a few possible scenarios here:

- Scenario 1: If new institutional arrangements do not materialize, it’s fair to presume that Wang Xiaohong, the current Minister of Public Safety, will become the State Councilor in charge of internal security.

- Scenario 2: If Wang Xiaohong replaces Ding Xuexiang as the Director of the Central Office, then Chen Yixin, the current Minister for State Security, might be in line to become State Councilor.

- Scenario 3: If new institutional arrangements are set at the Two Sessions, it is logical to presume that the fifth State Councilor position will be removed — and Wang Xiaohong will take on a new, and more important position overseeing China’s domestic security apparatus.

Who Will be the Vice President?

Han Zheng, the current EVP, and the only retiring PBSC member who was selected as an NPC delegate, is expected to replace Wang Qishan as Vice President. Given that Xi sidelined Wang Qishan due to his strong factional network (in the financial sector), it’s unclear whether Xi will feel fully secure about Han Zheng, who has an equally powerful base as Wang.

No Bureaucrat Left Behind!

The Chinese Communist Party (CCP)’s General Office and Department of Organization (essentially the party’s powerful HR department) will also see personnel changes at the top.

- The new Director of the General Office has not yet been confirmed.

- Wang Xiaohong seems like the only logical choice at this point (if no institutional rearrangements materialize, see above Scenario 2).

- It is also unclear when Chen Xi, the current head of the CCP Central Organization Department and a close ally of President Xi, will relinquish the post. It is unusual that Chen Xi has lingered on following the 20th Party Congress.

- Li Ganjie, a Politburo and Central Secretariat member, should be replacing Chen Xi.

Still in the Loop?

It’s also worth watching what kind of role Liu He, a retiring Vice Premier and close confidant of Xi, will play going forward, as Xi may still rely on his economic advice, and Liu quite likely will remain involved in overall economic policy planning, one way or another.

The Two Sessions Will Also Determine Who Will Head Important Ministries and Agencies

- Mini-State Council: Wang Wentao (who is allied with Li Qiang), Zheng Shanjie (who worked with He Lifeng in the past), or a wild card cadre all stand a chance to assume the powerful position of National Development and Reform Commission (NDRC) Chairman. The pick will show further evidence of how Li/He dynamics are playing out within the State Council.

- Minister of Finance: The new Minister of Finance will have to deal with the precarious fiscal state of central and local governments following the pandemic and ongoing property sector crisis.

- Possible candidates include Ding Xuedong, Lu Zhiyuan (who will bring local experience to deal with the central-local fiscal rebalancing), and Cheng Lihua (who would be the first female Finance Minister).

- Banking Regulators: Candidates for the central bank and top regulatory agencies remain influx.

- Right now, it appears that Zhu Hexin is in line to be Governor of the PBOC, with Vice Premier He Lifeng as Party Secretary, keeping the current dual-head system.

- Yi Huiman, a financial regulatory veteran, is expected to be the new Chair of CBIRC. Yi has overseen China's largest bank, ICBC, and pushed for major reforms including the comprehensive registration-based IPO system. Yi is also open to more international competition in the Chinese market to boost local capacities.

- Wu Qing, a former head of the Shanghai Stock Exchange, is in line to be the next Chair of CSRC.

Of Course, the Two Sessions Will See Changes in the NPC and CPPCC Top Leadership

- Zhao Leji, currently the third-ranking member of the PBSC, will be the new Chair of the NPC.

- Li Hongzhong, former Party Secretary of Tianjin and a Politburo Member, is the likely candidate for the First Vice Chair of the NPC.

- Consolation prize: Which provincial leaders will be “promoted” to Vice Chairs of the NPC?

- Possible candidates include Zhang Qingwei and Lou Yangsheng.

- Who will be the female Vice Chair and Chair of the All-China Women’s Federation?

- Tie Ning, a famous author, and Chair of China Writers’ Association, seems like a possible candidate.

- Wang Huning, the fourth-highest ranked member of the PBSC and previously Xi’s “ideology tsar,” will be the new Chair of the CPPCC — and therefore the Vice Chair of the Central Leading Group for Taiwan Affairs. It’s been rumored that he has been tasked by Xi with coming up with a new strategy for Taiwan reunification. What this would mean in practice, however, remains unclear.

- Shi Taifeng, the current Director of the CCP’s United Front Department and a Politburo Member, is likely to become the First Vice Chair of the CPPCC. This could be an indication of the rising importance of the United Front Work Department.

- An interesting addition to the list of likely Vice Chairs is Song Tao, currently the Director of the Taiwan Affairs Office.

- Song Tao’s possible promotion, as well as those of Wang Yi, Zhang Youxia, Shi Taifeng and Ying Yong, all reflect the “new era” doctrine of “能上能下” (meaning loyalty and capability could outweigh the traditional criteria, such as an age limit and more established career trajectory).

- Where are the members of the Communist Youth League (CYL) gang? Hu Chunhua, Zhou Qiang, and Shen Yueyue — all members of the now “former” CYL faction — are in line to be “honorary” Vice Chair of the CPPCC.

Part 2: Politics and Policies

Emerging Factional Dynamics

So how will the personnel reshuffling affect internal political dynamics? Our key observation is that as the old factions fade away and new factions emerge, regime fragmentation is coinciding with power concentration; as Chairman Mao once said: “党内无派千奇百怪” (“no factions within the party is an incredibly bizarre notion”). Power plays within and between the State Council’s political factions will also be in full view at the March meeting and beyond, as will indications of which individuals and groupings now wield significant influence.

- Key factions: In addition to the military-industrial gang, factions include Zhejiang (represented by Li Qiang), Fujian (He Lifeng), and Shanghai (Ding Xuexiang).

- We’ll be keeping an eye on possible power struggles between Li Qiang and He Lifeng through lens of both personnel and policy.

- Open question: What role will the EVP Ding Xuexiang, an especially trusted Xi associate with connection to the Military-industrial Gang, play in the new State Council?

The Half-Decade Hustle

Every five years, the State Council combines and redirects agencies, ministries, and commissions for both administrative efficiency and power consolidation. This year’s Two Sessions, however, like five years ago, will feature significant structural changes to the party-state apparatus.

- Although it is unclear which ministries will get ousted or reorganized, the preliminary signals from the 20th Party Congress Report and recent Politburo/Plenum meetings suggest that the Security apparatus might undergo a complete redesign.

- The rumored changes to Ministry of State Security and Public Security may reflect the emphasis on security and the streamlining of the security apparatus alluded to in the 20th Party Congress Report for the next five years.

- Some signs indicate that the Ministry of Public Security might be on the “chopping block,” with many of its functions possibly reassigned or significantly reorganized.

- Local governments might be stripped of their controls over the local Public Security Departments, and the current “federal” system might be replaced with a unitary one.

- The outcome would have a lot to do with where Wang Xiaohong, the current Minister, eventually lands.

Similarly, Technology and Education, two areas that China would need to tackle in the face of technological blockades from the U.S. and other countries, as well as critical internal issues like social welfare and social stability, will likely receive more attention from the State with the supposed establishment of Central Commissions coordinating these areas.

- There will be more coordination between the Ministry of Technology and Science and the Ministry of Education, to match the party’s recent emphasis on technology innovation and education (科教兴国).

- Another possible combination would be that of the Ministry of Human Resources and Social Security and the Ministry of Civil Affairs into a “Ministry of Society” (社会部), or some equivalent coordinating mechanism, to deal with the social instability caused by social benefits cuts, etc. (the very reason retirees went onto the street in Chinese cities recently).

In addition, China’s financial regulatory system and the state-run financial institutions are also expected to be restructured. This should come as less surprising given the ongoing anti-corruption campaign within the financial system and China’s upcoming economic challenges.

- The Ministry of Finance may absorb the State Administration of Taxation and gain broad authority over China’s fiscal policies.

- The Ministry of Industry and Information Technology and China’s sprawling space and military-industrial agencies might be further incorporated.

- Recent editorials by Central Commission for Discipline Inspection (CCDI) on China’s financial system indicates significant changes might be coming to financial institutions.

- PBOC might also undergo some fundamental changes with new Vice Premier He Lifeng as Party Chief.

- Some suggested that CBIRC and CSRC might merge to become a super financial regulatory agency, or CBIRC could take over stewardship of key financial SOEs from the Ministry of Finance while CSRC remains an independent agency.

Correspondingly, there could be significant changes to the existing party apparatus. The changes are unlikely to repeat the sweeping level of revamps that took place in 2018, but still, structural changes could further clarify the respective responsibilities of the party and the state — with the party as preeminent.

- Rumors suggest there would be a new Central Commission on Technology, with Ding Xuexiang, play a leading role.

- The Commission could be responsible for China’s tech and industrial policies as well as the vast military-industry and space sectors.

- The Central Financial Work Commission, which briefly existed from 1998 to 2003, seems likely to be revamped and oversee China’s financial system.

- He Lifeng will likely play a leading role in this.

- The Central Law and Political Affairs Committee might be stripped of its Public and State Security responsibilities.

- The rumored new Commission on Internal Security, possibly in conjunction with the National Security Commission, would take over these jurisdictions. This would be led by Wang Xiaohong, and it could explain why he was named a member of the Central Secretariat.

What Does all This Mean?

- Strategic reprioritization: the reshuffles will reflect the priorities set out in the 20th Party Congress Report and Xi’s personal preferences.

- The Two Sessions will likely reflect a sharp policy focus on economy, security, technology, and social stability.

- Evolving party-state relationship: the establishment of new Party Commissions and merging of State Council ministries will likely reinforce the preeminent role the Party plays in policymaking, while the State oversees policy implementation.

- Consolidation of power under the party (hence Xi’s direct leadership).

- Streamlining the State Council’s responsibilities and its role as policy enforcer.

Beyond factional struggles and power dynamics, personnel is policy. Personnel changes, therefore, will affect key indicators of regime legitimacy, including the party-state relationship, central-local dynamics, economic growth, and social stability:

- Decentralization again? Central-local rebalancing is critical to watch for how it will affect economic growth — given that decentralization was one of the decisive elements of Deng-era reforms to make local governments entrepreneurial.

- Provincial implementation of central policies also matters for stability maintenance (weiwen), which will be critical to watch given the erosion of trust between state and society — partly due to the economic difficulties caused by deleveraging, zero-COVID policy, and increasingly frequent social protests.

What About the Economy?

Economists agree that as China's growth model develops, increasing domestic consumption is critical to sustain economic expansion. Promoting increased consumption and tackling structural imbalances to create more, new drivers in the economy will, officials hope, cultivate a more sustainable and inclusive growth trajectory. However, the new econ team will have to navigate daunting obstacles:

- First and foremost is the uncertainty among both bureaucrats and entrepreneurs surrounding the inherently contradictory “signals for policy shifts” (in a more pro-market direction) and the still-dominant, ideologically driven, statist intervention approach of managing the economy as reflected in Xi’s recent Central Party School speech.

- China will most likely adopt a diverse approach to achieve its domestic consumption targets, including focusing on increasing incomes, supporting consumer credit, carrying out targeted cash transfer programs, and providing subsidies and tax relief to small businesses — all potentially part of “Common Prosperity” — the key here is who is giving money away, and who is getting it.

- Other challenges face the new State Council include 1) how to avoid/manage systemic risks introduced by the property sector; 2) how to tighten oversight on local governments’ debts given another round of stimulus is flooding in; 3) how to ensure the unemployment rate, particularly among new graduates and migrant workers, remains at a controllable level; 4) how to enhance social security to both enhance people’s willingness to consume and prevent other massive social protests.

- In the end, whether local governments will be incentivized again to develop the economy, whether private entrepreneurs will be confident again to invest their capital, whether average Chinese would feel safe enough to consume more, and whether the international circulation will be strong enough to drive the “dual circulation,” are all decisive factors re the future of China’s structurally slowing down economy.

How will the Government Handle Other Key Policy Areas in 2023?

Technology

Watch for possible reforms targeting key institutions like the Ministry of Industry and Information Technology (MIIT) and the Cyberspace Administration of China (CAC). The two have distinct mandates and face differing degrees of party control, but any announced reforms will give us a sense of Xi’s tech governance priorities — and indicate what, if anything, he dislikes about the status quo. The proposed legislation will also be key to watch: since China has already passed regulations on deep synthesis and algorithmic recommendations, there’s a fair chance it will pursue its own AI law, akin to the EU’s AI Act.

Climate Change

For China to achieve its ambitious 2030 and 2060 targets, the government will have to aggressively pursue carbon emissions reduction, eliminate coal-fired plants, and adopt clean energy. Prioritizing economic growth, however, may necessitate redirecting funds originally set aside for environmental protection. Will China signal an increased interest in participating in international fora focused on environmental law, especially when it comes to loss and damage financing, whose importance was globally elevated at COP27?

Tackling Taiwan

Since Xi’s 20th Congress Work Report, which signaled a harsher line on “interference by outside forces” on activities related to “Taiwan independence,” officials have intensified their rhetoric opposing Taiwanese self-determination. Referencing “outside forces” in this context suggests that the United States and its allies are adding fuel to the flame on the Taiwan issue. At the Two Sessions — either in his Work Report or during the Q&A — the Premier will likely be celebrating China’s resolve (think: “we have carried out major struggles”) against alleged Taiwan independence activities.

U.S.-China Relations

While the Two Sessions is not usually the place to talk about specific bilateral relationships, listen for implicit criticism of the United States and its role in the world. This will probably be positively juxtaposed against China’s support for peace, development, and “win-win” solutions to the world’s problems. More broadly, expect some references to the Global Security Initiative, China’s provisions of global public goods, especially in the developing world, and the recent policy paper on Ukraine as evidence of Beijing’s more measured approach in contrast to other countries’ “hegemonism” and “Cold War mentality.”

Foreign Policy

The war in Ukraine presents China with a significant dilemma. If Xi begins showing more solid signs of support for Russia — most visibly through a state visit to Moscow — China’s goal to peel Europe away from the United States diplomatically will likely slip away. That would have real implications for China’s economic and high-tech goals, for which European friendliness has been crucial. But for now, China continues to try to play both sides. Beijing wants to appear neutral, despite its pro-Russian stance, maintain the possibility to play “peacemaker” — and keep European countries at bay. Whether such a delicate dance will work remains to be seen. The world will be listening to anything said at the meetings about China’s approach toward Ukraine. Though it will not likely be much more than what was presented in the recent policy paper, it will be all the more salient in the coming days given U.S. official signaling about possible Chinese military support for Russia.

(This piece of analysis was primarily drafted by Haolan Wang and Jing Qian, with contributions from CCA members Yifan Zhang, Guoguang Wu, Kate Logan, Taylah Bland, Yi Qin, Nathan Levine, Andrew Chubb, Lyle Morris, Bates Gill, Michelle Mengsu Chang, Lizzi C Lee, Guonan Ma, Qiheng Chen, and Rorry Daniels; further background information about all personnel mentioned in the article, please see: https://asiasociety.org/policy-institute/decoding-chinas-20th-party-con…)