Briefing MONTHLY #46 | January 2022

Illustration by Rocco Fazzari.

POLLING DAYS

While it hasn’t cut through the summer festival of hi-vis vests in Australia ahead of three forthcoming federal and state election campaigns, 2022 is also an interesting year for voting in Asia.

This year’s polls will lack the sheer scale and colour of voting in the mega-democracies of India and Indonesia. But they may see the return of old guard forces in the Philippines and Malaysia adding to questions about the health of democracy in Southeast Asia.

And in the Pacific, the voting in Papua New Guinea, Fiji and Timor Leste may be the last outing for some high-profile leaders from the past two decades in countries which periodically have difficult relationships with Australia.

In the region’s third biggest economy, South Korea, voters seeking a new sort of leadership face the doleful choice of two main candidates who seem overshadowed by the incumbent president, who cannot run again.

In the guide below, Briefing MONTHLY examines seven national leadership and assembly elections, plus some interesting local level polls.

Meanwhile, Nepal has already kicked off the year’s regional elections. Last week the ruling coalition of five parties led by the Nepali Congress and two competing communist parties retained power as expected at an election for a third of the National Assembly.

NEIGHBOURHOOD WATCH

SOUTH KOREA: Scandals beat policies

South Koreans face another potential three-way race for the country’s presidency on March 9 amid a lack of clear enthusiasm for either of the two main candidates to replace incumbent Moon Jae-in.

A victory by the conservative People Power Party could cause increased tension with North Korea, while another left-wing president would probably add to difficulties with Japan over historical grievances.

The presidency tends to shift between the right and left, but Moon is finishing his term with unusually high popularity after some sharp swings in support while in office due to his mixed management of the pandemic, house prices and the economy. And the two key candidates are embroiled in scandal allegations.

Moon’s Democratic Party has nominated a populist former mayor and provincial governor Lee Jae-myung for the race and he has tended to lead the polling but has not generated much enthusiasm beyond the party’s progressive base.

The People Power Party’s candidate Yoon Suk-Yeol, a former prosecutor, appeared close to winding up his campaign in January after a series of controversies and rivalry with the party’s leader Lee Jun-Seok.

That has led to speculation that a centrist small party candidate Ahn Cheol-soo, a former entrepreneur, could step up his campaign for the job. Ahn mounted an early challenge to Moon in the 2017 campaign threatening to shake up the country’s traditional leadership, but he then failed to sustain his early popularity.

Korean voters, especially younger ones, say they want a leadership change from the establishment of the two main parties, which to a limited extent, Lee and Yoon do offer. But their squabbling over scandals is not what the voters intended.

PHILIPPINES: Back to the future

Filipinos choose a new president on May 9 with opinion polls suggesting they will swap controversial populist Rodrigo Duterte, who cannot run again, for the son of the ousted 1970s martial law president Ferdinand Marcos.

They will also choose 316 new members for the House of Representatives Congress where Duterte-aligned parties now dominate with 12 out of 24 new senators, who often go on to become presidential candidates. All regional governors and mayors are also up for election.

Polls suggest Ferdinand Marcos Junior (known as Bongbong) is gaining support on his divided presidential opponents: centrist Manila Mayor Isko Moreno; incumbent vice-president and Duterte opponent Leni Robredo; and former Duterte ally and boxing champion Manny Pacquiao. Duterte’s daughter and Davao City Mayor Sara Duterte is in effect aligned as a vice-presidential running mate to Marcos, although from a different party.

The scene appears set for the liberal and independent vote to be split across presidential candidates, while the new populist and old guard dynastic forces aligned around Duterte and Marcos enter an uneasy alliance over powersharing.

This will be an apparent shift from a loose pattern in post-Marcos Philippines of presidential power shifting between populist and more technocratic political forces.

PNG: New COVID risks

Papua New Guinea goes to an election in June with one of the lowest COVID vaccination rates in the region and outdated population distribution data for electoral rolls due to the postponement of its census until 2024.

Voters are due to choose 111 members for five-year terms in single seat constituencies over a two-week polling period scheduled to start on June 25, but the pandemic and an economic downturn will raise security concerns.

With dozens of parties potentially taking part, up to half the sitting members losing their seats in the past, and intense coalition building after elections, the results are hard to predict.

Prime Minister James Marape, from the PANGU Party, has been in power since he forced long-serving prime minister Peter O’Neill out of office in 2019. Incumbent prime ministers have emerged from the last three elections in a strong negotiating position because they are protected from a no confidence motion in the year before the election and the party with the most members gets the first chance to form a coalition government.

But Marape has faced persistent rivalry from senior ministers Patrick Pruaitch and Sam Basil, in addition to leading opposition politician Belden Namah. O’Neill could also mount a comeback.

Marape reshuffled his Cabinet in January apparently asserting control over key financial and defence roles in the run up to the election.

TIMOR LESTE: War horse battle

Timorese people will choose a new president on March 19 with incumbent Francisco (Lu Olo) Guterres, a former guerrilla fighter, declaring he will run again.

But there is speculation former president Jose Ramos-Horta may attempt to make a comeback as the head of state which is an officially ceremonial position decided in a two round voting system. He won the position in 2007 with the crucial backing of independence leader Xanana Gusmao, but lost badly in 2012.

Guterres, from the Fretilin Party, has elevated the power of the position in recent years blocking some ministerial appointments and calling an early election legislature in 2018 when the Fretilin-led government collapsed.

The more important National Assembly election is not due until next year where Gusmao appears to be concentrating his attention on restoring the National Congress for Timorese Reconstruction Party to power.

FIJI: Coup leader showdown

Fijians will choose a new government in the second half of the year with veteran Prime Minister Frank Bainimarama looking to extend his national leadership to two decades.

He first led the country as a military coup leader in 2006 but was elected prime minister in 2014 and 2018 and has remade himself as a climate change policy advocate. He had heart surgery in Australia in January.

But this time his Fiji First Party, which has a narrow parliamentary majority, is facing an unexpected challenge with the re-emergence of a previous coup leader, prime minister and later parliamentary opposition leader in Sitiveni Rabuka as a potential leadership figure in this election.

Fifty members are elected by proportional representation in a nationwide system.

MALAYSIA: UMNO’s reprise

Malaysians face an early election

Prime Minister Ismail Sabri appears to be facing increasing pressure from within his own United Malays National Organisation (UMNO) to hold an election this year even though it is not required until late next year and he has only been in the job for six months.

Ismail secured the top job last year when his former UMNO colleague Muhyiddin Yassin lost his parliamentary majority at the head of a hastily assembled coalition which included UMNO, the party that has dominated Malaysia for six decades. Ismail is also in the unprecedented position in Malaysia of being a prime minister who doesn’t actually head his party.

Muhyiddin had previously joined the two former UMNO figures Mahathir Mohamad and Anwar Ibrahim in 2018 to assemble the country’s first non-UMNO government in six decades. But that Alliance of Hope government only held power for less than two years until early 2020.

Now UMNO figures facing corruption charges including former Prime Minister Najib Razak and party president Ahmad Zahid want a shot at regaining power before their cases are heard and Muhyiddin may see an opportunity to profit from post-election coalition negotiations. UMNO and associated parties have done well at recent state elections making an early election attractive.

UMNO’s stranglehold on Malaysia has been broken by all this splintering. But this battle to define the country’s democracy has come at the cost of poorer management of the economy and the pandemic.

JAPAN: Whither Kishida-nomics

Relatively new Prime Minister Fumio Kishida must hold an upper house by July 25 and will be hoping to reinforce the stronger than expected personal mandate he received in the October lower house poll.

He has maintained strong opinion poll support since then with a forthright approach to containing rising COVID infections. But his so far vague promise of a new form of capitalism may come more into focus by mid-year posing some questions for voters about what he can really deliver.

INDIA: To BJP or not

Eight Indian States hold elections this year and most are held by Prime Minister Narendra Modi’s dominant Bharatiya Janata Party.

Modi has lost some of his political clout over his pandemic management and a backdown in a long running showdown with farmers over reforms, so the state elections will be an important pointer to the shape of a likely national election in 2024.

The most important state poll will be in the most populous Hindu heartland state of Uttar Pradesh, with the phased voting starting in February.

Poor results for the BJP in the state elections early in the year could have an influence on the July vote for the ceremonial post of president by the members of the country’s two parliamentary chambers.

CAMBODIA: Hun Sen’s handover

Cambodians will vote for members of about 1,600 communes or local councils on June 5 in a step towards national elections in 2023.

The voting will follow the announcement by the dominant Cambodian Peoples Party in December that Prime Minister Hun Sen’s son Hun Manet had been endorsed as the country’s future prime minister with no clear succession time frame.

The previous commune elections in 2017 unexpectedly underlined the increasing popularity of the opposition Cambodia National Rescue Party (CNRP) which won more than 40 per cent of the vote.

But that triggered a harsh crackdown on the CNRP by Hun Sen who has held power for more than three decades and the opposition is now fragmented into many small parties with divisions also emerging in the CNRP.

Hun Sen will have a high profile as the Association of Southeast Asian Nations chair this year paving the way for a tightly controlled national election next year and the possible handover to his son.

TAIWAN: Voting in China’s shadow

Taiwan will hold local elections in November to choose mayors and other positions in a regular four-year cycle towards presidential and national assembly elections in 2024.

The more China-friendly Kuomintang (KMT) did better than the China-sceptic Democratic Progressive Party (DPP) in 2018 underlining the KMT’s relatively strong support at the local level, while the DPP’s President Tsai Ing-wen prevails at the national level.

But amid growing recent pressure on Taiwan from China, the KMT has lost ground in more recent special elections and a referendum, which will make the local elections an interesting test of popular mood towards China.

ASIAN NATION

Signed up … Scott Morrison and Fumio Kishida meeting online

JAPAN TIES

Japan and Australia are planning a new Joint Declaration on Security Cooperation in the longer term after signing a long promised Reciprocal Access Agreement between their armed forces.

The access agreement establishes standing arrangements for cooperation in joint exercises and disaster relief operations, while improving the interoperability and capability of the two countries’ forces.

Prime ministers Scott Morrison and Fumio Kishida signed the access agreement virtually on January 6 after Kishida cancelled a planned visit so he could remain in Japan to deal with rising the COVID numbers.

They said they now wanted to update the 2007 declaration of security cooperation that has provided the basis for a rapid increase in security ties over the past decade so it could “serve as a compass” for years to come.

Morrison also announced a $150 million investment in clean hydrogen energy supply chain projects under a separate bilateral partnership on decarbonisation through technology saying this would accelerate the development of an Australian hydrogen export industry to Japan.

PNG PORTS

Australia has massively stepped up its spending under the 2018 Australia Infrastructure Financing Facility for the Pacific (AIFFP) with the announcement it is contributing up to $580 million to upgrading ports in Papua New Guinea.

The AIFFP was funded with $1.5 billion in lending finance and $500 million in in grants as a key part of the Pacific Step-up. But only a bit more than $100 million has been clearly committed to less than ten projects since then.

And the port spending which is part of PNG’s 30-year master plan in this field is significantly more than the $400 million, which was mentioned when they said they were looking at cooperation over ports in June last year.

CHINA RELATIONS

On the job … Xiao Qian (centre) with his new Canberra team

China’s new ambassador Xiao Qian has kicked off his posting, appearing to hold out the offer of a less publicly combative bilateral relationship after the tensions of the past four years.

In a statement issued on his arrival last week, he referred to how an older generation of leaders from the two countries had shown the “pioneering spirit of statesmanship” in establishing relations. This year is the 50th anniversary of the Whitlam government’s recognition of China.

Mr Xiao said: “I look forward to working with the Australian government and friends in all sectors to increase engagement and communication, enhance mutual understanding and trust, eliminate misunderstanding and suspicion, promote mutually beneficial exchanges and co-operation in all areas between the two sides, and jointly push the China-Australia relations back to the right track.”

FOREIGN STUDENTS

Concerns are emerging that the moves to relax working visas for foreign students as part of the campaign to restart international education will lead to a revival of low-quality courses which simply provide a back door entry to the labour market.

More than 40,000 international students have returned so far with 150,000 still offshore but holding a visa to return, with China, India, Vietnam, Nepal and Malaysia providing the largest number of students.

The Morrison government has underpinned its shift to encouraging students to return after the pandemic with visa extensions, visa fee rebates and a likely doubling of the hours students are able to work. Some Asian ambassadors backed this during the pandemic when their students were stuck in the country.

But observers are warning that this runs the risk of a repeat of the diplomatic crisis with India a decade ago over whether low quality training courses were being used as a way to allow students to really enter Australia to work.

International Education Association of Australia chief executive Phil Honeywood says students should not be used to solve Australia’s labour shortages.

“This complete turnaround in federal government policy settings has involved no consultation with the beleaguered international education sector and flies in the face of our nation’s emphasis on world-class academic outcomes,” he said in the opinion article in The Australian.

DEALS AND DOLLARS

MONEY TRAIL

Southeast Asia and India are the big winners from additional spending on foreign relations priorities since the last Federal Budget.

While many of the measures have already been announced, the Mid-Year Economic and Fiscal Outlook (MYEFO) released in December provides a more common basis for understanding how new spending has been allocated.

It shows the Comprehensive Strategic Partnership (CSP) with the Association of Southeast Asian Nations (ASEAN), which was announced during the November summit season just ahead of a parallel Chinese deal, gets $44 million over the next three years on initiatives which are so far focussed on bringing students to Australia. But the long-term planning is for $161 million over nine years.

The parallel CSP with India gets $29 million over four years, including on a Bengalaru consulate and a Centre of Excellence for Critical and Emerging Technology Policy as part of the broader Indo-Pacific policy.

The new spending by the Department of Foreign Affairs and Trade and three other departments over the four-year period on the expanded Pacific worker program is forecast to be $131.4 million.

But unlike the ASEAN and Indian spending, this is expected to be more than offset by domestic revenue of $165 million and GST payments of $50 million over four years. However, the new Australian Agriculture Visa focussed on Southeast Asia is forecast to be a better net revenue generator over time than the Pacific labour scheme. It is estimated to cost $122 million over four years with no revenue this year but $150 million over the next three years.

Rounding out this new broad international relations spending is a stated $36 million over four years on increased diplomatic presence, although the new money only amounts to $11 million over four years with new missions in Berne and Kabul nominated as the recipients.

CHINA TRUE BELIEVERS

After four years of growing bilateral tensions with China, businessman and former politician Warwick Smith still declares that the two countries “have a complementarity like no other”.

Smith makes the comment in the introduction to a new report about more than a dozen Australian businesses which have stuck with the complementarity vision through the political tensions.

“The political risks have gone up – but the Chinese consumer market is still growing at one of the fastest rates anywhere in the world,” Smith says of the companies examined in the Australia China Relations Institute report published in December.

It argues that the Australian engagement with China is deeper and more diverse than commonly appreciated even though the “gold rush” which once existed is over.

“These insights from well-placed executives point to Australian business engagement with China being far more durable and resilient than is commonly appreciated. As some observers in this report have said, the strength of the business ties between Australia and China may be the key to its future,” the report says.

WOODSIDE QUITS MYANMAR

Gas company Woodside has followed global competitors Total Energies and Chevron in exiting from Myanmar following last February’s year’s military coup and the deteriorating human rights situation since then.

The company put it operations under review after the coup but is now shutting the door on one of the largest Australian businesses in Myanmar which has been operating since 2013.

It exited some exploration permits last year but is now leaving other interests held with the Myanmar Oil and Gas Enterprise at an overall cost of about $300 million in write off expenses.

Chief executive Meg O’Neill said while the company had hoped to develop the gas resources with its joint venture partners, that was “no longer a viable option”.

As the standoff between the military and opposition groups has descended into low level civil war amid little diplomatic progress on reconciliation talks, many human rights groups have called on foreign resources companies to play a greater role in sanctioning the Myanmar military regime. TotalEnergies and Chevron announced their departure two weeks ago.

DIPLOMATICALLY SPEAKING

Law enforcement co-operation between China and the Solomon Islands does not affect Australia’s interests in the Solomon Islands. It is conducive to promoting prosperity and stability in neighbour areas around Australia. I am confident China and Australia have important converging interests and broad areas for co-operation in promoting prosperity and stability of island countries. We are ready to maintain communication with the Australian side and make joint efforts to bring the situation of the Solomon Islands back to stability at an early date.

Chinese acting ambassador Wang Xining, January 21

DATAWATCH

NOW AND THEN

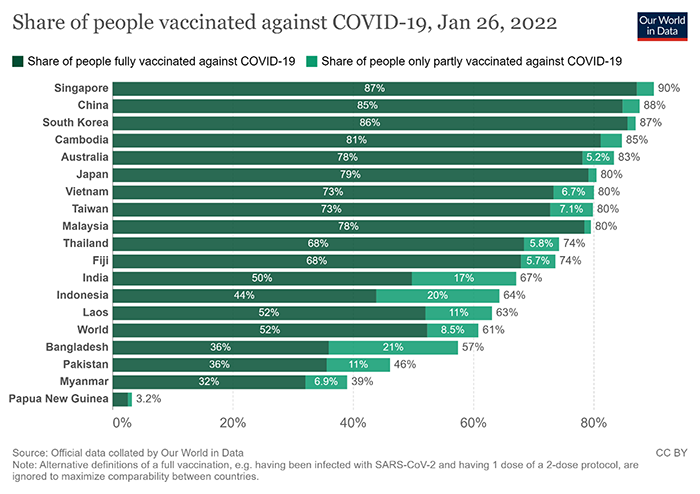

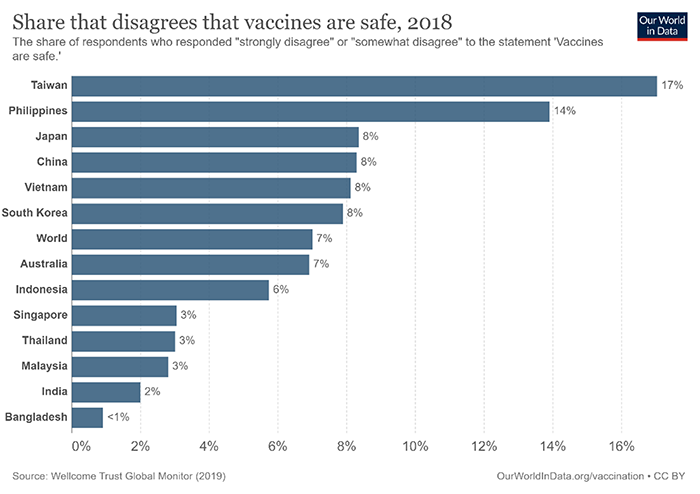

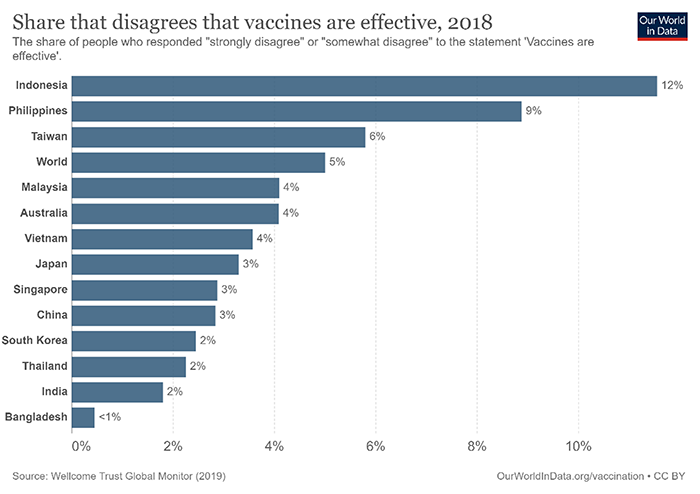

These charts show Asia’s current vaccination rate compared with the results of a 2018 survey of vaccine hesitancy, measured by attitudes to vaccine safety and effectiveness.

Like many international comparisons during the pandemic the correlations are not clear. Taiwan had high levels of vaccine hesitancy but has subsequently achieved a relatively high vaccination rate. The Philippines had high hesitancy and now has a slow vaccine take up. (The Philippines was missing from the vaccination data at the time of publication but separately reports double dose vaccination rate of 54 per cent placing it at the low end of the chart). But spare a thought for Bangladesh with zero hesitancy in 2018 but only a 57 per cent vaccination completion rate so far.

ON THE HORIZON

NO PARTY TIME

There was a time when the 50th anniversary of US President Richard Nixon’s visit to China would have been the trigger for a series of commemorations and modern day efforts to rekindle the spirit of those times.

But when February 21 rolls around it will now be more interesting to see whether the countries can avoid turning what Nixon called “the week that changed the world” into an opportunity for one-upmanship.

Nixon’s meeting with Mao Zedong was the first visit to China by a US President and all the more remarkable because he had built his political career on being a tough anti-communist.

While the US did not actually formally recognise China until seven years later, the visit ushered in a new era in relations between the two countries which is now in uncharted waters.

In a taste of what seems likely to come, two China-aligned Hong Kong financial commentators Andrew Sheng and Xiao Geng have already written: “A half-century later, the progress they launched has been all but lost, and US President Joe Biden is partly to blame.”

Correction: An earlier version of this article incorrectly identified Korea's People Power Party leader Lee Jun-Seok as the party's candidate.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

We are grateful to the Judith Neilson Institute for Journalism and Ideas for its support of Briefing MONTHLY and its editorial team.

Partner with us to help Briefing MONTHLY grow. For more information please contact [email protected]

This initiative is supported by the Judith Neilson Institute for Journalism and Ideas.