Lessons from Suze Orman

Suze Orman returns to the Philippines to share her financial wisdom.

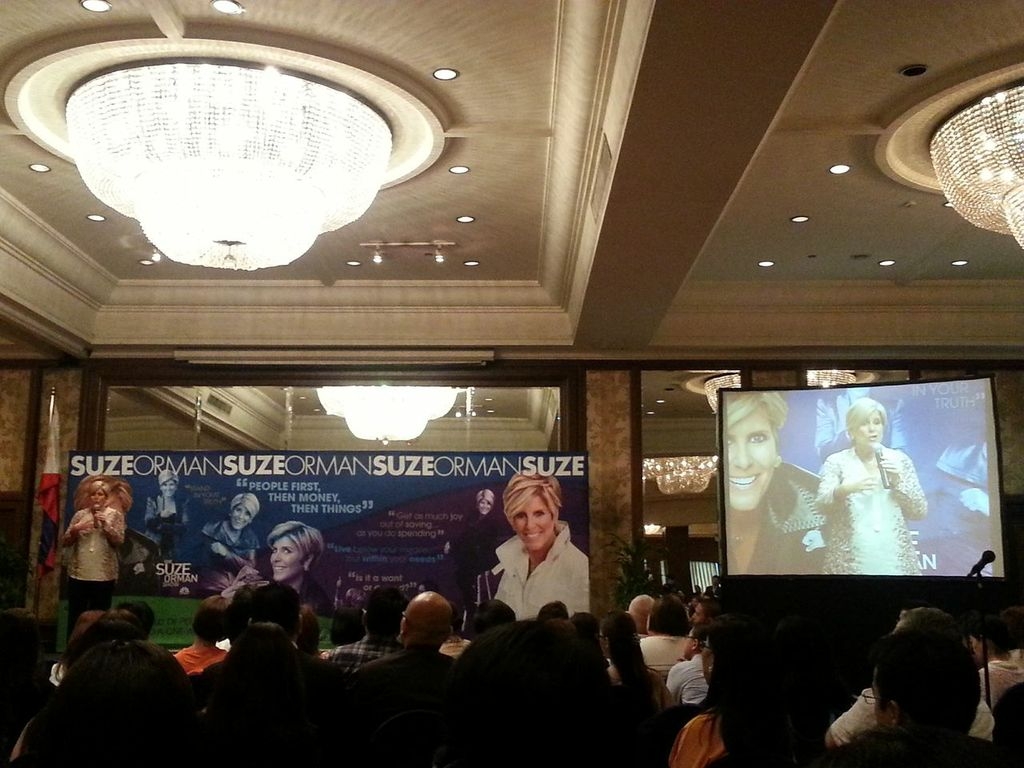

MANILA, Philippines - Last May, financial guru and self-made millionaire Suze Orman returned to the Philippines for a series of financial talks. Asia Society members had the privilege of attending two events with the dynamic Ms. Orman.

The first event was sponsored by Bank of the Philippine Islands (BPI). Hundreds of BPI clients and guests – young and old alike – flocked to the Newport Performing Arts Theater in Resorts World Manila last May 16, 2013 to listen to Suze give advice on personal finance.

Suze Orman, Financial Guru

Meanwhile, the event sponsored by Makati Business Club was more intimate – around one hundred audience composed of families, young professionals etc. The purpose of the talk was to create a focus group to evaluate what Filipinos wanted to learn about finance and their money. Suze hopes to one day create a course that Filipinos can take for free in order to educate themselves about managing their personal finances.

Although the two talks had different purposes, Suze shared similar advice to both audiences. Below are some nuggets of financial wisdom from the guru herself:

- You will never be powerful in life until you can control your own money.

- The goal of money is to make you feel safe and secure. If a financial move makes you feel anxious or scared, rethink your decision, because it may be a wrong move.

- The first step to financial freedom is to get out of debt! If you have credit card debt or any other debt, pay if off as soon as you can. The same goes for mortgage.

- Once you have paid off your debt, divide your money into two pots. One pot is your short-term savings to pay your bills and to keep your life going. The other pot is for long-term savings or retirement.

- Start investing at an early age. Time is your best friend when it comes to investment, even if it’s only a small amount every month.

- 3 thoughts (Laws of Money):

Live below your means but within your needs.

Ask yourself: “Is it a want or a need?”

Main goal: “Get as much joy in saving as you do spending”

- Give the same amount to family to fulfill necessities even if your salary increases. You must remember to invest in yourself first.

- If you love your country and want it to continue growing, invest in your own. Stay with peso and invest in the Philippine stock market.

- Invest in the PSE index fund. Historically, index funds outperform managed mutual funds.

- People > Money > Things. The things you own do not define you. You define who you are.