Briefing MONTHLY #59 | February 2023

ASEAN relations | Banks exit Asia | Wooing India | China dealmaking | Korea’s baby bust | Undiplomatic departure

Animation by Rocco Fazzari.

LOOKING SOUTH AGAIN

After several years of stepped-up diplomatic focus and aid spending under two separate federal governments, Australia appears to be finally getting some new recognition in Southeast Asia.

A decline in preference for both education and tourism visits to Australia in recent years appears to have turned around. And amid limited choices for dealing with growing US-China rivalry, there is some modest improved sentiment towards Australia as an economic and security partner.

These findings come from the latest State of Southeast Asia Report from the ISEAS-Yusof Ishak Institute which surveys elite opinion rather than general public opinion across the region, but nevertheless provides one of the only consistent insights into practical relations with Australia’s closest neighbours. (see: ASIAN NATION).

The more important bigger picture findings from the wide-ranging survey show a loss of status for China in the region although it remains the most influential economic (59.9 per cent) and strategic (41.5 per cent) power. But two thirds of those who see China as the most influential power in these two domains still view its rise with concern and almost two thirds would back the US over China if forced to choose.

The ISEAS poll suggests Southeast Asians still see China as a more significant economic and strategic force than the latest Lowy Institute Power Index found in its annual assessment. The Lowy ranking showed both countries suffering a small fall in both domains, but the US still ranked as more powerful in both economic and military capability. China was ranked more powerful in economic relationships and diplomatic influence.

But in a significant finding for Australia from the ISEAS poll of 1300 opinion makers, the majority of respondents from two of Australia’s longest standing regional partners – Indonesia and Malaysia – would back China over the US if forced to choose.

The improved soft power links for Australia suggested by the survey will be welcome reading as the Department of Foreign Affairs and Trade review of long-term economic relations with the Southeast Asian countries moves towards making policy choices with a new reference panel of business leaders (see: DEALS AND DOLLARS).

But the latest moves in the withdrawal of Australian banks from Asia this year highlight a challenging issue for the review. In this month’s edition we also look at little reported data on how Australian bank exposures in Asia have shifted through the pandemic and the downturn in relations with China. It’s a mixed picture of banks closing down Asian shopfront operations, but still maintaining a relatively steady overall risk exposure to the region - although there has been a big withdrawal from China.

And on a personal note. I met the now late Richard Woolcott as a young reporter in Canberra as he was rising to the top of the Department of Foreign Affairs and our paths then crossed many times, including here at Asia Society Australia. But I had the most engaging time editing his many oped pieces for The Australian Financial Review when I worked there. For a former senior government official, he was remarkably trusting (perhaps diplomatic!) about being edited – but not without some occasional feistiness about the outcomes. Vale Dick.

Greg Earl

Briefing MONTHLY editor

NEIGHBOURHOOD WATCH

JAPAN: Third time lucky

Japanese Prime Minister Fumio Kishida has made some big calls since effectively taking the country’s leadership baton from the long serving late Shinzo Abe more than a year ago – after a short stint by Yoshihide Suga.

First, he promised a new form of capitalism implicitly casting doubt on Abe’s form of neo-liberalism. Then he declared Japan was at a point of no return in dealing with its shrinking, ageing population in part casting doubt on Abe’s womenomics policy.

But the lack of clear detail over how he plans to implement these big calls means his choice of a new Bank of Japan governor from outside the central bank’s inner ranks means he is really now betting his future on reversing the world’s last remaining major bastion of ultra-loose monetary policy.

The appointment of a 71-year-old low profile university professor Kazuo Ueda to unravel the key component of Abenomics is a radical move compared to the other more rhetorical calls on policy reform. That’s because the job has usually safely alternated between central bank and finance ministry officials, like the outgoing Haruhiko Kuroda.

The fact that Ueda is not publicly associated with being for or against the Abe/Kuroda era of radically low interest rate policy seems to have made him appropriate for the sensitive job of changing that policy which could unsettle world markets and possibly determine how long Kishida can last.

- Tobias Harris at Observing Japan says the politically inexperienced Ueda runs the risk of being outmanoeuvred by the many vested interests in Abenomics.

KOREA: Seoul mate shortage

One is not enough ... a Korean fertility campaign poster

For a country anxious to raise its profile in the world, South Korea has now managed to smash its own record two years in a row: but for having the lowest fertility rate on separate indices published by the United Nations and the Organization for Economic Cooperation and Development.

The number of babies expected per woman fell to 0.78 in 2022 from 0.81 in 2021. With only 249,000 births compared with 373,000 deaths last year, the population is now projected to fall by 53 per cent to 24 million in 2100 which is a faster decline from 43 per cent projected in 2019.

The rate compares with 1.3 in neighbouring Japan, which once led this demographic collapse but has managed to achieve some measure of stability compared with Korea which is confronting the population downturn at a lower level of per capita wealth than Japan.

Conservative President Yoon Suk-yeol committed to overcoming what he called a “national calamity” during last year’s election but critics say his cash incentives to promote childbirth have failed to deal with deeper cultural attitudes towards the role of women at home and in the workplace as well as reluctance to allow greater immigration.

- In a revealing insight, Korea Herald business editor Lee Hyo-sik says his daughter’s day care centre is cutting staff due to declining enrolments and her favourite teacher is unlikely to find another job.

INDIA: Adani unity ticket

It takes a lot to unify India’s brawling major political parties on any issue these days, but billionaire democracy advocate George Soros has managed to do just that with his intervention in the debate over the governance of the Adani business group.

Soros, credited with breaking the Bank of England with short selling of the pound in 1993, sparked a new decline in the Adani share price with a claim that the fates of Adani and Prime Minister Narendra Modi were intertwined and the crisis would lead to an improvement in Indian democracy.

But this only prompted a rare show of bipartisanship with Foreign Secretary Subrahmanyam Jaishankar declaring Soros to be “old, rich, opinionated and dangerous.” Meanwhile Congress Party general secretary Jairam Ramesh tweeted: “Whether the PM-linked Adani scam sparks a democratic revival in India depends entirely on the Congress, opposition parties and our electoral process. It has NOTHING to do with George Soros."

Adani founder Gautam Adani has dismissed double digit share price falls in parts of his sprawling corporate group as “temporary volatility” after a report by US-based Hindenburg Research alleged stock manipulation and fraud. Adani, who has a long business association with Modi dating back to their origins in Gujarat state, has seen his wealth estimated to have halved to around US$50 billion since the report.

The allegations have raised questions about the independence of India’s corporate regulatory agencies and prompted scrutiny of the group’s growing overseas operations. Adani has promised some governance changes, terminated a share issue and halted acquisition of a coal-fired power plant in India.

- At India Today, Abhishek Banerjee offers six lessons from the Adani crisis. And see ENGAGING INDIA

SOLOMONS: new gen politics

One of the highest profile critics of the Solomon Islands’ growing ties to China has been forced from office potentially paving the way for more Chinese influence in the country.

The leader of the regional government in Malaita Daniel Suidani lost a vote of no confidence in the Malaita regional assembly in early February and then lost a High Court appeal against his removal from office. An ally of Prime Minister Manasseh Sogavare, who has led closer relations with China, was then elected Malaita premier.

Suidani had banned Chinese companies from the province and accepted development aid from the United States and Taiwan. But he has also criticised Australia for not doing enough to restrain Sogavare.

- Melanesian News Network founder Dorothy Wickham says in Australian Foreign Affairs that there is a new generation of politicians in Pacific countries who “are impatient, with a different approach to development, and do not hold on to the older (western) relationships”.

ASIAN NATION

ASEAN SOFT POWER

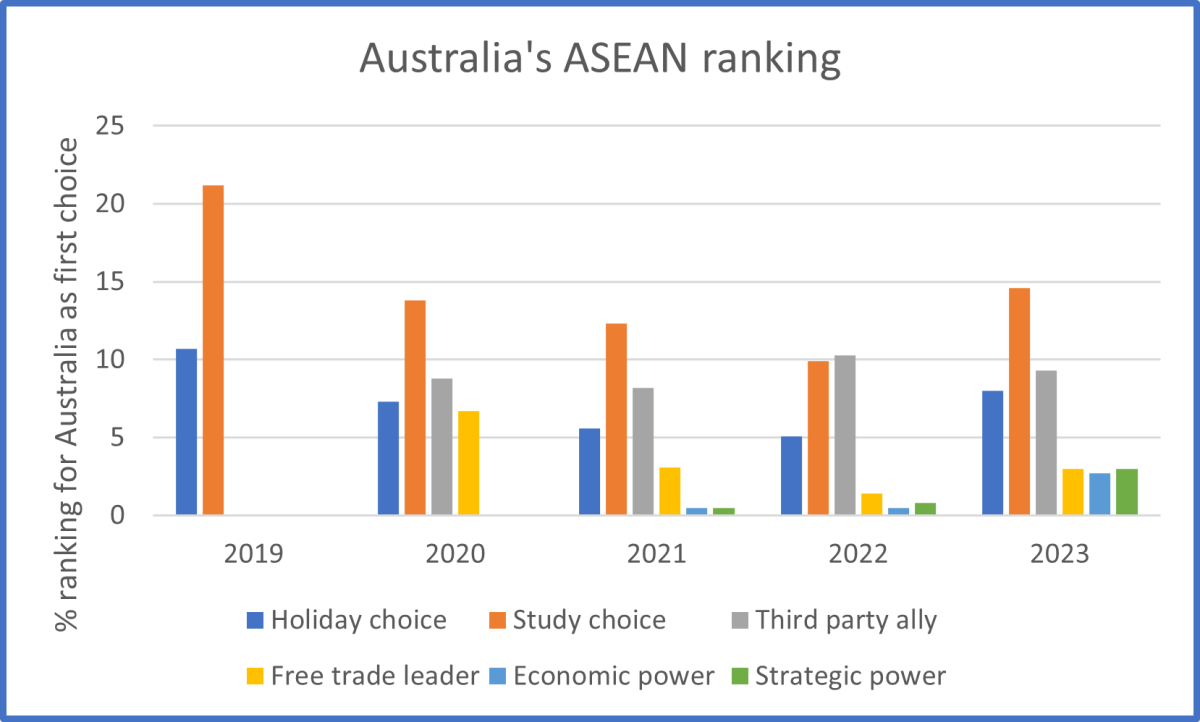

Source: ISEAS State of Southeast Asia report/Author calculations

Australia is showing signs of recovering its stature as a place to study and travel for Southeast Asians after a downturn in recent years despite increased development aid spending and increased diplomatic attention for the region.

The State of Southeast Asia survey asks respondents to choose their single favoured country for a tertiary scholarship, for a holiday, as a third-party ally amid US-China tensions, as an economic and strategic power, and as a free trade leader, so Australia is up against obvious big alternatives from the US to Japan. But as the chart shows there is a recovery in its study and tourism attraction as borders reopen and some improvement in partner measures, some of which have a shorter previous data series.

Australia (14.6 per cent) now ranks third as a study destination after the top ranked US (25.2 per cent) and Britain at (15.9 per cent). It still only ranks six (8 per cent) as a travel destination after the top ranked Japan (27.3 per cent) although up a bit and still marginally behind New Zealand.

As a third party ally it is down a bit but ranked fourth after the European Union (42.9 per cent), Japan and India. While up a bit at 3 per cent as a free trade leader, it still lags ASEAN (23.5 per cent) as the leader and the US, EU, Japan, and China. Australia's low rating as a free trade leader comes despite its leadership role in institutions including the Asia Pacific Economic Cooperation group, the revamped Trans-Pacific Partnership and the Regional Comprehensive Economic Partnership. The trade finding also illustrates how over the five years of this survey there has been a trend towards the ASEAN group itself being ranked higher in some of these regional power measures. But while the numbers are small in a competition with big powers, Australia’s ranking as the most influential economic power (2.7 per cent compared with 0.5 per cent last year) and strategic power (3 per cent compared with 0.8 per cent last year) shows some sign of greater influence.

There are some marked variations across the diverse region which are relevant to Australian service providers and diplomats. For example, 33 per cent of Cambodians selected Australia for a scholarship but only six per cent of Filipinos. When it comes to choosing a third-party strategic partner 18 per cent of Singaporeans chose Australia but only four per cent of Vietnamese.

ENGAGING INDIA

India has signalled that it could open the way for Australian universities to open campuses there as both countries embark on an ever expanding year of top-level engagement.

With Treasurer Jim Chalmers already in India for a Group of 20 finance ministers meeting, there will now be seven Australian ministers in India over a period of less than two weeks, making this the Albanese government's most intense public country focused ministerial diplomacy so far.

External Affairs Secretary Subrahmanyam Jaishankar reportedly flagged the university idea at an Australian Strategic Policy Institute forum in Sydney as Prime Minister Anthony Albanese confirmed that this year Australia would host Operation Malabar - a long-running joint naval exercise between India, the US and Japan.

Albanese told Jaishankar that the relationship was going from strength to strength as he also confirmed a bilateral visit to India next week setting up a series of meetings with Prime Minister Narendra Modi which will continue at the Quadrilateral Security Dialogue leaders’ meeting in Sydney in May and then the Group of 20 leaders meeting in India in September.

This week Education Minister Jason Clare and Foreign Minister Penny Wong will lead a delegation of university vice-chancellors and industry organisations to sign an education mutual recognition agreement and press for more on the ground teaching access.

Australian universities operate campuses in countries including Vietnam, Malaysia, and Indonesia but getting access to India which is one of the fastest growing sources of foreign students in Australia has long been on the agenda of bilateral trade negotiations. Monash, Deakin and the University of Queensland have some presence there.

The prime minister says chief executives from more than 25 major Australian companies will join him on his trip, including representatives of the resource sector, the finance sector, the university sector and from information technology. He will be accompanied by Trade Minister Don Farrell and Resources Minister Madeleine King.

Foreign minister Penny Wong introducing Swati Dave to Subrahmanyam Jaishankar during his visit to Sydney.

Picture: @SenatorWong

Meanwhile former Export Finance Australia chief executive Swati Dave has been appointed the inaugural chair of the Advisory Board to the new Centre for Australia-India Relations. The Centre for Australia-India Relations will open this year as part of Australia efforts after the interim Economic Cooperation and Trade Agreement to strengthen relations with the country. It will deliver the Maitri (friendship) Program, involving research and cultural partnership grants, fellowships and scholarships. Dave is also the deputy chair of Asia Society Australia, a member of the National Foundation for Australia-China Relations' Advisory Board and a former finance company executive.

INDONESIA RELATIONS

Australia and Indonesia are moving to upgrade their defence relationship with a planned new agreement which is intended to be binding under international law.

It appears to signal that the Indonesian defence establishment is more comfortable with Australia AUKUS nuclear submarine partnership than the foreign affairs system which has made persistent criticisms of Australia’s embrace of nuclear submarines.

And it comes as Defence Minister Richard Marles has also boosted defence relations with the Philippines by discussing joint patrols in the South China Sea and a commitment to annual defence talks while on a regional trip which also included Thailand.

The planned new Indonesia agreement comes a generation after Prime Minister Paul Keating signed a then surprise defence agreement with President Soeharto in 1995 which came unstuck during the tensions over Timor independence in 1999. The new agreement will seal a gradual rebuilding of defence ties under a joint security framework in 2006, then a comprehensive strategic partnership declaration in 2018 followed by an existing less binding defence agreement from 2021.

Marles said in a joint statement with his Indonesian counterpart Prabowo Subianto on February 10 that: “We intend for the new agreement to bolster our strong defence cooperation by supporting increased dialogue, strengthening interoperability, and enhancing practical arrangements.”

The negotiations will consider reciprocal access to each other's training areas, and streamlining entry and exit processes for joint military activities. This appears to be taking the two countries into a bilateral defence partnership more akin to what Australia has recently fostered with Japan in contrast to conventional military exercises with several countries.

The agreement between the defence ministers followed a two-plus-two meeting with foreign ministers covering a broader range of subjects but a statement with delicate wording on nuclear issues. It said both sides “highlighted their ambition for a world without nuclear weapons and their commitment to strengthening the global nuclear non-proliferation and disarmament regime, including its cornerstone, the Treaty on the Non-Proliferation of Nuclear Weapons both sides.”

DEALS AND DOLLARS

BANK EXIT CONTINUES

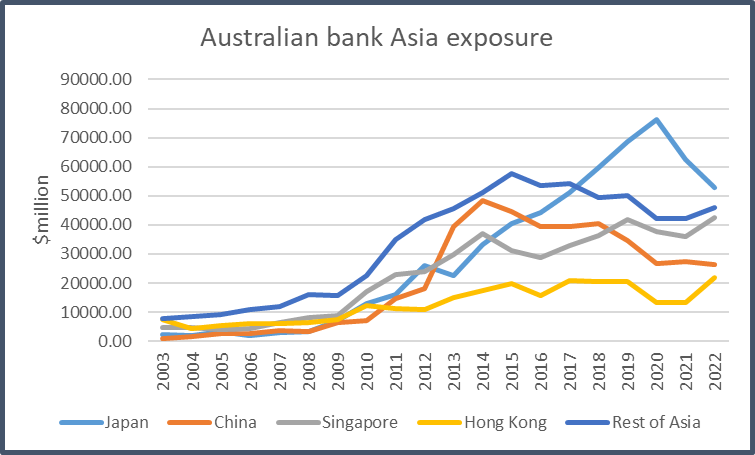

Source: RBA/APRA/Author calculations

The Australian bank exit from Asia has continued this year with Westpac settling a money laundering case in Hong Kong which has held up its planned departure from China, National Australia Bank reportedly closing its Beijing office, and ANZ continuing the delicate wind-up of its Myanmar operation.

Westpac and ANZ have traced their origins in the Pacific back more than 100 years and NAB was the first Australian bank into China back in 1982. But the long and varied winding back reflects poor returns from Asia, new domestic oriented strategies, the bilateral tensions with China, and plans to focus on trade finance rather than on-the-ground customer facing banking businesses.

It comes as the Australian government is placing a higher priority on a more diversified Australian business presence in Asia in the wake of the tensions with China, which underlined the risks of being too dependent on one country for both trade and investment. So, while the banks mostly still argue they can provide finance for Asian trade and investment from Australia or regional hubs like Singapore the declining physical presence poses an issue for the diversification strategy.

However as this debate plays out, little reported data from the Reserve Bank of Australia and Australian Prudential Regulation Authority (RBA/APRA) provide an insight into how and where the exit has been happening. And it is not as severe as the withdrawal of points of presence might suggest.

Australian bank and financial corporation ultimate risk exposure to Asia peaked in 2019 at just under $216 billion but was down to $189 billion by last September – which suggests the decline was more about the pandemic than either China relations or general poor financial performance.

While there has been a clear decline in exposure to China since 2014 just as the bilateral tensions began, this has been more than offset by sharp growth in exposure to Japan and steady growth in exposure to Singapore, while Hong Kong has remained quite steady. And the rest of Asia is relatively strong compared with the two big economies and the financial centres even though its share has been falling over the past few years on a similar trajectory as China.

- See Banking on Asia is hard to escape at The Interpreter for more details on which countries Australian banks are lending to.

MOORE'S WAY

Former Macquarie banker Nicholas Moore has called on some leading business figures for assistance as he steps up regional visits for his report on Australian business in Southeast Asian to 2040.

He has drawn on Macquarie Group chief executive Shemara Wikramanayake, Team Global Express chief executive Christine Holgate, Monash University vice-chancellor Margaret Gardner, and former ANZ Asia regional boss Vishnu Shahaney to serve on a reference group for the Department of Foreign Affairs and Trade regional strategy.

During a visit to Indonesia and Singapore this month, Moore identified services as an important focus for his report on top of Australia’s traditional resources and agriculture strengths and identified higher education, health, mining services, finance and accounting as having “good prospects for future growth.” Writing in Singapore’s Business Times he said: “ We appreciate that Australian products, services and expertise are valued in South-east Asia. But what I’m hearing from partners is both sides can do more, especially in developing skills and investment.”

And in an interview with The Australian he said his current focus was on talking to the people in the market who are engaged in investing and trade, and asking what more can be done. “It has already been identified that investment is an area we could really step up our game. We are trying to talk to people about what their ambitions are and what’s actually stopping investment taking place.”

In response to suggestions the government should take a bigger role in arranging or derisking Australia investment consortia in the region he pointed to the Katalis program established under the 2020 trade agreement with Indonesia as an example of where the government is playing a greater role.

CHINA BUSINESS

The contours of a deal on restoring business relations with China appear to be emerging with the Albanese government’s apparent decision to approve a potential $1 billion investment by Baowu Steel Group in a West Australia iron ore project.

The Australian reported that the Foreign Investment Review Board and Treasurer Jim Chalmers had assented to the Western Range project in which the state-owned Chinese company would hold 46 per cent alongside Rio Tinto with 54 per cent. It will be the largest Chinese investment in Australia since the $1.5 billion takeover of the Bellamy’s dairy business in 2019.

It comes after a meeting between Trade Minister Don Farrell and his Chinese commerce minister counterpart Wang Wentao on February 6 which has paved the way for Farrell to travel to China. He said after the meeting: “We've started the thaw in the relationship, as they would describe it. I'm optimistic that progress is going to be made in respect of all of the issues that are now standing between us.”

On February 24 Farrell said the key positive trade developments were: Australian coal had been unloaded in China; China had accepted import permit requests from West Australian lobster exporters; China had said the timber export ban had been lifted; and Buller Dairy was again re-exporting into China.

Australian bans on Chinese companies investing in infrastructure., dairy and construction between 2018 and 2012 played a key role in the downward spiral in relations and set the scene for Chinese officials to make a more open or predictable investment regime a key part of any return to more stable relations.

President Xi Jinping also appeared to emphasise investment access in his meeting with Prime Minister Anthony Albanese in Bali in November. Research maintained by the University of Sydney and KPMG shows that Chinese investment in Australia fell from $US$11.5 billion in 2017 to US$585 million in 2021. But the minority stake for Baowu Steel may be a model for future investment approval.

Prime Minister Anthony Albanese skirted around the issue in a National Press Club address this week saying foreign investment proposals would be dealt with on their merits but he was more focused on developing Australia’s sovereign capacity for domestic production.

However former Australian Strategic Policy Institute director Peter Jennings has strongly criticised the Baowu Steel approval arguing: “Our future reality is that Australia will not be able to get wealthy from China at the same time as we deter Beijing’s military adventurism and covert influencing activities.”

LYNAS MALAYSIA SETBACK

The Albanese government is facing its first tension with Anwar Ibrahim’s new Malaysian government after it moved to ban mining company Lynas Rare Earths processing plant from operating in Malaysia after July 1.

Lynas has appealed against the ban on its $1 billion rare earths cracking and leaching plant which is the world’s largest single rare earths processing plant and the only scale producer of separated rare earths outside China. Rare earths are an essential component for electric vehicles, mobile phone batteries, computers and medical imaging. Technically Lynas had its operating licence renewed but with conditions preventing it from importing and processing rare earths concentrate after July 1 due to concerns about radiation levels..

The decision means Lynas may have to shut down for a time which would disrupt the non-China supply of the rare earths when Australia has allied with the US to create alternative supply chains in critical minerals outside Chinese control.

Lynas has tended to persistently underestimate the extent of opposition to its Malaysian plant on environmental grounds which extends back to when Anwar’s Pakatan Harapan coalition was in opposition before it first won office in 2018.

The latest decision to implement the long-promised ban is likely to prove popular in Malaysia where Anwar is under pressure to maintain public support after narrowly coming back to power in last year’s election. He particularly needs to retain support from his own party’s more liberal/environmentalist wing after going into a new coalition after the election with the discredited long ruling United Malays National Organisation.

But Resources Minister Madeleine King has strongly backed Lynas saying that the Malaysian decision will “have an impact on global rare earths supply chains.” Malaysia has again suggested a compromise in which radioactive material is removed from the country.

FADING ASIA PIONEER

Clough Engineering led Australian business into Indonesia Picture: Clough

Italy’s Webuild is proposing to buy engineering firm Clough’s Asia Pacific projects for around $39 million in a deal that would allow creditors to avoid up to $2 billion of financial claims.

The Australian Financial Review reported that creditors have been told that Webuild would take over Clough’s operations in Australia, Papua New Guinea, Singapore, Malaysia and India, taking on about 1000 employees and another 90 staff in Papua New Guinea.

Clough was sold by its South African owners to Webuild in November amid a cash flow crisis and a focus on the future of its high profile Australian renewable energy projects, including the Snowy 2.0 hydropower project.

But the one-time Perth family company has been little recognised during the latest ownership change as a pioneer of Australian engineering in Asia starting in Indonesia in 1970. Its joint venture with Abudl Muiz to build a highway in Sumatra marked its offshore expansion. Then in 1984 it bought the Indonesian-based engineering company Petrosea facilitating its expansion into other parts of Asia. Then from 1989 it played a significant role in the modernising of PNG’s resources infrastructure.

CLOSING THE (TIMOR) GAP

The Albanese government may be edging closer to some form of compromise with Timor Leste over where to process gas from the Greater Sunrise gas fields which is crucial to the country’s longer-term finances.

The three owners of the project – state-owned Timor Gap (57 per cent), Australia’s Woodside Energy (33 per cent), and Japan’s Osaka Gas (10 per cent) issued a statement that they would consider where to process the gas after a long stalemate.

It said the partners would consider all issues for delivering the gas for processing in and sales from Timor compared doing this in Australia, including which option provided the most meaningful benefit for the people of Timor.

Timor has stepped up its campaign for processing in the country since the election of the Albanese government including flagging seeking Chinese investment if the original Woodside push for processing in Darwin was backed by the Australian government.

Significantly Woodside chief executive Meg O'Neill said in the statement that it was necessary to look at new modular technology that didn’t previously exist and take account of “global geopolitical instability and constrained energy supply chains”.

Days later Prime Minister Anthony Albanese told Federal Parliament after a meeting with his Timor counterpart Taur Matan Ruak that: “We know that important projects, including the Greater Sunrise project that we discussed today and I discussed with Woodside last week when I was in Perth, are important for the future development of Timor-Leste.”

DATAWATCH

TAKING ASEAN'S PULSE

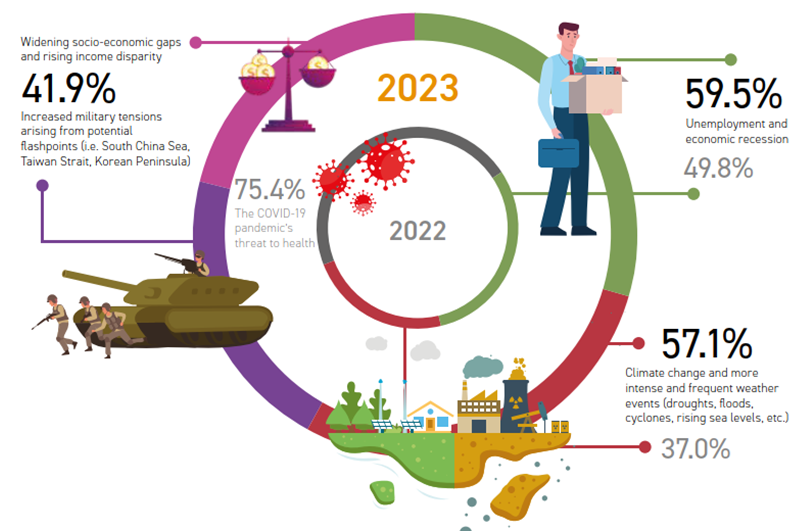

This graphic shows the change in the top three concerns across Southeast Asia in the past two years from COVID, unemployment, and climate change in 2022 to unemployment, climate change and military tensions in 2023.

Source: State of Southeast Asia report.

DIPLOMATICALLY SPEAKING

"My father is descended from Hakka and Cantonese Chinese. Many from these clans laboured for the British North Borneo company in tin mines and plantations for tobacco and timber. Many worked as domestic servants for British colonists, as did my own grandmother. Such stories can sometimes feel uncomfortable – for those whose stories they are, and for those who hear them. But understanding the past enables us to better share the present and the future. It gives us the opportunity to find more common ground than if we stayed sheltered in narrower versions of our countries’ histories."

- Foreign Minister Penny Wong, London, January 31

“It’s really important for all countries to think about their past in terms of providing a gateway for meaningful engagement in the future, and we want to see a Great Britain which is engaged in our region and they certainly seek to be that … “Because if Britain is engaged in the Indo-Pacific, it will help provide stability in the Indo-Pacific, and that’s really important.”

- Defence Minister Richard Marles, January 31

"I think it is incumbent upon the UK, in our dealings with Australia or any other country with which we were once a colonial power, to recognise that we need to demonstrate that this is a modern partnership, a partnership of equals – different but equal, geographically separated but emotionally and historically bound … We did touch upon the history of the UK in our relationship. It is about recognising that you cannot eradicate or erase your history, so you need to be conscious of it … The bottom line is we have a Prime Minister of Asian heritage, a home secretary of Asian heritage, a foreign secretary of African heritage."

- British Foreign Secretary James Cleverly, February 2

A footnote to last month’s edition: Japan’s ambassador Shingo Yamagami is reportedly returning to Tokyo early amid debate about his outspoken comments during his posting in Australia which featured here last month. The development was notably first published by former Australian ambassador to Japan John Menadue in his Pearls and Irritations publication. Japan’s Ministry of Foreign Affairs has confirmed it conducted two inspections of its Canberra embassy last year. Yamagami has defended his position in this letter to The Australian Financial Review.

ON THE HORIZON

Happier times … Li Keqiang holding his annual media conference at the NPC.

CHINA'S EMERGING GOVERNMENT

It may seem like a rubber-stamping exercise after the Chinese Communist Party gave Xi Jinping at least another five years at the top last October, but he formally only takes over as national president again next month.

The annual meetings of China National People’s Congress (NPC) and the National Committee of the Chinese People’s Political Consultative Conference (CPPCC) (known as the Two Sessions) begin on March 4.

The first annual session of the 14th NPC is where the top personnel changes endorsed by the Communist Party Congress will be implemented at the country’s government level led by the departure of Premier Li Keqiang from his ten years in Xi’s shadow. A wave of lower government and provincial government changes will continue for some weeks later.

The almost 3000 member NPC meets in full session for roughly two weeks each year to outline some greater detail about the country’s legislative program but most of the power is devolved to an NPC standing committee which consists of about 170 members.

The much watched economic growth target for the year ahead is normally delivered by the Premier in his work report at the opening of the Congress.