Briefing MONTHLY #1 | November 2017

A new monthly update on Asia and Australia-Asia relations

It is our pleasure to launch Briefing MONTHLY – a new newsletter for Asia Society Australia members with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia following the launch of the long-awaited Foreign Policy White Paper, it is an opportune time to offer our members at the forefront of Australia’s engagement with Asia a professionally edited, succinct and an authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business and geopolitics, Briefing MONTHLY will be distinctly Australian and internationalist. It will highlight trends, deals, visits, stories and events in our region that matter. Briefing MONTHLY can only succeed if it provides the information you need, so please share your feedback with us.

Greg Earl,

Editor, Briefing MONTHLY

Philipp Ivanov

CEO, Asia Society Australia

Doug Ferguson

Chairman, Asia Society Australia

AUSTRALIA REDEFINES ITS REGION

Source: 2017 Foreign Policy White Paper, p. 26

The Federal government has set out an ambitious public bid for a new Indo-Pacific community of interest with Japan, India, South Korea and Indonesia to deal with less explicitly stated concerns about a much more assertive China and a possibly less engaged US. The new Foreign Policy White Paper gambles that these nations will help Australia navigate a much less certain region so that business can take advantage of the opportunities that will arise if stability can be preserved.

China: Its power and influence is already matching or sometimes exceeding the US. Australia’s challenge is to encourage China to play a leading regional role consistent with the existing rules-based order. China now impacts virtually all Australian international interests.

India: The redefinition of the neighbourhood as the Indo-Pacific will ensure India is a cornerstone of future strategic and economic policy as a “front-rank” partner. It will have the world’s largest working age population within ten years and be the fastest growing large economy.

ASEAN: Australia will seek to remain a leading economic, development and strategic partner in this region as competition for influence here grows. Investment in regional institutions will be crucial to this. But Indonesia is of “fundamental importance” to Australia and has been emphasised as a higher strategic partner.

Japan: One of Australia’s most important global and regional partners. Each country is “heavily invested” in the success of the other.

US: The government says US long-term interests will anchor its security and economic engagement in the Indo-Pacific but Australia should still broaden US contacts to ensure this.

South Pacific: This will be the main development aid focus due to Australia’s higher level responsibility here. There is specific acknowledgement of the needs of PNG and Timor Leste and a strategy of greater integration via digital infrastructure and guest workers.

Geostrategy: Economic power is being used for strategic ends and there is a risk that trade and investment will now contribute to strategic rivalry rather than contain it.

Trade: Consultation before, during and after trade deals. More domestic advocacy of open trade and investment. Strong support for the World Trade Organisation system, but recognition that regional deals are more practical.

Asian economics: A middle class of almost 3.5 billion by 2030 will ensure continued demand for Australian resources and create new opportunities to export services and premium agricultural products.

Macro-economics: Productivity gains from the 1980s and 1990s have largely been exhausted and new technology has not yet provided an obvious uplift leaving developed economies with little room for new stimulus measures.

Business: Relatively low direct investment in Asia possibly affects the capacity of Australian business to tap into growth markets and value chains.

Government: There will be more diplomatic missions to deal with a more complex outlook and a more whole of government approach to foreign policy.

Soft power: Develop a stronger national brand to reinforce Australia as a competitive investment destination, great place to visit, quality educator and exporter of premium products.

Reaction: Labor has criticised the climate change approach, how aid cuts undermine the South Pacific commitments and inadequate domestic policies for delivering the new foreign policy. But it will support the thrust of the White Paper, particularly the way it acknowledges how economic power shifts are changing the strategic outlook.

DIPLOMATICALLY SPEAKING

“The international rules-based order will continue to be challenged by some nations seeking short-term gain and others who are promising the false hope of protectionism and isolationism.” Julie Bishop

NEIGHBOURHOOD WATCH

SUMMIT SEASON

- The Singapore Asian Trade Centre has produced the best analysis on the outlook for the restructured Trans-Pacific Partnership trade deal after the member country leaders agreed on its “core principles” in Vietnam. But this study from the ISEAS-Yusof Ishak Institute provides a good catch-up on where the TPP came from and how it can still work with 11 members.

- Five key takeaways from the meetings of leaders from the Asia Pacific Economic Cooperation group, the East Asia Summit and the Association of Southeast Asian Nations are detailed in this Lowy Institute analysis.

- This Politico assessment of Trump’s trip reflects the general scepticism amongst US commentators about what the president achieved. And China now has an opportunity to fill a regional power vacuum, according to this Nikkei analysis.

- But Joseph Chinyong Leow, of Singapore’s Nanyang Technological University, argues against the consensus view that while the trip did not achieve much, it provided momentum for renewed US regional engagement.

- US President Donald Trump’s first Asian tour has left the region guessing about which country he is likely to target for a bilateral trade initiative to reinforce his opposition to plurilateral pacts like the reformed Trans-Pacific Partnership.

CHINA’S NEXT LEADERS

Brookings Institution senior fellow Cheng Li is famous for his deliberative approach to charting the rise of China’s leaders starting with a database of 30,000 elite political figures across the country. This is a long but fascinating transcript of a presentation after the 19th Communist Party Congress in October which saw President Xi Jinping assert his control over the party and country. Li argues that the seven member Politburo Standing Committee is a bit more competitive than much of the one-man-band media coverage suggests. And more intriguingly he provides some pointers on how the political elite is changing and where the future leaders will come from. His tip? Engineers and provincial party secretaries are on the wane and the rising political class will contain aerospace industry executives, university presidents and foreign educated returnees.

SAME STORY, DIFFERENT READ

Global value chains, new Silk Roads or plain old trade routes: whatever you call these sinews of the modern economy, they have certainly been the making of modern Asia – or to use another buzzword Factory Asia. The Asian Development Bank’s new Asian Economic Integration Report contains all the data anyone could want on the region’s progress towards a more integrated economy and its global trade links, complete with a new index to measure the progress. It makes the point that while global foreign investment into Asia fell six per cent in 2016 to US$492 billion, Asian investment into Asia rose nine per cent to US$272 billion. On the other hand, you can just go back to basics and read Lowy Institute fellow Stephen Grenville’s ode to Ternate, the Indonesian island that was arguably the starting point for Asia’s first global supply chain. The Portuguese, Spanish, Dutch and English all fought to control the supply of nutmeg from the isolated eastern Indonesian island and Grenville argues modern plurilateral trade treaties still contain lingering elements of this quest for monopoly.

ASIAN NATION

MANDARIN FOR ALL SEASONS

Department of Foreign Affairs and Trade secretary Frances Adamson has now delivered two speeches in quick succession on the state of relations with China – and the venues said it all about Australia’s most challenging foreign relationship. The first to Adelaide University’s Confucius Institute Lecture contained a tough message for the Chinese government about the role of academic freedom on Australian university campuses. The second to an Asialink/Macquarie University Thought Leadership Dinner shifted the balance back to business opportunities and a long bilateral relationship – including the fact that each of the seven members of the Politburo Standing Committee have visited Australia. Between the words and between the lines these speeches provide a good wrap of where the China relationship is at.

MONA TO MACAN

Australia’s newest opinion shaper in Asia has been on the ground less than a year and he is now at the frontline of one of the most profound societal upheavals in the region – how Indonesia grapples with Islamic fundamentalism. Aaron Seeto jumped from a curatorial role at Queensland Art Gallery to run Indonesia’s new Museum of Modern and Contemporary Art in Nusantara (MACAN). The new gallery which opened in early November has parallels with Hobart’s Museum of Old and New Art (MONA) as it is owned by an Indonesian businessman Haryanto Adikoesoemo who has amassed a diverse collection of Indonesian and foreign works. See Rosemary O’Neill’s profile here and Jewel Topsfield’s earlier interview here.

DEALS AND DOLLARS

FINDING A NEW CHOPHOUSE

Eating out in Asia involves a mobile phone as much as chopsticks these days and Paul Bassat’s Square Peg Capital is making this point by backing an online booking start-up in Singapore. The Melbourne-based venture capitalist which raised $230 million for a ten year fund earlier this year has led a $US13 million Series D fund raising round for six year old booking site Chope. Chope is part of a vibrant restaurant booking and food delivery start-up scene in South East Asia which ranges from the well-established Food Panda to the newer Darmakan. Chope got started with valuable backing from mall owner CapitaLand but now says 60 per cent of its business is outside Singapore in China, Thailand and Indonesia. Square Peg partner Tushar Roy says Chope has hit the metrics that the fund requires from online marketplaces.

BRANDING STARTS AT HOME

Food exporters have warned that Chinese consumers want to see that products have a successful reputation in Australia before they will buy them in China. Fonterra Australia managing director Rene Dedoncker says all his company’s China products can be checked online in Australia and PwC partner Ben Craw says food products should be well known at home before they are taken offshore. Branding was the key theme of the agriculture session at HSBC’s annual Australia China Conference in Sydney with New Hope Group managing director Nick Dowling lamenting that Australian beef did not have the quality brand image in China that Australian wine had established. CBH Group marketing and trading manager Jason Craig illustrated how demographics are changing business in China for Australian famers with falling beer consumption a risk to barley exporters while ageing will be a boost for oats producers.

BOTTLE STOPPER

Melbourne-based packaging company Pact group will more than triple the size of its Asian operations by spending $142 million to buy two plastic bottle and bottle capping manufacturing businesses from New Zealander Graeme Hart’s Reynolds Packaging. The purchase of CSI Asia and GPC Guangzhou will increase the company’s Asian revenue to $200 million and broaden its footprint to sites across China, South Korea, Nepal, India and the Philippines. Chief executive Malcolm Bundey said the purchase would increase the company’s management, manufacturing and technology capacity to expand further in Asia.

TURNING SOUTH

Insurance company IAG is the latest major company to shift its focus from Asia this year after struggling to get the desired return on capital invested in businesses in India, Malaysia, Thailand, Indonesia and Vietnam. Chief executive Peter Harmer says there are no plans to sell the businesses but he will not be investing in them as he focusses more on Australia. The IAG has $850 million invested in the Asian portfolio making it one of the significant Australian business footprints in Asia but earnings fell more than 50 per cent last year. IAG pulled back from a China expansion just before Harmer took over as chief executive.

ANZ’S NEW ASIAN ROAD

Calculating the on the ground impact of decisions to cut back on business ventures in Asia is normally quite hard, sometimes leading to unreliable sweeping statements. But thanks to the ANZ’s relative openness about how it is reshaping former chief executive Mike Smith’s Asian expansion we now have an interesting piece of hard data. Institutional banking chief Mark Whelan has revealed that the Asian wind back has involved cutting about 10,000 customers to a new base of about 7000 which he says is about right for a global institutional bank of the ANZ’s size. But he argues in this Australian Financial Review interview that the bank still has about 40 per cent of its institutional assets of $123 billion in Asia and it is one of the top five institutional banks in the region.

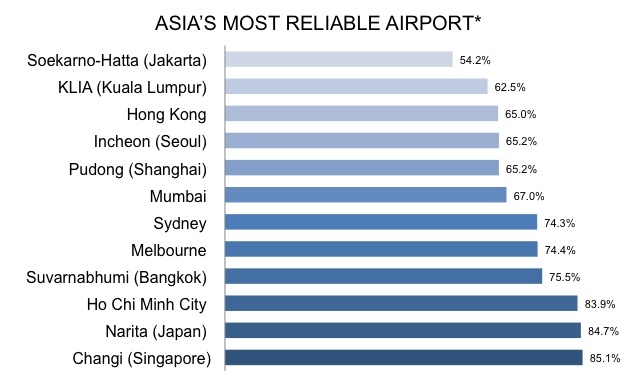

DATAWATCH

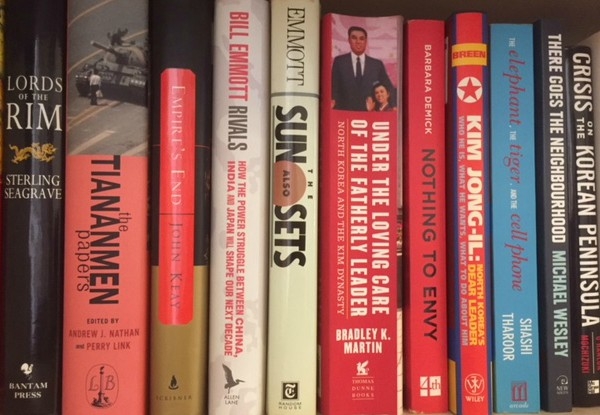

WHAT WE’RE READING

DRAGON & KANGAROO BY ROBERT MACKLIN

(HACHETE AUSTRALIA)

Here’s a fact that places the debate about the North Australia Infrastructure Fund and the Chinese Belt and Road Initiative in an intriguing historical context. In 1872 the Chinese population in Darwin of 6000 was about three times the European headcount and the city was the only port in the country where Chinese could land. And 3000 of them built the then most significant piece of local infrastructure: the rail line from Darwin to Pine Creek. The role of Chinese in driving forward the first mining projects in the Top End with entrepreneurial community leaders and less of the racial conflict seen down south is the most interesting takeaway from this account of a shared history starting with John Macarthur employing Chinese sheep herders in the 1820s. Macklin visualises this narrative putting Australia and China on a pathway to greater integration that does not sit so easily with the recent debate about Chinese spies on university campuses and the moves to revive the quadrilateral partnership between the US, Japan, India and Australia.

DIGITAL INDONESIA EDITED BY EDWIN JURRIENS AND ROSS TAPSELL (ISEAS-YUSOF ISHAK INSTITUTE)

The competition between Chinese ecommerce giants Alibaba and Tencent for dominance in South East Asia’s most important digital marketplace is both an insight into the next wave of Chinese offshore investment and a little appreciated frontline in the global battle between US and Chinese companies for online space. This publication drawn from the annual Australian National University Indonesia Update provides a detailed account of how digital disruption is changing Australia’s closest Asian neighbour. The story of how Go-Jek has transformed how to survive Jakarta’s traffic jams has already shown how technological innovation may allow Indonesia to leapfrog some traditional development log jams. But Jurriens and Tapsell are even more optimistic: “Digital technology has given minorities and marginalised groups, including women, new opportunities to shape their identities and share them with the world.”

ON THE HORIZON

WHY ASEAN AND WHY NOW?

Austrade will launch the second edition of its guide to business opportunities in South East Asia on December 12 in Sydney as part of the build up to the summit of leaders from the Association of Southeast Asian Nations (ASEAN) also in Sydney next March. The new Foreign Policy White Paper emphasises the need to build closer economic and strategic links to South East Asia. The Austrade publication will contain case studies of businesses which are focussing on the opportunities arising from the gradual integration of the region through the ASEAN Economic Community.

ABOUT BRIEFING MONTHLY

Briefing MONTHLY is a public update with news and original analysis on Asia and Australia-Asia relations. As Australia debates its future in Asia, and the Australian media footprint in Asia continues to shrink, it is an opportune time to offer Australians at the forefront of Australia’s engagement with Asia a professionally edited, succinct and authoritative curation of the most relevant content on Asia and Australia-Asia relations. Focused on business, geopolitics, education and culture, Briefing MONTHLY is distinctly Australian and internationalist, highlighting trends, deals, visits, stories and events in our region that matter.

Partner with us to help Briefing MONTHLY grow. Exclusive partnership opportunities are available. For more information please contact [email protected]

Read previous issues and subscribe >>

Copyright © 2018 Asia Society Australia, All rights reserved.