The Prospects of a Resolution of the U.S.-China Trade War

ASPI President Kevin Rudd addresses the Asia Society Japan Roundtable on U.S.-China Relations in Tokyo

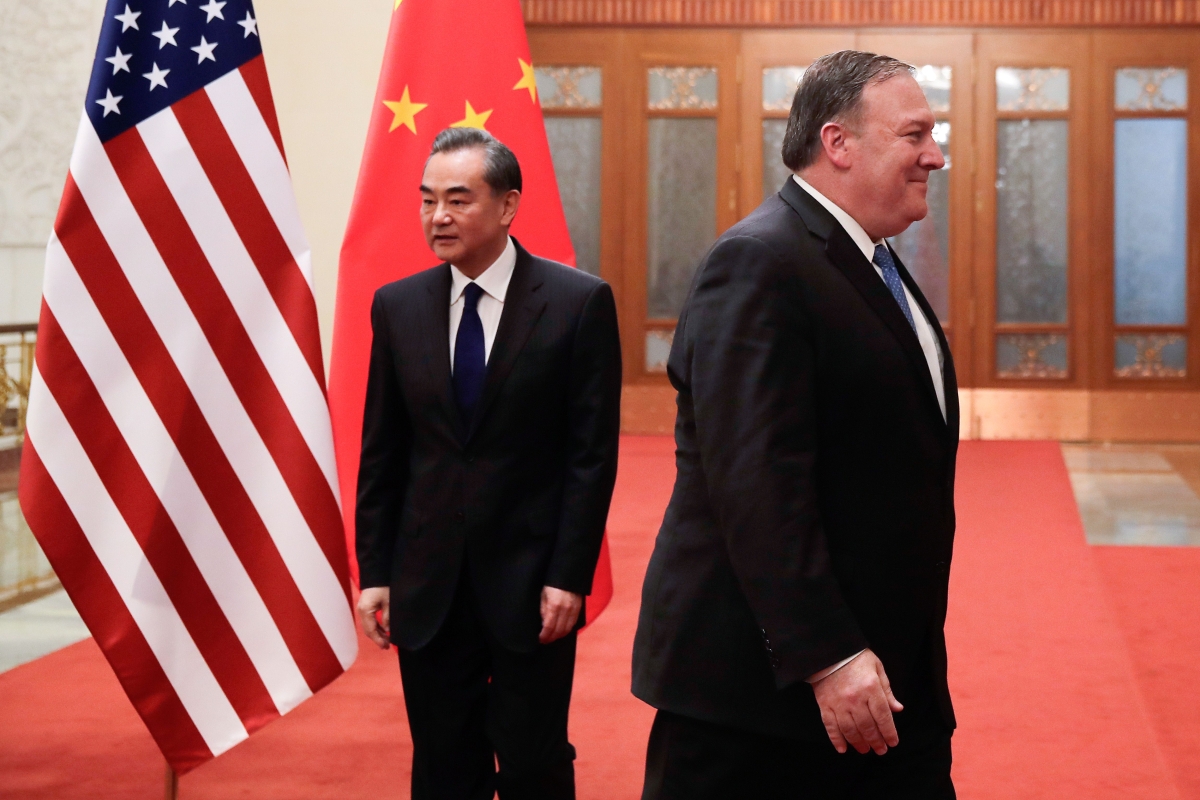

U.S. Secretary of State Mike Pompeo (R) walks by Chinese Foreign Minister Wang Yi before their meeting at the Great Hall of the People in Beijing on June 14, 2018.

Andy Wong—AFP/Getty Images

Following is the transcript of remarks delivered at the Asia Society Japan Roundtable on U.S.-China Relations at the International House of Japan in Tokyo.

When asked by my hosts what I wanted to see during my week-long visit, I said I wanted to understand Japanese politics. So I was the easiest guest of all. The government issued me with a leave pass to the Japanese Diet where together with an interpreter, I wandered the corridors of your parliament, met with many, many MPs from both sides of politics, and attended my first ever LDP faction meeting.

Japan has a robust democracy. And like Australia’s, it too is certainly not for the faint-hearted!

One of the many strategic and economic concerns which Australia and Japan share, as allies of the United States, is the future trajectory of U.S.-China relations. Today, my remarks will focus principally on the U.S.-China trade war, where it is located within the broader framework of U.S.-China relations, and the prospects of resolution by year’s end.

The U.S.-China relationship is now in a period of deep transition, from 40 years of strategic engagement to what the current Administration calls a new period of strategic competition. There are many reasons for this, arising from Xi Jinping’s changing worldview, the internal dynamics of the Trump Administration and the conclusion in Washington that China is no longer a status quo power.

I have sought to analyze a number of these factors in recent addresses to the U.S. Military Academy at West Point, the Lee Kuan Yew School in Singapore and most recently at the U.S. Naval Academy at Annapolis. For those who are interested, these are available through the Asia Society Policy Institute website.

But the immediate concern of many economic policy makers around the world, nervous about the implications for global growth, is the likelihood of a resolution to the growing trade, economic and technology war between China and the United States, its timing and the content of any such resolution.

Certainly this has been the concern of global finance ministers meeting in Bali this last week as the combined impact of "end of cycle" concerns for the U.S. economy after a long-term boom and bull run, monetary policy tightening, rising global protectionism, continuing geo-political risk, as well as the particular implications of an unfolding trade war between the largest economies in the world.

Changes in the U.S.-China Relationship

The deteriorating state of the U.S.-China relationship, besides recent well‑documented declaratory statements by the U.S. Administration, most recently the Hudson Institute address by Vice President Mike Pence, has also been reflected in a series of actions by China.

The cancellation of U.S. Defense Secretary James Mattis’ visit to Beijing this month, while no means unique in the checkered history of contact between the two militaries, indicated that mil-to-mil contact between the two sides is now frozen.

China’s refusal to facilitate a meeting between Secretary of State Mike Pompeo and Xi Jinping in October indicates a faltering diplomatic relationship.

The scheduled Diplomatic and Security Dialogue, due to be held later this month, appears to have been postponed indefinitely.

Foreign direct investment flows between the two countries radically decreased, from a combined sum of $60 billion in 2016 to $43 billion in 2017.

This is on top of recent changes to increase the powers of the Committee on Foreign Investment in the U.S. (CFIUS) rules and separately to tighten export controls on "emerging and foundational" technologies that are "essential to the national security of the United States."

Whereas to date the trading relationship has not been materially affected, there are signs that Chinese tourism numbers to the United States have declined over recent times.

Despite recent reports of a consideration by the Administration to ban all Chinese students from American universities, and other reports that new restrictions will be placed on Chinese students researching STEM subjects in U.S. tertiary institutions, Chinese student numbers do not seem to have been affected thus far.

These are not small developments in U.S.-China relations, of the type we have often seen during the ebbs and flows of this relationship since diplomatic normalization in 1978. They seem to be more fundamental in nature. The question arises, therefore, as to how the Chinese leadership are reading these changes in U.S. strategy.

Given the continued opacity of the Chinese system, it is difficult to answer these questions with anything approaching complete clarity. But through a combination of the official commentary, academic articles, political and policy statements and other sources, we can begin to fashion a picture.

Chinese Perceptions of U.S. Strategic Change

China spent much of 2017 seeking to analyze the extent to which the Trump Administration represented a rhetorical rather than substantive departure from the terms of strategic engagement the two countries had broadly shared since 1978. Based on the Mar-a-Lago summit, Trump’s "State Visit Plus" to Beijing in November 2017 and the U-turn in U.S. strategy on North Korea in March 2018, China concluded that difficulties within the U.S.-China relationship were tactical rather than strategic, and could be managed within the existing framework of the relationship.

That,in turn, led to several efforts at senior levels to resolve the impasse on the U.S.-China trade dispute, involving repeat visits to Washington by Politburo member Liu He, and a visit to Beijing by President Trump’s Senior Economic Team, comprised of Treasury Secretary Stephen Mnuchin, Director of the National Economic Council Larry Kudlow, U.S. Trade Representative Robert Lighthizer, Director of the White House National Trade Council Peter Navarro, and Secretary of Commerce Wilbur Ross.

Despite coming close to resolution in July, and on two subsequent occasions across the summer, the inability of the White House to agree internally on its final negotiating position with China made an agreement impossible.

The Chinese analysis, it seems, is that the U.S. Administration is divided between three distinct camps:

- Secretaries Mnuchin and Ross, who are seeking to conclude a trade deal to dramatically reduce the bilateral trade deficit in the shortest time possible;

- Larry Kudlow, who is arguing for a wider free trade deal with Beijing which addresses the structural impediments to freer trade between the two countries, including both tariff and non-tariff barriers;

- and a third camp, made up of Robert Lighthizer and Peter Navarro, pressuring for a "trade plus" deal which addresses the immediate trade deficit, structural impediments to trade, the reform of the foreign investment regime in China as it impacts on technology transfer and intellectual property protection, as well as the future role of Chinese industry policy (in particular under Made in China 2025), under which the Chinese state would effectively subsidize China’s domestic and international market dominance of the critical high technology sectors of the future.

There is a further Chinese view that Navarro, in addition to White House Senior Advisor Stephen Miller, are of a view that there should be no negotiated deal with China; that they are in fact initiating a new American strategy of containment of China; seeking to start a new "Cold War" between the two countries.

A further part in China’s analysis is that President Trump’s ultimate position on all of the above remains unclear — although in the earlier part of this year, China’s calculus was that the President would do a deal on the immediate trade deficit, so long as it was dramatic enough to satisfy his domestic political base. This appears to have represented a fundamental miscalculation on Beijing’s part of the underlying complexity of the White House’s internal policy coordination processes, and the range of voices now contending for policy positions.

The net effect, it seems, of these various factors, is that Beijing will not engage in any substantive dialogue with this administration until after the mid-term elections, due only several weeks from now.

China instead wants to see what type of political environment emerges after the mid-terms, and whether the President’s position will be strengthened, weakened, or otherwise changed as a result. China is also watching carefully what happens with the Mueller investigation, given the view across a number of think tanks that VP Pence’s recent speech in particular was designed for domestic political purposes in order to develop a robust "anti-China front" for the President, if he becomes subject to conclusions and recommendations from Mueller which pass doubt on the President’s national security credentials on Russia.

For these reasons, we are unlikely to see any signs of substantive reengagement between Washington and Beijing on the trade war until the weeks leading up to the Buenos Aires G20 summit, scheduled for 30 November-1 December, when President Trump and President Xi are reportedly next scheduled to meet.

The optimistic scenario would have both sides at that stage agreeing on a high-level process to recommence negotiations to discuss the unfolding trade/economic war between the two. The pessimistic scenario would initiate no such process, resulting in further escalation from 1 January – the increase in U.S. tariffs from 10% to 25% across $200 billion in Chinese exports. The flow-through impact for consumer prices for a substantial range of goods could be felt immediately.

What we can observe from Chinese official commentary is that following the Beidaihe meetings of the Chinese leadership in August, when the entire senior leadership decamped to the beach for three weeks, and after extensive deliberations on the U.S.-China relationship in general and the trade war in particular, Beijing formally concluded that there had been a major shift in U.S. strategy: that it is likely to be by-and-large bipartisan; that there are no longer voices urging restraint from any of the agencies of states within the administration; that the business community is either supportive, quiescent or silent on this change of course; that the American NGO community is largely supportive; and so too is U.S. public opinion.

Certainly the tone of Chinese official commentary emerging over the course of the last month is not particularly encouraging. In an authoritative editorial published in the People’s Daily on 29 August, authored by the Deputy Director of the State Council Research Center, Long Guoqiang, he states the American reasons for a U.S.-China trade war are as follows:

- First, "interest extortion"– that is, to force China to expand market access and increase purchases of U.S. products;

- Second, "strategic containment"– to constrain China’s rise and curb China’s economic, military and technological development; and

- Third, "mode suppression" – that is, to "stigmatize" what he sees as China’s unique state-led development model.

And on 29 September, a senior official at the Chinese Academy of Social Sciences, Li Xiangyang, stated the following:

- "First, we need to reconsider the assumption that the U.S. and China want an inter-dependent and mutually beneficial relationship;

- "Second, we need to reconsider whether the experience of the U.S.-China relationship over the past four decades can be a guide for the future of the relationship;

- "Third, we need to reconsider whether trade and commercial ties can still serve as the ballast for the broader U.S.-China relationship."

China’s Likely Response

This leads us to ask the more fundamental question, that whatever Chinese declaratory positions might be within its own national media, directed at its own national constituencies, when push comes to shove, what is China most likely to do in response to America’s new strategic direction?

While Xi Jinping is under considerable domestic economic pressure, it is difficult to construct a scenario under which he can easily agree to the sort of "trade plus" negotiating outcome that seems to represent the current center ground of U.S. administration opinion.

The alternative strategy for Xi Jinping is to "double down" and deploy a nationalist response to what has been universally reported in China as an "insulting" and "intimidating" speech by Vice President Pence.

In China, as we all know from folkloric depiction of the country, questions of national "face" are important in the national political calculus. It may well be that China, in the face of deepening economic difficulties, resolves that the more effective political path for themselves lies in renewed appeals to national self-reliance, a full-frontal attack on what it perceives to be U.S. containment strategies, and a broader appeal to Chinese cultural nationalism.

Consistent with such an approach, China would be likely to strengthen its existing strategic relationship with the Russian Federation; continue to improve relations with its most powerful and problematic neighbors, India and Japan; as well as intensify its efforts in third countries to resist American pressure to decouple those countries from China’s embrace.

In reaching its conclusion as to which way to go, China will be deeply mindful of what unfolds in the U.S. domestic political environment after the mid-terms.

China will also be mindful of how a continuation and intensification of the trade war into 2019 will affect its own economy, which is already hurting.

But it will be equally mindful of the impact of comprehensive tariffs on U.S. domestic inflation and employment through 2019 and into 2020, particularly given the fact that most mainstream western economists are concluding that the U.S. is currently enjoying an over-extended boom and bull market, and that a correction or even a recession is long overdue.

The Art of the Deal?

If China is to choose to negotiate, rather than double down, the almost impossible diplomatic art form late this year and early next year will lie in the construction of a deal which the Trump Administration finds acceptable, but which cannot be conceived in Beijing or around the world as a significant loss of Chinese face.

The greater the American public commentary on the need for Xi Jinping to make concessions, the greater the difficulty in constructing such a deal. Both in its content, and in its presentation.

Nonetheless, there are modest signs of a willingness on both sides to try one more time. The Administration will be mindful of when the current dynamics of the trade war will start to tip into a dangerous direction for U.S. consumers and the general economy. Which would seem to be in the first quarter of next year. Just as China does not want to undermine its own deleveraging strategy (driven by its over-riding macro-economic need to re-balance its growth model away from continuing debt-driven growth) by a sustained loosening of domestic credit policy to supplement domestic demand brought about by declining export income.

In other words, the near-term economic logic is clear to both sides. What is less clear is whether the U.S. Administration is clear internally on its long‑term economic agenda with China — which goes to the heart of intellectual property protection, forced technology transfer and the use of Chinese state industry to subsidize China’s global efforts to dominate the high technology industries of the future, as defined in China’s 2025 industry strategy. If the Navarro-Lighthizer argument prevails, and becomes a precondition to the resolution of tariff war, then we will we be in for a much longer war of economic attrition between the two.

A December compromise may well be a deal on deficit reduction and tariffs, coupled with a time-limited process to resolve the three sets of structural issues outlined above: IP, technology transfer and Made in China 2025. This, however, is likely to simply postpone the substantive matter — because substantive resolution would require a fundamental redirection of the nature, direction and machinery of the Chinese party-state.

And then there is politics, pure and simple — both American and Chinese — and its impact on any agreement in December or even beyond. If President Trump emerges weaker from the mid-term congressional elections, and faces impeachment proceedings from either the House or the Senate, or else faces unanticipated, negative findings from the Mueller Investigation on Russian interference in the 2016 elections, these factors would be likely to reduce the President’s capacity to strike a deal with Beijing. Indeed, he may be more likely, as Chinese strategists already predict, to go even harder on China to strengthen his presidential political credentials against an external adversary. Indeed, the better result from Beijing’s perspective would be for a good Republican outcome in November, and a "within range of tolerable outcomes" on Mueller, leaving the President with sufficient political scope to land a deal with Beijing.

Chinese politics will also be complex. Xi Jinping shows no sign of being in trouble domestically in terms of his hold in power. But his critics will be watching closely any critical missteps in the U.S. relationship, given the central role of the U.S. in the Chinese domestic nationalist discourse. Xi’s dilemma will be an economic imperative to resolve the trade war, but a political dilemma of not conceding to the Americans, compounded by a president with a mercurial capacity to change his mind at the last minute when their factors intrude in his judgement. Indeed, this is likely to generate great caution on Xi’s part as he approaches his meeting with Trump in Buenos Aires in December.

On balance, all factors considered, the two sides are more likely to strike a deal than not. But the prospects of it being derailed by both policy and political considerations are real. Just as the prospects of a deal being subsequently derailed during the negotiation and implementation process of any agreement are real as well.

Whatever the outcome, the impact on Chinese attitudes to the United States in the future, way beyond the fault lines of the current debate, will be profound. And we are only seeing the very beginning of the deep reappraisal of Chinese long-term strategy towards the United States. These processes take much time in the Chinese system. And it will be some considerable time before we see evidence of any change in China’s declaratory and operational course as it continues to pursue its own national objectives.